Editor’s note: This article is part of the Startup 101: A Legal Perspective series, guest-written by Odun Longe, a startup lawyer at The Longe Practice. Click here to see all the posts in the 8-part series.

We met Tina and Tom last week Thursday. They have agreed to let me tell you some more about them.

Recall I told you on Thursday that Tina and Tom divided the shares of the Company equally between them? As with most Nigerian founders, Tina asked her friend Tammy to help incorporate the company at the CAC, specifying that she wanted the shares divided equally between herself and Tom. Tammy, being an efficient and intelligent lawyer working with a Tier 1 law firm in Nigeria, completed the incorporation within a reasonable time, ensuring that the Form CAC 2 (Statement of Share Capital and Return of Allotment) reflected Tina’s wishes. Tina now had formal and legal documentation reflecting the share distribution between herself and Tom.

But that was all the documentation Tina had with regards to the Company’s shares. Ideally, Tina (and Tom) should have more documents related to this process. These additional documents would include documents relating to vesting. This could be in form of a stand-alone vesting document known as a Vesting Schedule or as part of a Founders’ Agreement signed by Tina, Tom and the Company, and/or a Founders’ Restriction Agreement signed by Tina and the Company on the one hand, and another by Tom and the Company on the other hand.

What is vesting? Vesting is the manner in which founders (or employees) of a company ‘earn’ beneficial, real, actual, substantive ownership of their shares in a company through periodic installments. So on Day 1 of the Company’s incorporation Tina and Tom would, on paper, own 50% of the Company’s shares at the CAC. With a vesting clause, their ‘ownership’ is recast as a ‘right to own earned over time or by agreed-upon milestones.’

So in this scenario, Tina and Tom ideally should have also entered into a vesting arrangement whereby they would earn beneficial ownership of those shares over a specified period, the most popular being over a 4 year period with a 1 year cliff. (A cliff is that point where ownership rights begin to vest, i.e. the point where the installments commence). As such, the total number of shares to be vested would be divided into four and earned yearly or in other cases, monthly, quarterly or semi-annually in years 2-4.

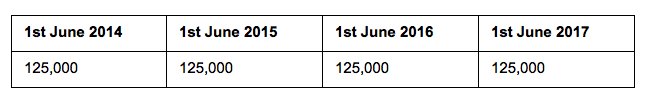

If we assume the Company was incorporated 1st June 2013 and 50% ownership in the company meant 500,000 shares for each person, Tina and Tom’s vesting arrangement after a 1 year cliff would be as shown below:

Thus, on each anniversary date, Tom and Tina have now officially earned, and thus beneficially own, the number of shares vested as of that date, and the cumulative shares through that date.

Now, if the above arrangement was in place, Tom’s sudden departure would not have left Tina and the Company in a bad position. Let’s say Tom left the company on February 17, 2014, it would have been during the cliff period and Tom would not have come into beneficial ownership of any shares. Now, let’s say Tom leaves today February 17, 2015, Tom would be leaving with 25% of his shares that vested as of 1st June 2014. If a monthly vesting period is in place, then Tom in addition to the vested 125,000 shares as of June 2014, would also be entitled to a prorated number of shares from July 2014 till January 2015, i.e. shares for 7 months which would be 72,917 shares (rounded up to the nearest whole number as fractional shares are not allowed in Nigeria) . So a total of 197, 917 shares.

Now that we understand what vesting is, it only makes sense for me to explain why all founders should have a vesting arrangement in place.

Two major reasons.

First, to protect yourselves. No need to harp too much on this. Tina and Tom’s situation is a perfect reflection of why founders must vest. Once a startup comprises of two founders or more, a vesting arrangement must be put in place to protect all the founders and the startup itself. Part of the reasons you are coming together as co-founders is your commitment to the idea, the company and yourselves. But things may change for each individual that affects said commitment and this shouldn’t be allowed to jeopardise the company.

Secondly, your future investors will require it. Particularly your seed series or series A investors (which usually are institutional investors). The reason that VC Company is putting money in your company is YOU! (where YOU = all the founders). If a reasonable vesting arrangement is in place, the VC won’t likely bother reinventing the wheel. However if there is no vesting, or the arrangement is unreasonable, or too much time has elapsed with the founders having come into full or almost full ownership of their shares, then sorry folks – all those shares you thought you had? You’ll likely be vesting from scratch. Under certain circumstances, you may be able to negotiate that you start vesting at 25% already earned as of the date they invest. However most times, VCs would have you start vesting at 0 with a cliff period. They want to know you are in the game for the long-term, that is why they are putting their money in you and your startup! It’s designed to manage what they consider the single biggest risk to their investments: founder risk.

When arranging for vesting, it is necessary to also include certain circumstances under which the vesting could be accelerated, i.e. the founder coming into beneficial ownership of the shares ahead of the specified period. These circumstances are known as trigger events, mostly being termination without cause and change of control. Acceleration could be due to a single trigger event or a double trigger event. Acceleration could also be full acceleration or partial acceleration (the most common). Whether acceleration is due to a single trigger or double trigger event, or whether full or partial are all matters to be governed by the necessary agreements ín place and these would all depend on the founders’ circumstances and negotiations.

Where founders compensate employees with equity, vesting should apply as the employee’s commitment should also be established before the employee can come into ownership of the shares or exercise the option to purchase such shares.

From my experience as a startup lawyer, one of the greatest deficiencies I have found among Nigerian founders is the absence of a vesting arrangement. I have also discovered that not many understand how vesting works, so I hope I have been able to shed some light on this.

As usual, comments and questions are welcome!

P.S. Watch out for Thursday’s post, It’s a guest post on Intellectual Property (IP) by Funkola, my co-founder who heads our IP practice and of course Tina and Tom continue to feature.

Legally yours,

Odun.

Disclaimer

Articles do not constitute legal advice, neither has a lawyer-client relationship been created by engagement in the comment section. If you require professional legal advice, kindly contact your legal adviser.