IN PARTNERSHIP WITH

Good morning ☀️ ️

Squid Game has been generating a lot of attention.

As it tops top-10 lists in 90+ countries and inches closer to stealing Bridgerton’s crown for most-watched Netflix show, the survival drama is also busy causing trouble.

Last week, South Korean internet service provider, SK Broadband, sued Netflix over the increased traffic the series brought to their network. Somwehere else, a woman is getting bombarded with thousands of calls and messages from viewers after Netflix used her very-real phone number in the show.

Seems like people really like playing games with each other.

In today’s edition:

- The rise of Kenya’s news aggregators

- Morocco is getting supercharged

- OkHi is improving Nigeria’s address verification system

- TC Insights: Africa’s crypto moves

- Events: TC Live with Ciku Kimeria

- Tech Probe

THE RISE OF KENYA’S NEWS AGGREGATORS

Kenya is all about the news. No, really, “Habari”, a common greeting in Swahili, means “Any news?” in English.

Of the country’s 52 million population, less than 40% say they get their news through print media. This number, in addition to TV viewership, has been on a steady drop since 2013 when digital media hit the country.

In Kenya, the circulation of English daily newspapers declined from 102 million copies in 2014 to 87.1 million that same year. And Kiswahili daily newspapers declined in circulation from 58 million copies in 2014 to 37 million in 2018.

Why are the numbers dropping?

The average cost of newspapers in Kenya is $0.54, and that can be expensive, especially in a country where a quarter of its citizens live on $1.90 a day.

There’s also the rise in news aggregators, which are cheaper and more accessible.

Why pay for a newspaper when you can get it for free online?🙃

How are Kenyans reading news now?

Through a number of means, though news aggregators and social media are at the forefront.

Kenya has a 70% internet penetration rate. This figure is important because the average rate for internet penetration in African countries is 44%.

It also means that a lot of Kenyans are online, and according to this report by the Kenya Media Assessment, only 4% of Kenya’s reading population don’t get their news online.

Most peruse news aggregators to find out what’s happening in their country.

The new news circuit

In an increasingly digital society, news aggregators are offering a new avenue for readers to access diversified content and human stories.

News aggregators use AI to collate news from different sources, placing them in one, central, scrollable feed. The rise of the news aggregator has, without a doubt, changed the global news industry.

There’s Google News and Flipboard and, more importantly, OPay’s Opera news, which is doing something different from other news aggregators: curating original, local news stories from paid content creators.

Alexandria Williams has more about Opera News in Aggregators are enabling independent voices in Kenya’s controlled news circuit.

MOROCCO IS GETTING SUPERCHARGED

Tesla is making its first entry into the African market. This month, the electric vehicle (EV) company installed its first two Supercharger stations in Morocco—at a hotel in Casablanca and a resort in Tangier. Supercharger stations are often a signal of Tesla entering a new market; Tesla has more than 25,000 Supercharger stations worldwide.

Why Morocco?

Morocco has become a go-to destination for electric vehicle manufacturing in Africa. In 2017, Chinese automobile maker, BYD, became the third automobile manufacturer to set up shop in Morocco with a 50-hectare car manufacturing plant for the production of electric cars, buses and trucks and electric trains.

This year, STMicroelectronics, a French-Italian electronics and semiconductors manufacturer with a factory located 20 kilometres outside of Casablanca, also began manufacturing Tesla Motor’s semiconductors.

Africa’s Tesla Challenge

While there are charging ports and parts manufactured for Tesla in Africa, the company’s vehicles still aren’t available for purchase.

Africa’s two new Superchargers may just be for Tesla drivers on summer road trips through Europe to Morocco and not necessarily a signal that the company will start selling EVs in Africa anytime soon.

But some eager drivers are already purchasing Teslas from abroad and importing them into Africa. East and Central Africa’s first-known Tesla owner imported his Model X 75D to Kenya and paid around $75,000 in import duties.

Even if Tesla began to sell cars in Africa, major adjustments to import duties on EVs need to be made first. Or, similar to what the company did in China, African countries may need to begin manufacturing EVs domestically to lower costs.

Accept international payments from your customers in the USA, UK, Canada, and 60+ countries using Pay with Apple Pay.

👉 Create a free Paystack account to get started.

This is partner content.

OkHi IS IMPROVING NIGERIA’S ADDRESS VERIFICATION SYSTEM

OkHi, a digital address verification startup, is pivoting from Kenya to help Nigerian companies verify their customers’ addresses.

Why Nigeria?

One of the most tiring ordeals in Nigeria is trying to figure out your billing address so you can shop online. Granted, banks have made it easier for you to request this info, but even so, it doesn’t work for all financial services that need billing addresses.

