The promise of Cashless Lagos and now Cashless Nigeria was that we would be able to use our cards to seamlessly pay for goods and services without using cash. The reality has been somewhat different.

Step In, a bar favoured by Lagos’s teeming expatriate population has some of the best steak in Lagos. Filled with freely spending, well heeled patrons, armed with a variety of Naira and FX denominated cards. I have no idea of their daily take but imagine it must be substantial, especially during the weekend and on match days. It should also be an acquiring bank’s dream of a perfect merchant customer.

Step In, does not have a Point of Sale Terminal and wants nothing to do with “those infernal machines that never work”.

Having performed the “ATM Stroll” one time too many, on this particularly wet day at Step In, I was driven to understand why Point Of Sale terminals (fondly called POS) do not work. I also need to know, why merchants in Lagos are not particularly fond of card payments. Sometimes hiding POS terminals until you forcefully request to use them.

The “Stroll” is well known to Lagosians, where you are accompanied by a waitress or bouncer (depending on the proprietor’s judgement of your trustworthiness), to the nearest ATM. Which hopefully works, and you then extract the needed cash to settle your bill. I then decided to investigate the reasons why terminals do not work and merchants are unwilling to use them.

These are my findings

The Vast Majority Of POS Terminals Don’t Work!

Working with the banks, NIBBS, & the Central Bank, you will often hear the magic word “deploy”. Usually in the context of how many terminals they have provided to merchants.

There is another magic word called “active” which you rarely, if ever, hear in public.

From my conversations with bankers, as of the end of April 2014; approximately 20% of the over 160,000 terminals “deployed” are “active”. These “active” terminals were used by 340k cards for some 1.5 million transactions in that month with a value of 16.9 billion Naira. For comparison, there were approximately 6 million cards used in ATM’s to withdraw approximately 161 Billion Naira across approximately 13,000 ATM’s in Nigeria.

With these figures, “Cashless Whatever” seems to be a bit of a misnomer. There is still plenty of cash — that 161 billion Naira across the 6 million cards. The cash was just not withdrawn from the banking hall. In fact, a banker confessed ruefully that they now do greater cash volumes through their ATM’s than in their banking halls.

The greater problem is the low number of active terminals. Now “Cashless” is being deployed to the rest of the country due to its great success in Lagos. Obviously success has a very flexible definition. After all less than 6% of the equivalent number of cards used in ATM’s were used for POS payments and only 20% of the terminals are in use. Like a magician pulling a bunny out of a hat, we only hear of the ever increasing number of “deployed” terminals. Things are working! Look, ever more terminals are being deployed.

Merchants Have Issues With Cashless Payments

“The bloody terminals don’t work” expressed in a variety of ways with flowery language not suitable for children and young adults, is a common refrain amongst merchants. The main problems they have with POS terminals are;

- Transactions do not complete within a reasonable time

- Customers are charged for failed transactions

- Customers are charged multiple times

On top of these, merchants are charged a fee of 1.5% of the value of the transaction capped at a maximum of 2,000 Naira. Especially vexing for all the merchants I spoke with, is that they do not get immediate value. “You take my money, give it to me days after and it is short.” Apparently for a number of merchants, reconciling accounts with their bank is a major problem for them.

So due to all these problems, merchants have a simple defence reaction. They just don’t use the terminals. They collect them from their bank and leave them on the shelf. Customers have their own defence reaction. They shop with cash and have no expectations of POS’s working. They carry multiple cards from different issuers and shop in venues where they are well known and there are ATM’s close by.

Why Don’t Terminals Work?

In Nigeria today, there is no expectation that you can successfully make a mobile phone call on the first try. So people carry multiple phones and/or have multiple mobile subscriptions usually with dual sim phones. In fact network quality and reliability of some operators has been so bad that these operators were banned from selling subscriptions and were also fined.

It is these same GSM networks that the POS terminal uses to verify transactions using GPRS.

Typically, you would like, for the time taken for a POS transaction to have a definite upper limit. Say as Guaranty Trust Bank, you want POS transactions on your merchant terminals to take no longer than 20 seconds. After all, it is supposed to be more convenient than cash, right? You would also want the transaction to complete with no errors within that time. Unfortunately with Nigeria’s GSM networks today, there is no way for you to achieve this. Furthermore the networks will give you no performance guarantees. None whatsoever.

Today, if you use the GSM network for your POS transactions, you have no way to guarantee the performance of your terminal network especially if you use GPRS! As a result, terminals don’t work as they should. Well according to the banks, 80% of the terminals are not active.

