In October last year, Autochek began operations in Nigeria and, soon after, expanded to Ghana, Uganda, Kenya and Cote d’Ivoire. Autochek is an automotive technology company that leverages technology, data, knowledge, and experience to provide affordable car loans to buyers and sellers. It also provides them with quality maintenance and after-sales services. In just over a year of operation, it has built a partner network of over 1,200 workshops and dealers, and over 70 financial institutions on the platform approving and disbursing car loans across Africa.

Speaking at “Building from the Ground Up”, a learning series for entrepreneurs powered by the UK-Nigeria Tech Hub in partnership with TechCabal, Autochek’s CEO, Etop Ikpe, discussed what has helped the platform grow so much in such a short time.

Ikpe is a seasoned entrepreneur who has been at the forefront of digitising the automotive loan process. Before becoming CEO of Autochek, he was co-founder and CEO of Cars45—another car financing tech company. Under his leadership, the company expanded into two other African countries: Ghana and Kenya. He was Commercial Director of Konga and co-MD of the now-defunct DealDey, one of Nigeria’s largest discount stores at the time.

Etop explained that entering the auto industry started as an experiment, after his experience digitising multiple industries—fashion and general merchandise. He felt the car industry was high-value, high-volume, and high-velocity, yet was not getting enough attention. He realised he could build a big business out of it.

His previous experience in digitising other industries gave him the opportunity to do deep research into the African auto market, and he found out that there was a fundamental gap in financing.

“In emerging markets like Brazil, India, Indonesia, Malaysia, and large parts of Latin America, you find the average of institutional credit into automotive transactions—how many people buy a car through the use of loans— at about 65% to 70%, but it is less than 2% across most parts of sub-Saharan Africa. Africa’s GDP per capita is sub $2,000, and the average car price is about $5,000. It’s then that you realise that sub-Saharan Africa needs credit.”

When Ikpe did more research into this problem, he realised that it wasn’t that there was no capital or cars available in Africa. It was that nobody was supporting the ecosystem with enough intelligence around valuation and condition analysis that would help investors competently deploy credit into the sector. So, Ikpe and his team wanted to take that 2% average and try to build it to 50 or 60%, over five years.

Ikpe believes that the success of his business will have a ripple effect on the ecosystem and society: “There’s a huge opportunity for growth and overall residual impact on the entire ecosystem, where low credit penetration is causing lack of productivity despite people working hard”

In the course of the “Building From Ground Up” interview, hosted by TechCabal’s Managing Editor, Koromone Koroye, Ikpe explained that mobility is important for people to be able to access healthcare, better job opportunities, and business opportunities. “Access to mobility helps you get better opportunities. Low motorisation rates lead to transportation poverty, meaning that, overall, it’s so important that people can be more productive through access to better transportation.”

Expanding across Africa

Autochek’s expansion strategy is based on establishing key market nodes—economic powerhouses on the continent. After conducting research, it selects regional leaders that oversee these nodes and their region. Ikpe explained that the economic powerhouse for North Africa is in Egypt or Morocco; West Africa’s in Nigeria; Francophone West Africa’s in Côte d’Ivoire; East Africa’s in Kenya; Central Africa’s in DR Congo; and Southern Africa’s in South Africa. So, Autochek’s strategy involves developing localised regional expansion strategies from these powerhouses or nodes.

One of the major things that helped Ikpe with building and expanding the business was being dispassionate about the idea: focusing on only objective- and data-driven insights. Another was humbly assessing whether the product is a market fit without giving into to his preconceived biases about the market. To do this effectively, he listened to customer complaints and adjusted the product to suit the market.

Expanding to other African countries has shown the Autochek team that while there is a similar need for technology in every country, there are cultural differences to watch out for which could impact their business. Autochek realised that in some markets they had to build a high level of trust, while in others, they needed to provide clarity around product use, taking customers through a step-by-step approach on how to use the product.

They also discovered that in some markets, the customers need time to adapt to the product, while in others the product relied on word-of-mouth to achieve scale.

With increase in the value of foreign currencies increasing the prices of cars, and no increase in the income of customers, Autochek has had trouble with ensuring affordability of its cars. This is a huge challenge because 90% of the cars that are sold by Autochek are imported into the country of sale. That is why Ikpe said the company is fully in support of local car manufacturing.

Despite this, however, Autochek still wants to provide consumers with options when it comes to assortment and pricing. By providing credit and liaising with OEMs (Original Equipment Manufacturers) to reduce prices, and increasing their sales by, say, 20%, they would be able to convince more customers to do business with them.

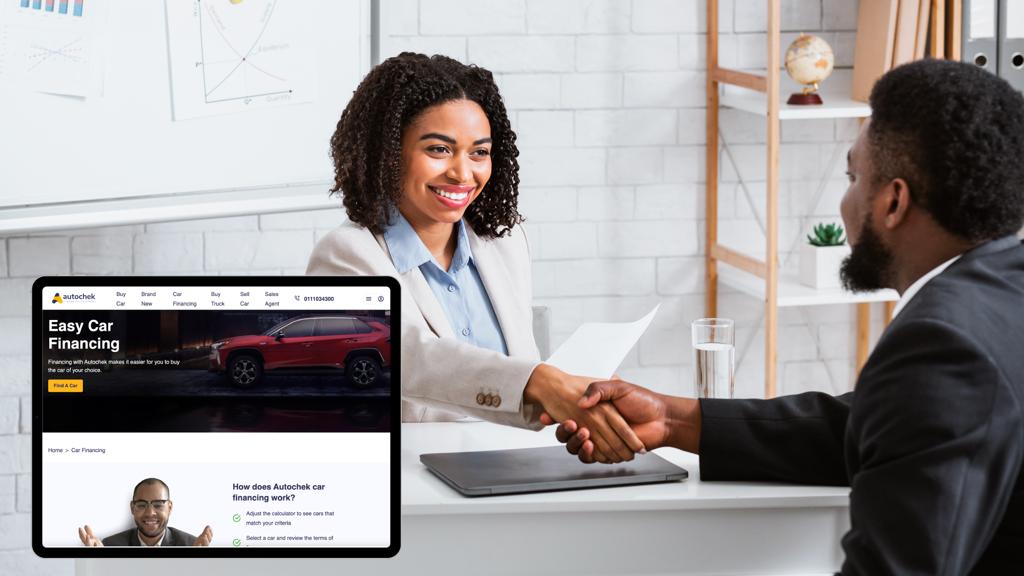

To use Autochek for financing your car purchase, you can walk into a car dealer using its product or go directly to its website where you’d see various car stores like Toyota and BMW. Choose a car and start your loan application online or at the dealer’s location. After completing the form, your application goes to Autochek’s banking partner who then sends loan offers to the car buyer—as many as ten—based on their credit assessment. You are then moved to the disbursement stage: you go through the bank processes, your car is registered, then goes through Autochek’s management circle before it is ready for pick-up.

You can watch the full conversation here.