IN PARTNERSHIP WITH

Happy salary day 🤑

The thought I’m peddling this week is that streaming services may have become too expensive for how scanty their libraries are.

Season 7 of Big Brother Naija premiered this weekend, and anyone without a DStv subscription has to get a Showmax subscription to keep up with the characters. It’s either that or tuning into Twitter FM for live updates.

The good news: I now have 24-hour access to 20-something-year-olds playing children’s games. 🙂The bad news? I have both Netflix and Showmax subscriptions but still can’t watch all the shows I want like Criminal Minds or Ms. Marvel. I’d have to get Disney+ if I want to watch those, but the service isn’t even available in my country yet.

Streaming services don’t have to look too far for why they keep losing subscribers: there are too many of them now, and most offer too little for their asking prices. 🤷🏾♂️

In today’s edition

- Crypto Market

- Standard Chartered shuts down international spend on naira card

- South Africa’s taxman wants its share of bitcoin scam

- Netflix’s ad plan will have a smaller library

- TC Insights: Acquire South Africa

- Future is Female mentorship programme is live

- Crossword: Guess the currency

- Job opportunities

CRYPTO MARKET

|

|

|

|---|---|---|

|

Bitcoin

|

$21,886 |

– 2.15% |

|

Ethereum

|

$1,515 |

– 2.52% |

|

BNB

|

$254 |

– 1.28% |

|

Solana

|

$38.12 |

– 1.79% |

|

Cardano

|

$0.49 |

– 3.74% |

|

|

Source: CoinMarketCap

|

|

* Data as of 04:30 AM WAT, July 25, 2022.

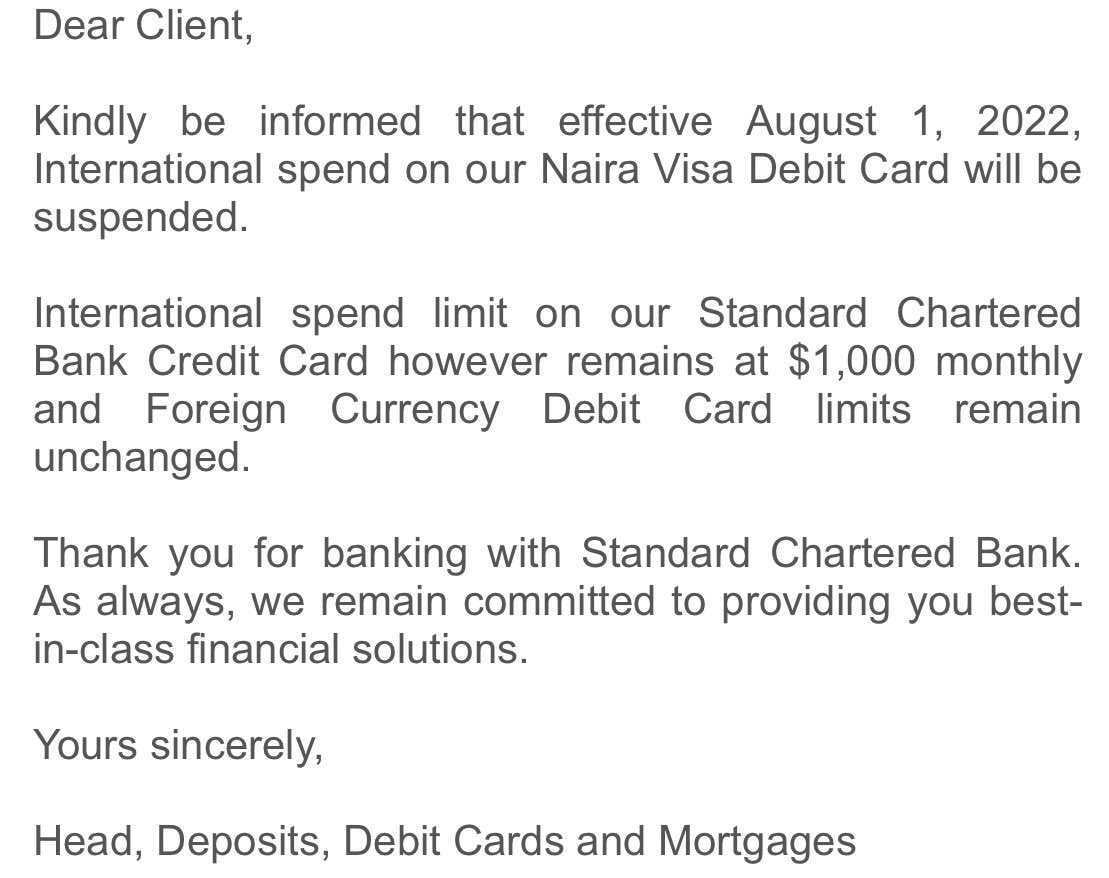

STANDARD CHARTERED SHUTS DOWN INTERNATIONAL SPEND ON NAIRA CARD

There’s more troubling forex news from Nigeria.

A few weeks ago, several African fintechs shutdown their virtual dollar card services after their API provider, Union54, experienced recurring chargeback fraud issues.

