5G is the future of mobile communication, but it’s going to take some time before the revolutionary technology goes mainstream in Africa. In other regions, interest in 5G continues to grow and it has even morphed into a security and political issue. But in Africa, not a lot of telecom companies are in a rush to introduce the new broadband.

Only two countries on the continent currently have rolled out the broadband. 5G is live in Lesotho and South Africa but it is not widespread yet.

In Lesotho, only the country’s Central Bank and mining company have used the technology according to a Deutsche Well report. And in South Africa, telecom company, Rain launched a commercially available 5G service in October 2018. Rain’s 5G service is only available in select locations.

For the rest of the continent, development of the 5G mobile broadband has been slow, for a number of reasons.

For starters, 5G infrastructure is expensive. GSMA Intelligence predicts that companies globally will spend around $1 trillion over the next five years to upgrade to 5G.

This involves the purchase of new spectrums, upgrade of existing 4G macro networks and deployment of small cells.

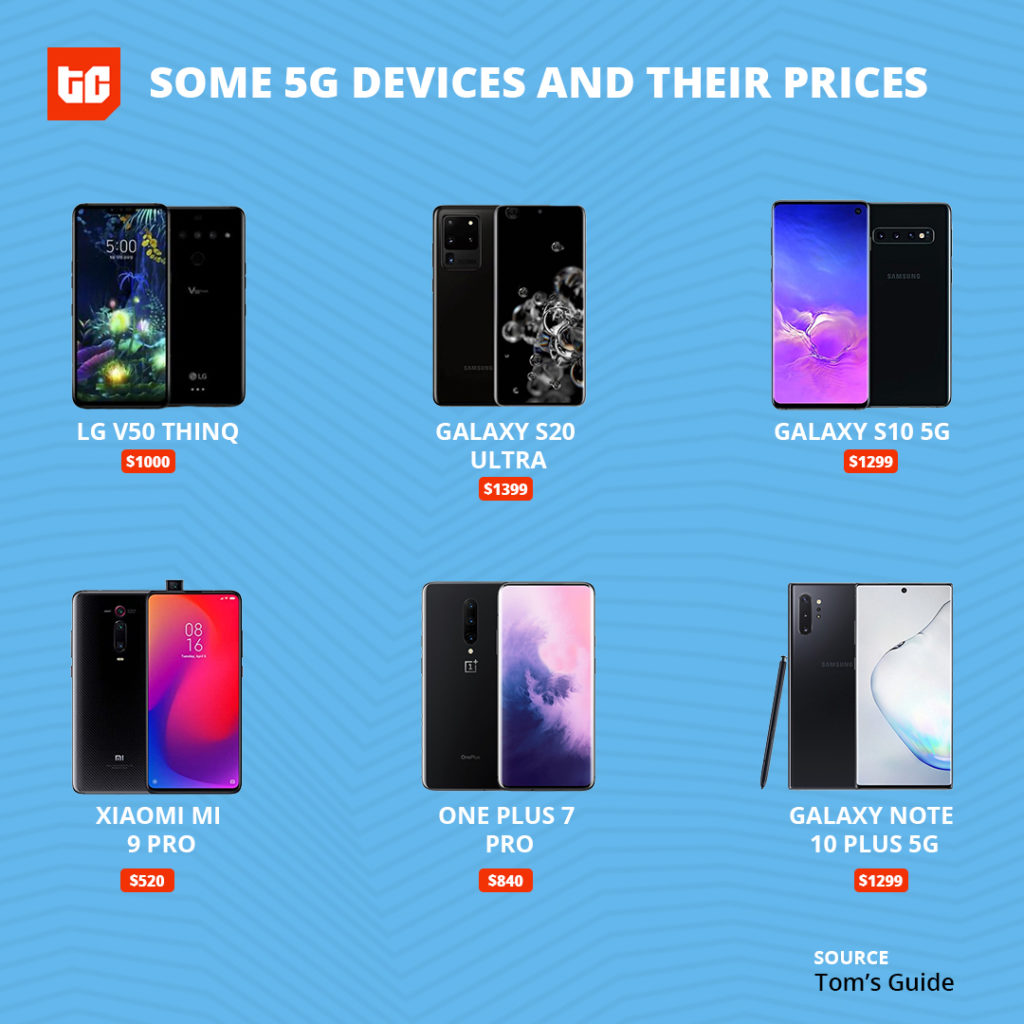

Customers also have to switch to 5G-capable devices. Few of these exist and many of them are expensive.

