Lagos-based mobile payments company, SimplePay has raised new funding from Nigeria’s Bank of Industry (“BOI”). Managing Director and CEO of BOI, Olaoluwa Rasheed will now join the company’s board as part of the investment deal.

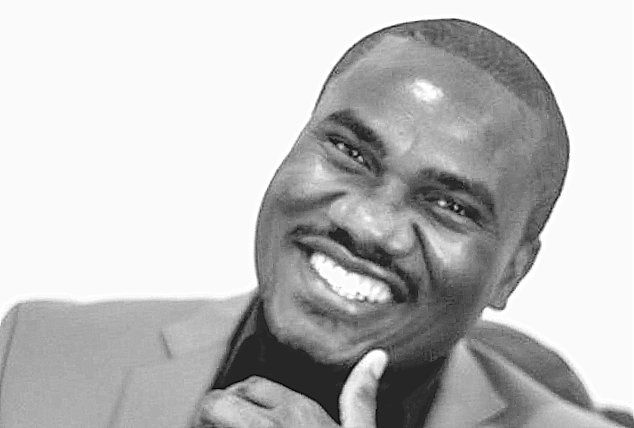

SimplePay executives have previously said the startup was gunning for a million dollar round, following an investment of $330,000 from seedstars in September 2014, as well as other private investments along the way. Parties to the transaction declined to disclose the terms of the new round, but it is believed that Simeon Ononobi, the company CEO still owns majority of the company.

Simeon Ononobi says the new funding will help them double down on their innovative technologies by hiring more engineers as well as aggressively pursue more strategic partnerships.

He goes on to say that the Bank of Industry is bringing more than just cash to the table. BOI is looking to participate in the future of payments in Nigeria and will likely be bringing not just industry connects but also SME access to SimplePay.

SimplePay still has its work cut out for it on the demand side, however, where it needs to convince users who create and use SimplePay accounts for electronic purchases. It’s very likely a chunk of the new funding will also go into driving awareness for the product. One of the founding partners at Seedstars, Benjamin Benaim, is also coming onboard in an executive capacity to lead product development.

The competition is hardly twiddling their thumbs though. Local competition, Paga, for instance, seem to have a big funding coming. The company CEO, Tayo Oviosu mentioned this in a Radar AMA recently. Interswitch recently put $850,000 in ACE, an ecommerce logistics startup. Konga recently acquired a mobile money company to power its proprietary payment method, Konga Pay. Etranzact, and of course, PayPal aren’t spinning their wheels either. Things are getting interesting.