Many Nigerian businesses and individuals were affected as most can’t use their naira cards to pay for international services like Netflix or Amazon Web Service (AWS). It appears more will be affected in coming weeks.

What’s happening?

Last weekend, Standard Chartered Bank, a British multinational bank, announced that it would be shutting down international spend on its naira cards. From August 1, all its customers will no longer be able to use their cards to pay for foreign subscriptions.

This time, the culprit isn’t chargeback fraud but Nigeria’s deteriorating forex situation.

Over the past few months, several commercial banks in Nigeria have instituted a $20 international spending limit on their naira cards. Banks like Zenith and UBA also suspended the use of naira cards for international ATM cash withdrawals and POS transactions.

This is all because the Central Bank of Nigeria (CBN), Nigeria’s apex bank, has reduced how much forex it makes available to commercial banks following a massive 2-year drop in its forex earnings. While the CBN continues to sell dollars at an official rate of ₦415/dollar, the prices of forex on parallel markets have soared to ₦630/dollar.

Zoom out: It’s not clear if other banks will follow suit, but if we learnt anything from Q1 when most banks instituted the $20 spending limit, it’s that bad news comes in quick succession.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

SOUTH AFRICAN TAXMAN WANTS A BILLION FROM BITCOIN SCAM

Two weeks ago, the US Commodities Futures Trading Commission (CFTC) announced that it had charged a South African man with involvement in a $1.7 billion bitcoin fraud scheme.

Well, the good news is that some of the funds from the said scheme have been recovered by the liquidators of Mirror Trade International (MTI), a company which the accused Cornelius Johannes Steynberg was CEO of, and which was used to run the scam.

The bad news, however, is that for people who were victims of the scam, it is unlikely they will touch a cent of the recovered funds, all thanks to the South African Revenue Services (SARS).

The billion-rand bigger picture

According to MyBroadband , in March 2021, the liquidators recovered 1,281 bitcoin frozen by MTI’s former brokerage in Belize, FXChoice. The liquidators immediately sold the bitcoin and received R1.1 billion (~$65 million) for the assets.

SARS says that the liquidators failed to file their tax returns and slapped them with a R580 million (~$34 million) fine plus tax and interest, bringing the total to R930 million (~$55 million) between the tax years 2020 and 2021.

But, but, what about the victims?

If the SARS’ claim is successful, between R69 million (~$4 million) and R169 million (~$10 million) in the failed scheme’s estate, a sizeable chunk of which will likely be spent on legal fees, leaving little for the victims.

Apart from the South African taxman, at least 3 other parties are vying for their slice of the R1.1 billion pie—MTI’s liquidators, Steynberg’s liquidators, and the CFTC in the US, where it is claimed MTI defrauded 23,000 individuals out of 29,421 bitcoins valued at R29.6 billion (~$1.7 billion.)

That’s it, folks

It seems as though victims of the fraud scheme were probably looking to get justice in the form of both their money back and seeing the perpetrators of the scheme behind bars. It’s starting to look more likely that they will just have to settle for the latter.

NETFLIX’S AD-TIER PLAN WILL HAVE A SMALLER LIBRARY

Some people say that exclusivity is the backbone of successful businesses. Now we can’t be sure if Netflix executives believe this, but these stakeholders are bringing exclusivity to Netflix.

Since April 2022, when Netflix officially announced that it would launch ads on its platform, there have been speculations about how the ads would operate, especially with Netflix’s recent efforts to end password sharing on the platform.

Netflix finally announced last week that its imminent ad-supported plan would not allow users to see all the movies on its current catalogue. This comes after the streaming service company partnered with Microsoft to market an ad-supported tier in its subscription options.

While we will have to wait till next year to see what movies will be off limits for the ad-supported tier, there’s the looming question of whether hits like Stranger Things and Squid Game will be included as exclusives, seeing that these movies literally pulled people to use the service.

If you ask us, putting those hit movies as exclusives will negatively affect the adoption of the ad plans. Who wants to watch ads and still not watch hit movies? Definitely not us!

Netflix already has a location-specific library that restricts what users can see or when they can. For example, season 6 of Peaky Blinders took 4 extra months to be available in some parts of the world.

Big picture: We don’t see how this exclusivity pays Netflix. Its limited library is probably Netflix’s biggest crutch right now. Is it the wisest thing for Netflix to dilute its library some more?

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront

This is partner content.

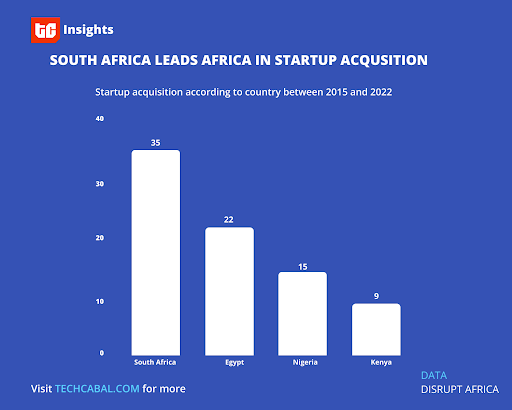

TC INSIGHTS: ACQUIRE SOUTH AFRICA

While Nigeria remains Africa’s leading information and technology market, South Africa has cemented its position as the king of tech mergers and acquisitions. It leads the way for exits, with companies in the country accounting for more than one-third (35) of the acquisitions that have taken place across Africa’s tech space since 2015. Egypt, Nigeria, and Kenya complete the pile with 22, 15, and 9 respectively.