Before you blame it all on fintechs and banks, it’s not their fault. It’s the street-addressing system in Nigeria. While most urban areas have street names registered on Google Maps, the address system for rural or semi-urban areas—where the majority of people live—do not. There’s also the problem of mismatched house numbers.

It’s not only Nigeria, though. The United Nations estimates that more than 75% of countries have poor or no street-addressing systems, which affects 4 billion people—more than 400 million of them in Africa—and costs businesses billions of dollars annually.

Most banks in the world use utility bills and send human agents to verify prospective customer addresses as part of a mandatory Know Your Customer (KYC) procedure. Because of the poor address verification system in Nigeria, the process is not only time-consuming and costly but also limits people’s access to financial services.

OkHi’s OKRs

Through its products—OKCollect, OKVerify, and OkGo—the company enables businesses, from e-commerce to ride-hailing startups, to collect accurate addresses with a GPS and photo from their customers, verify the information using smartphone data and help agents navigate to the locations without getting lost.

Read more in Michael Ajifowoke’s An ex-Google EMEA lead expands his address verification service to Nigeria

Join the Future Africa Collective – an exclusive community of investors who invest in startups building the future of Africa. With a $1,000 annual or a $300 quarterly subscription fee, you get access to invest a minimum of $2,500 in up to 20 fast-growing African startups each year.

Learn more here.

This is partner content.

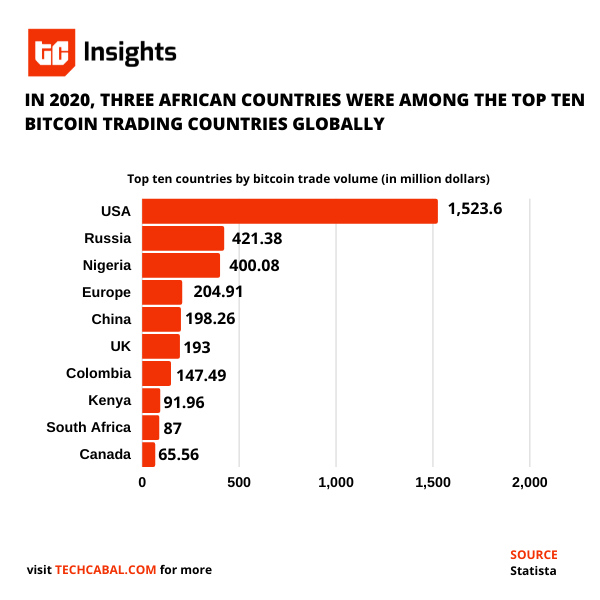

AFRICA’S CRYPTO MOVES

Although Africa captures only 2% of the global value of all cryptocurrencies received and sent across the world, cryptocurrency activity in the region ranks among the top 10. Overall activity in the region rose from 67% in October 2019 to 78% in 2020.

One of the use cases driving crypto activity is remittances. Remittances remain a huge source of income for many African countries. According to the World Bank, remittance flows to sub-Saharan Africa for 2019 were close to $48 billion. However, remittance to sub-Saharan Africa costs higher than most regions across the world. On average, a sender incurs an 8.9% transaction cost to send money to the region when compared to the global average of 6.8%.

Africans are choosing cryptocurrency over fiat currencies to send money across borders so they can bypass bank charges. In the same vein, reduction in currency value across the continent and increasing hyperinflation has increased adoption, with most people hedging against these economic uncertainties with crypto.

Yet, there are challenges limiting cryptocurrency adoption. Aside from the lack of reliable and affordable internet outside major cities, financial illiteracy is an issue. A lot of people are ignorant of how digital currencies work.

Secondly, cryptocurrencies are not legal tenders in many African countries. Converting local currencies into cryptocurrency is a complex process often mediated by informal brokers.

Apart from being largely unregulated, cryptocurrency is volatile. Also, the lack of proper regulation in many African countries means most people remain skeptical about adopting it. The recent crypto scams in South Africa have fueled this distrust.

In 2020, South Africa witnessed the world’s biggest crypto scam worth US$588 million. In April 2021, a bigger crypto scam happened in the country. The co-founders of Africrypt stole US$3.6 billion from investors.

People with little or no experience in blockchain technology or cryptocurrencies are at higher risk of falling prey to these crypto scams.

While these challenges persist, the convenience of using smartphone apps to purchase cryptocurrencies continues to appeal to young Africans. Kenya leads the world in peer-to-peer transactions in digital currency while Togo (2), Tanzania (4), and Ghana (10) make up the list of top-ten countries globally.

It’s never been easier or safer to make online payments. Get the FCMB Virtual Debit Card and you don’t have to worry about forgetting your Debit Card at home!

To learn more, please click here.

This is partner content.

JOB OPPORTUNITIES

Every week, we share job opportunities in the African ecosystem.