Additionally, some major benefits of 5G are better support for connected devices (IoT) and the development of smart cities. Neither of these has seen a major push on the continent.

Africa is not ready for 5G yet

Speaking at a telecom conference in 2019, Rob Shuter, CEO of MTN Group, said: “[5G] would be used for very specific cases.” Shuter’s MTN is one of Africa’s biggest telecom conglomerates with over 200 million subscribers.

While MTN has started testing 5G in countries like Nigeria, Shuter explained that the broadband “would not be a technology for everybody because most people don’t need it.”

“Your phone works fine on just 3G,” he concluded.

Shuter wasn’t speaking without context. After many years, 4G adoption is only still in its early stages on the continent. Only 7% of the 774 million mobile connections in Africa is 4G. This is way lower than the 44% global average.

2G, a much older broadband, and 3G have continued to dominate the African market.

In 2016, 70% of the continent’s mobile connections was 2G, while 3G was 28%. After over a decade since its adoption, GSMA predicts that 3G would replace 2G as the dominant connection by 2020.

Thus, most telcos have paid more attention to accelerating the adoption of 3G and subsequently 4G. They are still developing their network infrastructure to accelerate this switch from 2G.

In most countries, initial 4G development had been slow due to delays in assigning spectrums to service providers. But in the last four years, things have changed and the pace of development has increased.

In Nigeria, MTN, 9Mobile (formerly Etisalat) and Globacom launched their 4G services in 2016. So far, MTN has achieved 24% 4G coverage in the country. Although the company says it is “[b]est positioned to provide 5G services in the longer term,” it is more focused on pushing the adoption of 4G.

Meanwhile, Airtel, Nigeria’s third biggest telco launched its 4G network in 2018. The service became available in over 100 towns in March 2019.

Tigo, Senegal’s second largest telco now rebranded as Free, secured its 4G licence in December 2018. Vodacom Ghana secured approval for 4G spectrums in late 2018. And Orange, a telco operating in many francophone Africa countries, launched its 4G service in Senegal and Burkina Faso in 2016 and 2019 respectively.

Since early 2019, seven 4G LTE networks have been launched in different sub-Saharan African countries. Between 2019 and 2020, telcos will spend $8.5 billion on network infrastructure in the region.

GSMA predicts that 4G adoption will rise to 23% by 2025; but it will only overtake 2G, not even 3G, by 2023.

So when will 5G become a thing in Africa? MTN’s Rob Shuter says give it five more years. Meanwhile, according to GSMA, 5G adoption will grow to 3% or 28 million connections by 2025. That’s not a lot.

Could KaiOS power the adoption of 4G in Africa?

The growth of 4G in Africa could, however, be accelerated by the popularity of cheaper 4G-capable devices. Over the last few years, this has been happening. Phone companies have produced high quality devices but retailed them for the low-end market ($100-$200). This is increasing smartphone adoption on the continent. Smartphones accounted for 39% of all phone connections in 2018. This is expected to rise to 66% by 2025 thanks to cheaper devices.

KaiOS is also powering the next generation of feature phones which are ultra-cheap devices that have dominated the African market for years. Calling itself the “smart feature phone”, KaiOS devices are powered by MediaTek chipsets and are able to provide 3G and 4G connectivity access.

Many of these devices are sold for less than $50 and they run apps like WhatsApp, YouTube, Facebook and Google Maps. A number of African telecom companies including MTN and Vodacom are helping to bring these devices to the market as they push to increase revenue from data services.

So while 5G may be the talk of the town at the moment, Africa isn’t structurally ready for it. The focus is to get people to switch from 2G and onboard more people on the 4G train.