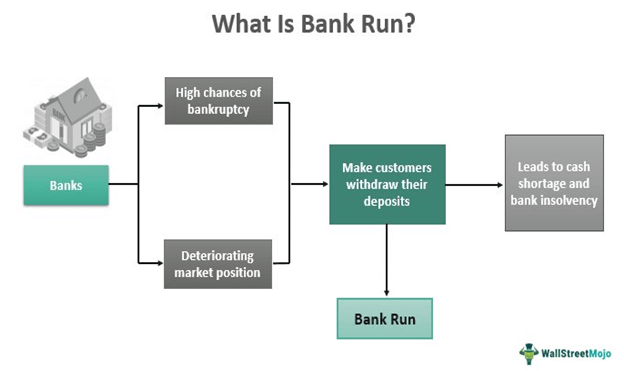

Yesterday, news broke that Silicon Valley Bank, the bank of choice for most startups and venture capitalists, was shut down by the Federal Deposit Insurance Corporation (FDIC). The closure was triggered by a bank run that began after the bank announced that it lost $1.8 billion in the sale of treasuries and securities. Without clear communication, many customers took those losses as a sign to take their money out of the bank.

A memo released by the FDIC has assured SVB’s customers that insured depositors will have access to their money by Monday. But there’s a catch: deposits are only insured up to $250,000, and non-insured depositors will be paid an advanced dividend within the next week. Future dividends could be paid as SVB’s assets are sold in the immediate future, according to the FDIC.

Where does this leave African startups?

The closure of SVB has triggered panic on the African continent, and that fear is not without reason. Y-Combinator’s president, Garry Tan, said on Twitter, “30% of YC companies exposed through SVB can’t make payroll in the next 30 days”. Y-Combinator has over 80 African startups in its portfolio. One of its founders tweeted yesterday, “All the startup founders groups I’m in are in full-on panic mode. Everyone is moving money around. Nobody knows which banks are safe.”

Several African startups had funds in SVB as the bank was a lender for startups and asked that startups have deposits in the bank as collateral. The bank offered loans against shares for founders and cashflow loans. Also, before Mercury Bank—one of Silicon Valley Bank competitors—was created in 2019, SVB was the preferred bank for startups.

According to SVB’s website, Chipper Cash, one of Africa’s most valuable startups, was one of its customers. The startup has recently been in the news for conducting another round of layoffs after laying off 12.5% of its employees last year. Employees at another fintech startup that spoke to TechCabal on the condition of anonymity said that their company had $1.5 million in SVB and are confused about how the company would move forward.

Uncertainty is the name of the game

Startups that have received funding from SVB may be directly affected by the crash. As part of the investment, they may have been required to open deposit accounts in the bank, which housed money for operational expenses. It’s similar to how crypto startup Nestcoin let go of many employees when one of its leading investors, FTX, crashed. The startup had most of its operational funds in the now-defunct company. This may be the case for companies that received significant investment from the bank.

But there are signs that the effects may not be as wide-ranging as feared. Many observers have noted it was challenging for Africa-based startups to open accounts in the bank. The situation will get more apparent over the next few weeks, and it will become clearer to measure the effect of SVB’s closure on African startups.

*This is a developing story