When Branch launched in Nigeria in 2017, it was a single product company with a money lending license to offer loans to individuals. Loans start from as low as ₦1,000 (~$2) and increase gradually up to ₦500,000 (~$1,200) as the borrower repays.

Four years, ₦40 billion (~$97 million) and three million loans later, the business is evolving.

The company which also operates in Kenya, Tanzania and India acquired a Nigerian microfinance bank license this year. In doing so, Branch has joined the growing number of Nigerian fintechs maturing into digital banks after some years in the lending app nursery. Carbon and Fairmoney are in this class too.

Branch’s mobile app (available only for Android) now includes a wallet that offers users unlimited money transfers and commission-free bill payments, in addition to instant loans (it is quite instant; I have tried it more than once between April and now) that are collateral-free.

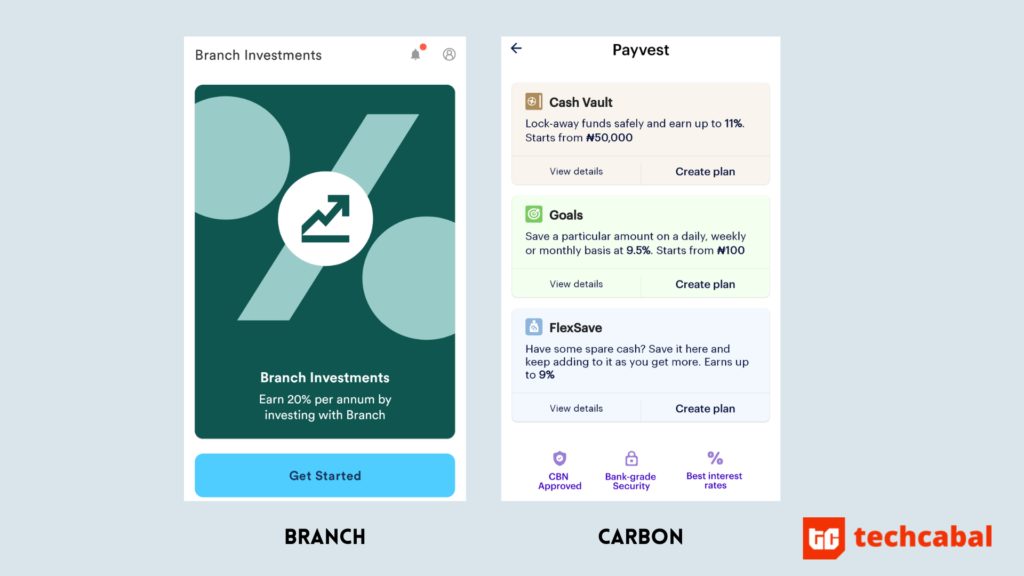

But the Branch feature that catches the eye is the “Invest” tab. Clicking the button, users are invited to “Earn 20% per annum by investing with Branch.”

For example, a user who keeps ₦1 million in this product for a whole year receives ₦200,000 at the minimum. Returns are paid every Monday and if left in the Branch wallet, compound for the next payment.

20%?! How are they able to offer that?

You are not alone in asking. It was the first question Dayo Ademola, Branch Nigeria’s managing director, faced on CNBC in May. It was the main curiosity as well on a Zoom call with journalists earlier this month.

According to a June 18, 2021 Central Bank of Nigeria fact sheet, Heritage Bank offers 13.88% on fixed deposits, the highest of any Nigerian deposit money bank. But that’s an outlier; Access Bank’s 7.28% is about the average rate.

Zenith Bank’s 3.94%, though one of the lowest, is better than what Stanbic IBTC, Standard Chartered and First Bank all offer. So how is Branch, a startup, able to go so high on retail investments?

Investor capital, low costs

To assure customers that their funds are safe, Ademola explained that Branch’s finance money license from the CBN permits them to offer fund management services and they “only invest customer funds in principal securities and low-risk securities.”

She does not specify what these securities are. Low-risk securities could be government treasury bills. But since practically every other bank makes the same claim and that the yield on instruments like treasury bills are stifled by inflation, Branch’s extra margin has to come from elsewhere.

So, on CNBC as with the call with journalists, Ademola offered two reasons why Branch can afford its promise: investor capital and a profitable, lean business operation.

“Our investors have effectively taken a long view of our business in Nigeria,” Ademola said.

By this she points to the fact that Branch, which is a San Francisco-based company, has been funded by, among others, the International Finance Corporation (IFC) and Andreessen Horowitz (a16z), one of the biggest Silicon Valley venture capital investment firms and early Facebook investor.

Both organisations participated in Branch’s two big funding rounds – a $170 million Series C round in April 2019 and a $70 million Series B a year earlier, attracted by Branch’s branding as a “$2 loan” service for emerging markets. $50 million of that 2018 raise was a debt facility from a firm that focuses on alternative credit.

VISA is also an investor in Branch and has driven their Nigeria expansion. But beyond leaning on investor capital, Ademola said Branch is able to depend on its balance sheet from lending to support other ambitions. “Our lending business is profitable here.”

This profitability, she explains, has been possible because of the lowered cost of not having to operate physical bank branches across Nigeria.

“We operate on a lower cost structure than your typical commercial bank and are able to pass some of these savings on to our customers,” Ademola said.

Better than your bank?

Branch Nigeria’s pitch, then, is that it is “better than your bank.”

Digital banks tend to tease variations of this tagline – Kuda, for example, is the “bank of the free.” But as Ademola said, no other Nigerian fintech startup offers a 20% annual return on investment products.

Carbon offers a number of options that offer between 9 and 11% earnings. There is not yet an investment product on Fairmoney.

Because I have borrowed easily on Branch, there is an appeal to adventure along on their bold investment claim. But it may be necessary to approach promises of high-returns with a sense of caution.

“Fintechs don’t have cheap sources of deposits in the form of current and savings accounts (CASA), hence they may try to attract customers with high-reward, yet possibly high-risk deposit products,” Adedayo Bakare, an investment analyst, tells me.

While a 20% return is an enticing high reward, it also signals the high-risk nature of the models fintechs have to adopt in order to beat banks. “Higher risk is also why they charge borrowers high rates on loans. Because it is not backed by collateral,” Bakare adds.

Indeed, Branch’s microloans charge a 20% interest. A ₦2,000 (~$5) loan for one month, for example, will be paid back with ₦2,400 – a 20% interest rate. By contrast, Guaranty Trust Bank is able to lend to its customers at a 1.5% monthly rate.

And how about investor capital as a pillar? Bakare is skeptical: “If you look at the structure of funding for banks, investor capital is not even up to 30% of funding in many cases.”

Reaching every smartphone

Branch doesn’t have audited accounts in the public domain showing their non-performing loan (NPL) ratio and capital adequacy ratio (CAR).

Both numbers would give a clearer picture of the returns on their three million loans. Going by its profitability and investor capital, it would appear both metrics are in good health.

It will then be intriguing to see customer reaction to the newly launched investment offer. Nigerians have fallen for ponzi schemes at an alarming rate that suggests legitimate platforms offering high-reward returns can find an audience.

Ademola, who became Branch’s MD for Nigeria in March, is confident of being the country’s go-to platform, extending financial access wherever a smartphone receives an internet signal.