The global pursuit of financial inclusion as a vehicle for economic development has yielded positive impact in Nigeria as the exclusion rate has reduced from 53.0 % in 2008 to 36.8% in 2018. Despite overall progress, the gender gap still remains. According to the EFInA Access to Financial Services in Nigeria, 57% of women were financially excluded as against 49% men in 2008. In 2018, 41% of women are still excluded against 33% of the male counterpart. The gender gap increased from 7 in 2008 to 8 percentage points in 2018, indicating a systemic obstacle to women financial inclusion in Nigeria. Some of the factors driving financial exclusion among women stem from institutional, cultural barriers and socio-economic constraints. In some markets especially in gender-segregated societies, women have limited access to public spaces, identification documents, bank accounts, mobile phones, and economic activities.

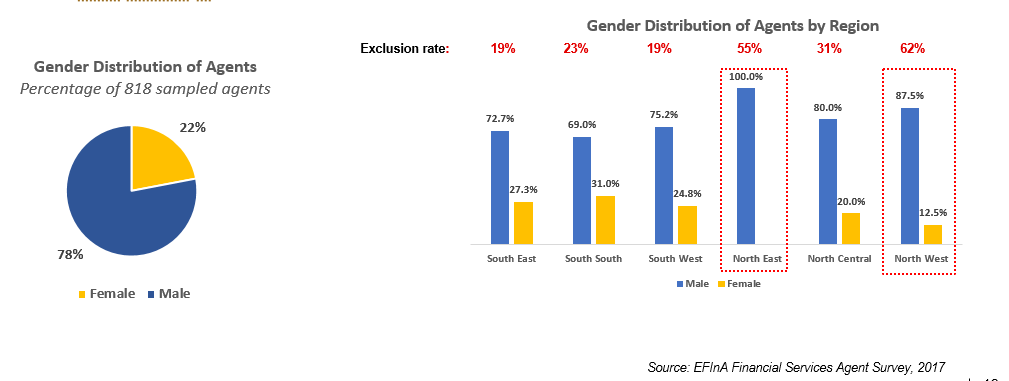

There is a predisposition that women offer better customer experience and women are more likely to access financial services from an agent of the same gender. Microsave studies have shown that Female agents create a reassuring environment for transactions for both male and female clients. Customers feel that female agents have more patience and are more willing to spend time to address queries or explain the features of a new product. However, there is no or little representation of women in agent banking across markets. More women in agent banking may be the key to close the gender gap in financial access in Nigeria.

More intentional action is needed to encourage more participation of women in agent banking. According to GSMA study, enlisting female agents may be the most effective way to overcome low literacy rates, and build women’s confidence and trust in using financial services. Providers need to consider the following while formulating their agent network strategy for women:

- Identify and provide reliable tailored information for female agents as part of the recruitment and on-boarding process

- Influence male family members to support female agents. Provide reliable information, and encouraging them to motivate female household members to become agents

- Address the issues of lack of capital, lower-quality training and customer enrolment rate

- Providers should invest in better understanding of this segment of their agent network as it will be very crucial for further business expansion

- Adopt progressive and innovative agent models tailored to women to enable female agents to succeed

- Providers should think of creative ways that are culturally appropriate to integrate women into their networks if they are to grow their female customers

- Engage female field force as part of the agent recruitment and on-boarding team

In conclusion, providers need to understand the women segment of their agent network. Data analytics will provide insight into gender performance patterns generating knowledge to support Financial Services Providers (FSPs) in decisions that narrow the gender gap in agent banking.

As part of EFInA’s efforts to support the widespread deployment of agent networks in Nigeria, EFInA in partnership with SANEF (Shared Agent Network Expansion Facility) with the support of the Central Bank of Nigeria will be holding its second Quarterly Financial Services Agent Forum in Abuja on Wednesday, September 4, 2019. The platform is organized to discuss recent happenings in the agent networks space that is impacting their business. All agents and super-agents interested in attending this forum should click on this link to register https://bit.ly/2PfsB7e

Henry Chukwu is Programme Specialist, Agent Networks at Enhancing Financial Innovation and Access (EFInA), a financial sector development organization that promotes financial inclusion in Nigeria. EFInA is funded by the UK Government’s Department for International Development (DFID) and the Bill & Melinda Gates Foundation.