Despite established competition from Uber and Bolt, OPay launched OCar, a ride-hailing service which they hope will be as popular as ORide, the bike-hailing service. It is the latest in a string of verticals that includes OFood, OLists, Okash and OWealth.

While the company has seen impressive adoption with ORide, cab-hailing is generally considered to be a different beast.

Since Uber’s entry into Nigeria in 2014, competition has swiftly followed: Rideshare, GidiCab, InDriver, among others. Of all the newcomers, only Bolt has managed to grab considerable market share.

The barrier to entry in the ride-hailing services industry is low. First, you need an app like Onde, then you’re left with the task of recruiting drivers and getting people to use the app.

Many entrepreneurs find the first step easy, but the second step is where the challenge lies.

It’s a careful demand-supply dance: to get drivers to sign up to your platform, they need to know they’ll earn money, to get people to use your service, they need to know they will find drivers.

So how is OCar tackling this problem, given their late entry to the space?

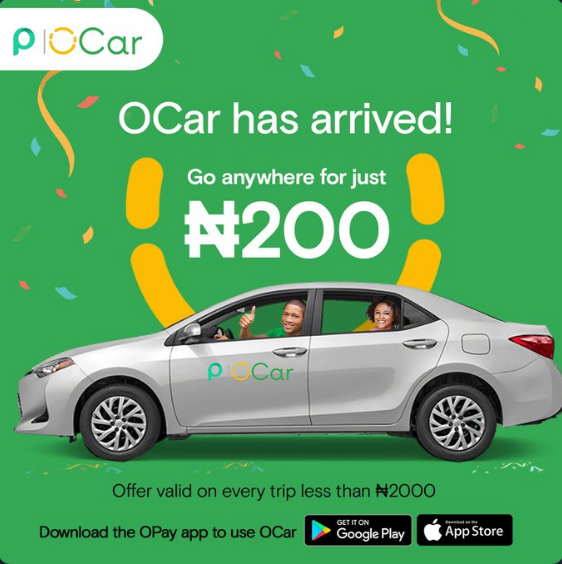

Massive discounts for riders while drivers earn full fare

Like ORide, OCar started with eye-watering discounts. In the first week, it was N200 ($0.55) for trips within Lagos, followed by the current N250 ($0.69) charge.

These heavily discounted fares make you wonder how the drivers earn money. But despite these discounts, OCar pays the riders the full fare and sweetens the deal with a reported N800 bonus for each trip.

An OCar driver who spoke to me on the condition of anonymity explained that he has been picking up passengers all week.

“People are using it because it is cheap. I’m registered on Uber and Bolt, but throughout this week, I’ve only been taking trips from OCar,” he told TechCabal.

Next-Day Payment

While Uber and Bolt have a weekly remittance for their drivers, OCar pays drivers in 24 hours. In a cash-intensive business where drivers need cash flow to fuel their cars and carry out maintenance, it is commonplace to hear cab drivers insist they only want cash trips.

OCar has tapped into this need for cash by paying the drivers on their platform within 24 hours. This has proved to be a gamechanger. Why wait seven days when you can get your earning from card payments the next day?

Tacked on to same-day payments, OCar also charges lower commissions than Bolt or Uber. Bolt takes 20% of drivers earning as commission, Uber charges 25% while OCar charges 15%.

Should Uber and Bolt be worried?

On the face of it, Uber and Bolt have a lot to be worried about but Bolt is the company more likely to see its market share reduced.

A driver who spoke to TechCabal pointed out that Bolt is notorious for slow issue resolution.

“If you use Bolt, you will know that if a customer orders a ride and refuses to pay, Bolt will not pay the driver back. This is why Bolt drivers are likely to fight when customers don’t pay because they know they won’t get their money back.

“With Uber, once you tell them a customer refused to pay, you will get your money back.”

While customer loyalty is rare in the cab-hailing space, Uber has built a modest crowd of loyalists who will use Uber or nothing.

Oluwatosin Itabiyi, an Information Technology analyst, uses Uber for 9 out of 10 trips.

He told TechCabal: “Uber cabs never show up with another plate number or another whole human being who is not the driver. Bolt drivers are fond of changing their cars and it’s unsettling because it can be unsafe. According to one Bolt driver, they have to go the Headquarters when they have to change their car details but for Uber, they do it online, hence it is seamless.

“Uber consistently gives me 5 coupons every week. It’s been months since they started doing it and one time when they sent it and it didn’t work, I complained and not only did they rectify it, they gave me a discount on my last trip from the previous coupon cycle. Bolt gives slightly bigger coupons once in a blue moon for 3 trips and sometimes ridiculous coupons of one hundred Naira.

“What would I do with a hundred Naira coupon? I feel mocked,” he added.

Subjective issues like driver attitude and quality of the cars seem to lean largely in Uber’s favour.

What about fringe players?

Many fringe players have faded into irrelevance, with little or no online presence. But InDriver, a new entrant in the ride-hailing space is hoping to win people over with their unique model.

Unlike Uber or Bolt, InDriver does not determine fares with an algorithm but instead lets you “choose your fare”.

When you make a request on the app, you also set the fare you’re willing to pay. This information is sent to drivers on the app, who decide if the fare you’ve proposed works for them.

It is too early to judge adoption for InDriver. In the final analysis, while the ride-hailing sector has cooled in years, there is no doubt that OCar’s big ambitions will earn them market share.

The question is, which of the big two’s market share will they bite into? Uber or Bolt. Or will both withstand OCar’s nascent threat to continue their dominance of the Nigerian market? Only time will tell.