In the same vein, South Africa leads the way annually in terms of the number of successful exits. It topped the list in 2019, 2020, 2021 with about 6, 3 and 9 exits respectively, and is on course to repeat the feat this year, with 6 such deals so far as of the end of May 2022.

South Africa’s robust economy and high economic indices mean deals like these are common occurrences. For instance, the country is the most developed country in Africa, with services representing 73% of its $329.53 billion strong GDP as of 2021.

According to Tshepo Magagane, an investment banker based in South Africa, “It is primarily the shape and structure of the economy, with South Africa having more mature companies which are then rechanneling funds into the start-up tech scene with the capital markets and banking system playing a supportive role.”

Similarly, the presence of strong and established local tech businesses means exits are never far away from budding and viable startups. “What you see in South Africa is a more pronounced local ecosystem; the likes of Naspers Foundry, large Technology, Media, and Telecom (TMT) companies are a big driver of activity. Successes from Naspers and other telco giants such as MTN and Vodacom have created a virtuous cycle,” he further shared.

This has made working in startups attractive to many young graduates fresh out of school, ensuring the startup pipeline continues to expand. “Graduates coming out of UCT, UP, Wits, Stellenbosch are not looking for jobs in big companies, they are focusing on start-ups and small companies.”

While the volume of acquisitions will likely increase activity within the startup ecosystem, a focus on getting acquired by bigger companies may stifle innovation among startups.

“In the long term, there are risks that the involvement of large companies may strangle innovation/risk-taking (or block new entrants).”

A strong private sector is key to stimulating acquisition deals and other countries can draw invaluable lessons from South Africa for acquisitions to become frequent. “It is important to create an environment in which the private sector can flourish by reducing and minimising redtape, creating an enabling legislative environment, fostering an efficient legal structure, and enhancing the local financing system.”

Acquisitions have just begun and as startups continue to play important roles in daily life on the continent, the future indeed looks bright.

You can download all our reports here and watch videos from our events. Send your custom research requests here.

FUTURE IS FEMALE MENTORSHIP PROGRAMME LAUNCHES

Moore Media International Public Relations, a US-headquartered PR agency focusing on African tech startups, announces the launch of the third edition of The Future is Female Mentorship Programme. The programme is a public relations (PR) and communications mentorship initiative dedicated exclusively to African female tech founders. It is the only one of its kind in Africa dedicated to female founders.

Mirroring previous editions, the third edition will provide African female tech founders of early-stage startups with the fundamentals of PR and comms for their business. During the programme, the founders will learn how to create a PR plan, tips on incorporating storytelling into their PR and comms, best practices on how to secure media coverage, how to position their startups for investment opportunities, and more.

If you are an African female tech founder launching in African markets and/or serving Africans in the diaspora, apply here by July 29. You can also learn more about the programme here or follow @CMooreMedia and #CMMTheFutureIsFemale for updates.

Fincra provides easy-to-integrate APIs developed and designed to launch seamless and reliable global payment solutions.

With Fincra’s customisable APIs, developers can build quick financial applications.

Build the best payment solutions on Fincra.

This is partner content.

CROSSWORD: GUESS THE CURRENCY

Nothing has driven us all to anger these past months like the value of all our currencies. Take the edge off today and see how many of these currencies you can actually guess.

IN OTHER NEWS FROM TECHCABAL

The UK Global Talent Visa isn’t just for techies. Writers, fashion designers, and even academics can get it too. Here’s how 2 Nigerian writers, Ope Adedeji and Chika Jones, used the visa to japa.

The co-founder of talent discovery startup Jobox is not gunning to be Steve Jobs but he does want to change the world. Here’s how he’s doing just that.

Digitising consumption in Africa has made significant progress. But digitally transforming boring business processes like how businesses pay other businesses has remained largely unchanged. What will it take to change that?

The growth of Nigeria’s tech ecosystem is being threatened by rising inflation and fuel prices.

JOB OPPORTUNITIES

- Big Cabal Media–Head of Events, Financial Analyst – Lagos, Nigeria

- Klasha – Senior Backend Engineer, Senior Frontend Engineer, Content Marketing Manager – Cape Town, South Africa

- TeamApt – Technical Product Manager, Software Engineering Manager, Paid Marketing Specialist – Lagos, Nigeria

- Heroshe – Senior Product Manager – Africa (Remote)

What else is happening in tech?

- Mobile money interoperability in Kenya has its work cut out.

- Liquid Cyber Security launches Africa’s cybersecurity fusion centre in South Africa.

- Tanzania’s fintech NALA enters Kenya, and inks diaspora remittance deal with Equity Bank.

- Google fires engineer who said its AI tech was sentient.