This article is the first of a four-part series submitted to TechCabal by Hillary Omitogun. Hillary Omitogun is a UX Researcher, Market Research Consultant, and B2B Writer focused on helping founders and VCs better understand their market.

The rise of Decentralized Autonomous Organisations (DAOs)

Digital currencies like cryptocurrency are radically changing the global economy as we know it. The main appeal of these currencies is their openly-sourced decentralised nature, which makes them more secure than traditional currencies. The rise in popularity of Decentralised Finance (DeFi) has propelled the sudden but inevitable interest in Decentralized Autonomous Organisations (DAOs).

What are DAOs?

As the name suggests, DAOs are communities that have no centralised leadership and are managed by members. The rules and governance at these organisations are encoded on a blockchain, thereby facilitating transparent and collective decision making among the stakeholders.

A DAO allows people to remotely coordinate social capital, funding, and time through smart contracts, which are transaction protocols or programmes that automatically execute an agreement. This agreement—often called rules—is typically decided by the DAO members and fosters transparency.

How do DAOs work?

After agreeing on a set of rules, DAOs proceed with a funding stage that interested parties can participate in. DAOs typically raise funds by selling native tokens and filling their treasury. Subsequently, the DAO goes live and important organisational decisions are made by its members.

DAO members often need to own the DAO’s tokens to be eligible to vote on proposals and updates. In most cases, the magnitude of a vote greatly depends on the number of tokens held. It should be noted that not all DAOs have their own token; some simply use Ethereum or Bitcoin in place of a native token.

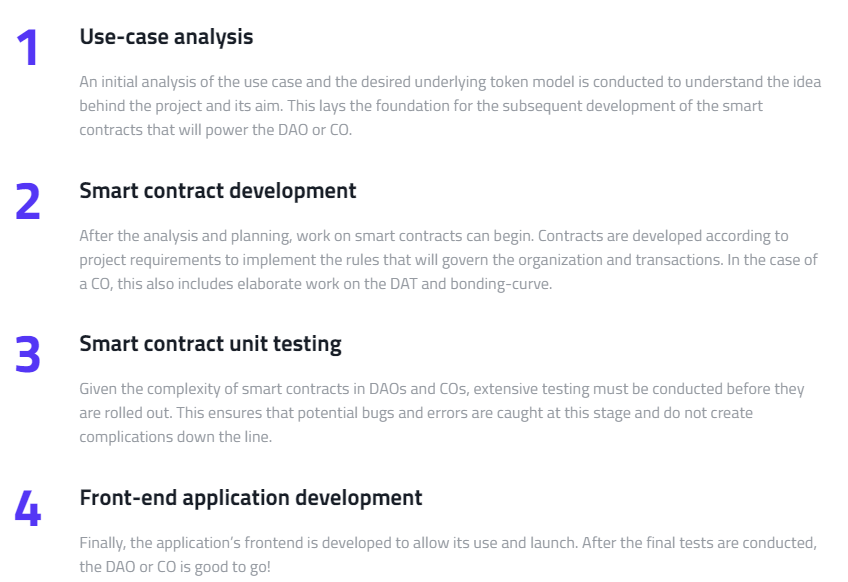

Companies like LimeChain, Aragon, and Alchemy have tools for building a DAO on an open-source infrastructure. These tools make it easy to incentivise contributors, pool capital from people anywhere and govern transparently with group participation.

How are DAOs used within crypto communities?

There are several use cases for DAOs, most of which are funding areas. DAOs can be social clubs, business-oriented, or charity-focused. This piece by Aragon describes over 10 use cases of DAOs, including art collectives, social media, metaverses, insurance, trust funds, project fundraising, media, politics, nomad communities, and venture capital.

Non-profit organizations can be structured as DAOs to accept donations worldwide and collectively decide how such donations should be spent. Another use case applies to freelancing. DAOs can be used to form a network of contractors who gather their funds for expenses like software subscriptions.

Are DAOS the future of online communities and borderless interactions?