Reaching an agreement on a term sheet, and subsequently entering into a funding relationship is a transformative moment in the life of a company and its founders. Cash, insight, partnership and the network VCs bring, can unlock inestimable opportunity. For VCs, the addition of a portfolio company with competent management, sales traction, massive market potential and an optimal route to monetization is equally inspiring. Getting to this nirvana, however, isn’t as easy.

Harrowing stories of cutthroat competition, tough-as-nails VCs and pitch decks being ripped to shreds shade the vision of founders. The very thought of being close to a product breakthrough, while short on cash, and even shorter on negotiating leverage, is the founder’s nightmare.

Last week I wrote part one of Valuation Variance, providing a glimpse into the VC mind. My intent was to allay the belief in the pound-of-flesh-exacting and cold-blooded nature of VCs. To establish instead their humanity (most have it, I promise!). This time I would like to make the point that the founder/funder relationship is best built on open, transparent dialogue, mutual respect and recognition of the interdependence. VCs equally have a responsibility to understand and educate the entrepreneurs they work with.

I agree with Harvard Business School professor, Deepak Malhotra: “Founders are like single parents looking for a spouse who will love and nurture their children as much as they do. And yet, despite the tremendous value that can be created with a VC–entrepreneur partnership, these negotiations can yield poor outcomes. The mistakes are usually not immediately apparent; they manifest themselves over months and years, as the parties come up against issues of power, trust, control, and much more. It’s important to recognize that some of the mistakes are systematic and predictable—and solvable.”

In the startup world, valuation conversations is where differences in viewpoints and assumptions surface.

Much has been written on what VCs want. Much less has been written on what founders consider key in determining valuation. Founders’ perspectives are paramount because founders innovate and founders build. Without their risk-taking, the entrepreneurial ecosystem would dry up. VCs are entirely dependent on founders. Validating the founder perspective is paramount to engendering trust and bridging skepticism.

Here are some fundamental founder beliefs that VCs need to understand:

Founder Belief #1 – Cash (Generation) is King

It is assumed that there exists a fundamental disagreement in the basis for company valuation. VCs generally expect that negotiations will require a painful correction of founders’ misconceptions.

My research suggests otherwise. In a recent survey of Africa-based technology founders, 50% said their means of applying a standard valuation approach is by using a market multiple. Although this statistic is lower than VC responses, this does tell me that founders understand that financial results are the primary driver of value. As may be expected, however, founders do not have the breadth of information on market pricing that VCs have, and this is where VCs should look to educate the founders they work with. Given that founders and VCs are more closely aligned in methodology than generally assumed, a presentation of market data should bridge disagreements in many cases. This alignment should inspire VCs and founders to foster a collaborative spirit.

It’s interesting to note that the two most common responses after market multiple was 1) bracketing valuations based on stage of business (also a favorite of VCs) and 2) more surprising to me, how much money and time had already been invested in the business. Founders have sacrificed their salaried job, their own savings, and put a lot of their social capital on the line to make ventures work – and they prescribe significant value to this. Understanding this perspective, and empathizing with what founders have contributed to bring a business to life, is important to building a relationship of mutual respect.

Founder Belief #2 – People Matter

Over 60% of investors I surveyed said their greatest fear in funding African startups is management team quality. This assessment spans the emotional, social and leadership intelligence of a founder. Likewise, nearly half of founders called out management team quality as a key factor influencing their valuation. Start connecting the dots!

What if more VCs focused on building relationships early with founders, even if they weren’t ready to invest? What if VCs did more to play an active role as mentors to promising founders? Surveyed founders highlighted major concerns when approaching VCs were that they were “not human”, “inaccessible”, and looking to “rip off founders if they are uninformed or desperate.” This isn’t an attitude likely to preclude a healthy partnership or attract high quality founders.

Likewise, founders need to highlight that they understand the inherent risks in their market and business plan, that they have the ability to lead the company through these challenges and to growth – that they have developed an internal system to successfully attract, train, and retain quality staff. Easing the leadership worry immediately shifts the tone. Two parties move from being adversaries on opposite sides of the table, to partners on the same side.

Founder Belief #3 – Protect Myself First

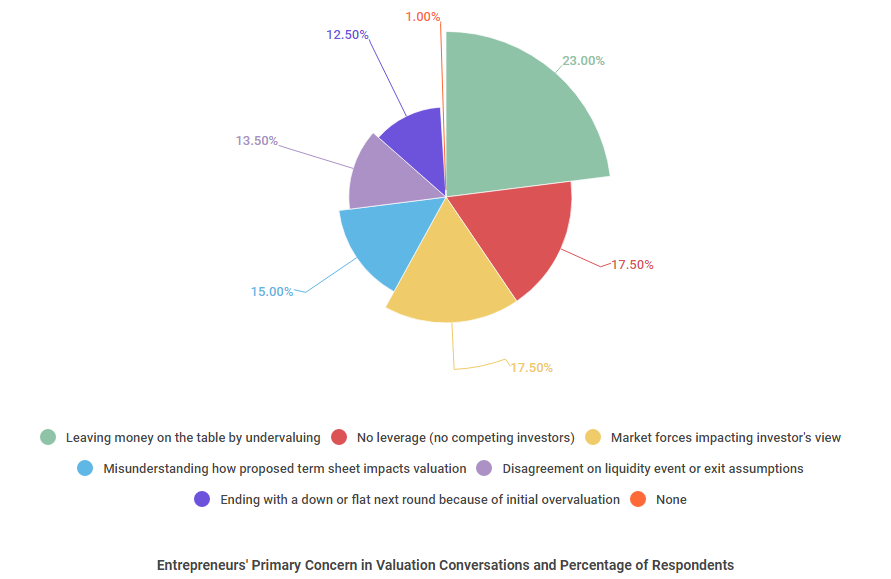

Surveyed founders made it quite clear. The number one fear in establishing a valuation is “leaving money on the table by undervaluing their company”. Missteps abound when founders negotiate from a place of this fear, and more often than not, it comes from a place of misunderstanding the market dynamics rather than greed.

A spirit of fear is inherently contrary to a candid, honest, trust-building negotiation. VCs, this begins with you. You must be unequivocally committed to enabling a healthy ecosystem, even if this means teaching, training, mentoring, supporting, being forthcoming about comparable valuations and doing what is best for a business. This behavior melts the fear that muddies the valuation discussion.

Remarking on the spirit of the VC and founder relationship, three West African startup leaders shared that VCs could help in the valuation conversation by:

“Communicating what a VC would like to see in terms of traction metrics to achieve the entrepreneurs’ target valuation.”

“Educating founders; showing comparable valuations in the market.”

“Having transparent templates or guides to help ease valuation concerns, and help support a founder in determining value of their company at every stage of the business as it grows.”

Although anxieties abound when negotiating on valuation, remember that each party has the same ultimate mission to build a successful business and mutual understanding is key. The Africa-startup market poses enough challenges to investors and entrepreneurs – both parties must work together as a team rather than adversaries.

At Singularity, we are working with other investors and ecosystem leaders to assemble a database of valuation metrics that can be used by the overall entrepreneur community. Although specifics on deals won’t often be available because of confidentiality, we are trying to assemble a resource so that transparency helps the overall African startup community. Stay tuned!