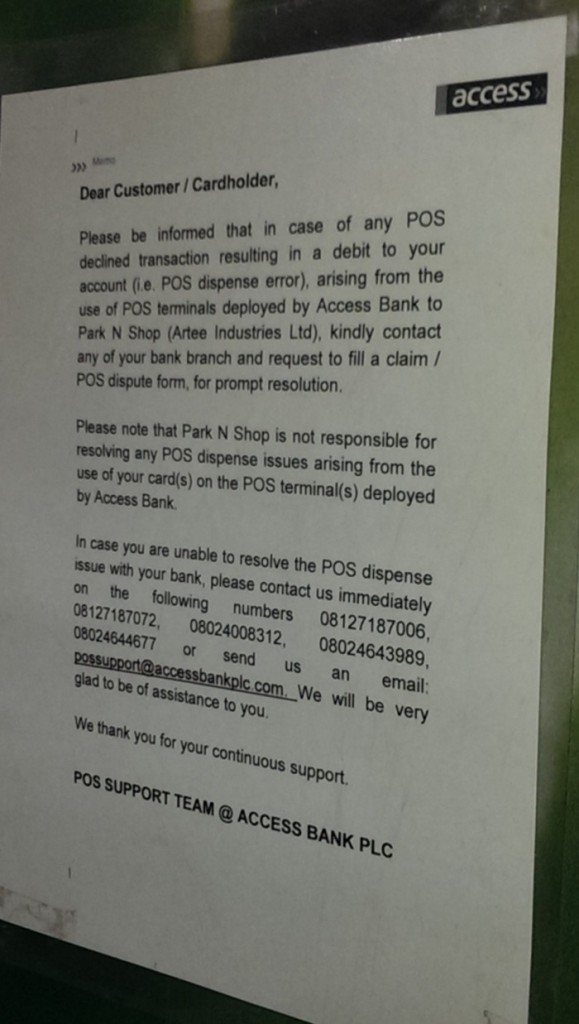

A notice posted close to the till at Park N Shop. Please don’t take it out on the cashier contact us or your bank.

How Can We Make Terminals Work?

Simple, use anything but GSM!

Zenith bank due to its relationship with Visafone, deployed CDMA terminals running on Visafone’s CDMA network. There was a successful lobby to get the standards changed to allow CDMA, which was not in the original standard as published by the Central Bank of Nigeria. Zenith now found much to its satisfaction that they enjoyed better performance than other acquiring banks. Serendipity in action. It is no accident that the top two acquiring banks happen to be GTBank and Zenith.

Wifi also works fantastically well, especially in situations where you have to support a large number of terminals with relatively large transaction volumes. A rule of thumb specifies that four or more terminals in a location justfies the use of Wifi in that particlular location.

Terminals using GSM can be made to work, or shall we say their performance can be improved. This will require the terminal to use other, more suitable “bearers” apart from GPRS. A bearer being the service that allows information to be transferred across the network. SMS (text) and USSD (the * and # combinations you use to load airtime or access mobile banking are examples of USSD) are examples of bearers.

This is problematic as the standards as written and the entire structure of the POS community in Nigeria may not allow the use of different bearers.

Fixing The Problems

Zenith and GTBank point to the lucrative nature of being successful acquiring banks, their transaction values and volumes using POS being far in excess of everybody else. I don’t think it is a coincindence that they are amongst the best performing banks in Nigeria today. Fix the problems with merchant accounts and you are golden, as they say.

Give immediate value

Credit the merchant account immediately the transaction goes through. You can charge the merchant for this at the end of the month. Remember as the majority of POS transactions today involve debit cards, the risk to the bank of default is extremely low. In effect, the bank is advancing the merchant monies pre daily settlement, which in effect; is a guaranteed loan for 24 hours.

Fix reconciliation

Banks should make it easy for the merchant to see card transactions and their charges. It is possible and requires some internal work.

Will This Happen?

I was reading a report of the CBN’s Governor’s speech identifying the challenges around electronic payments which were not limited to;

- Weak risk management frameworks

- Security Issues

- Resistance of target customers to patronise and embrace new products

- Low level of card usage on POS terminals

In my opinion, the regulator is blaming users and merchants for not using these wonderful electronic card payment systems that today, don’t work properly and appear not to be significantly better than cash. Risk management and security are particular bugbears for bankers. Even though they hardly admit that the vast majority of frauds are insider related. It is the fear of fraud that drives the processes and procedures that merchants find so distressing.

Customers are resistant due to the generally unpleasant experience they have when a POS terminal does not work they way it should. The vast majority of deployed terminals do not work as we have seen and those that work, do not work properly a significant part of the time.

The payments ecosystem as constituted today actually precludes these changes happening in a systematic manner. I will examine in another post, what needs to change in the Nigerian payments ecosystem to ensure the goals and incentives of all the players align with the goals of the regulator.

I am wary of the regulator’s previous “successes” with mobile money and ATMC. This leads me to treat with caution any changes they make in an attempt to drive further adoption of the “successful” cashless policy.

This post was first published on Adewale’s blog.