- TechCabal – Consumer Tech & Digital Culture Writer – Africa (Remote)

- Big Cabal Media – Senior Sales Manager – Lagos, Nigeria

- Big Cabal Media – Product Management Intern – Lagos, Nigeria

- Future Africa– Research Associate – Africa (Remote)

- Ericsson – Sales Associate – Accra, Ghana

- MaxHosa Africa – Videographer/Photographer – South Africa

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

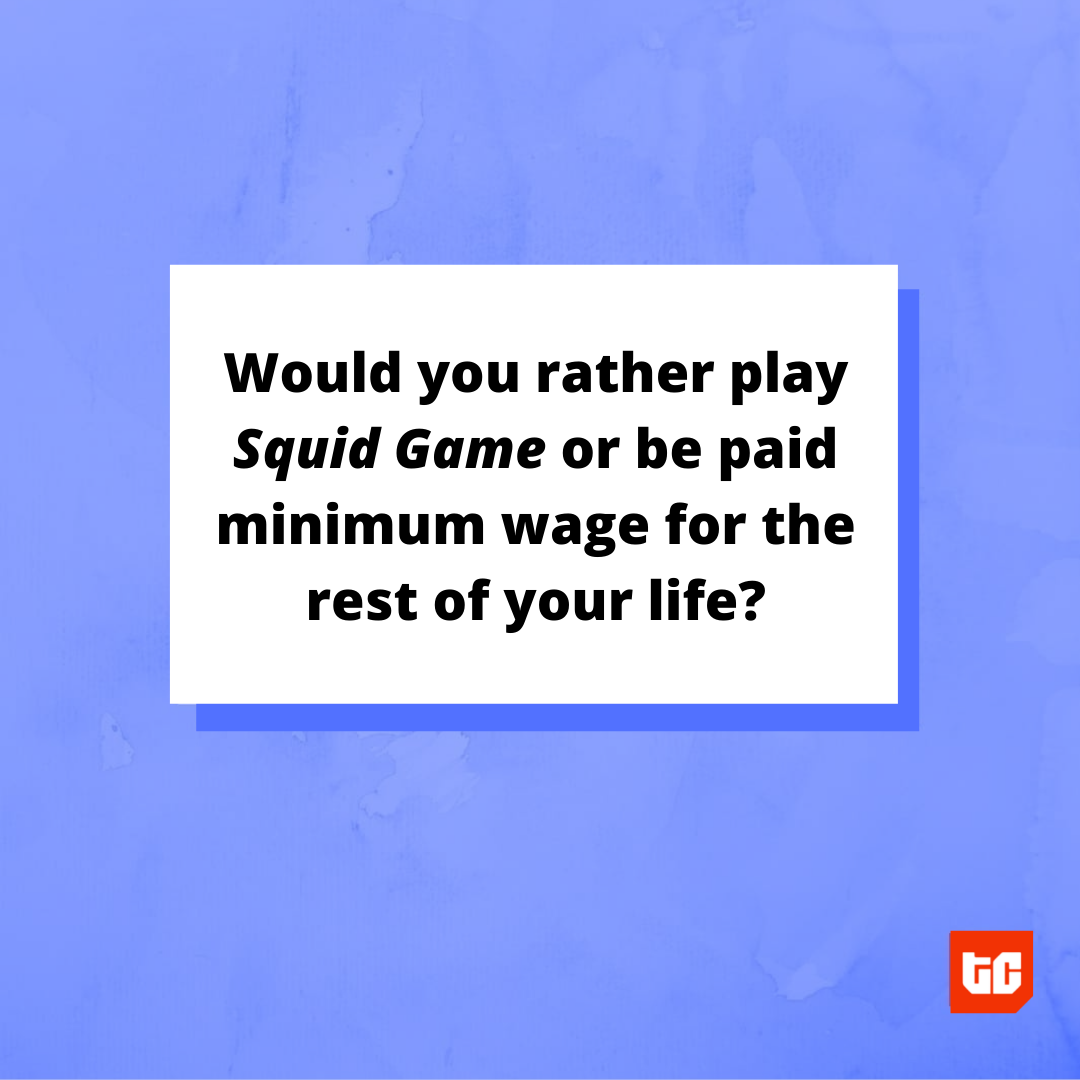

TECH PROBE

Woud you?

Share your thoughts with us on Twitter and Instagram, or send a reply to newsletter@techcabal.com.

We’ll publish some of the most interesting responses on Friday.

What else we’re reading

- Here’s a deep dive inside Facebook’s plan to connect the world with robots.

- Who’s the voice behind Netflix’s Super Sema series? It’s Kenya’s 13-year-old Sycie Waweru, and she’s doing welllll.

- Last month, Google announced its plan to remove anti-vaxx content from YouTube. This month, it’s moving against those who contradict climate change.