Untapped Global, an innovative investment company focused on emerging markets, launched its digital investment platform into public beta on Tuesday. The platform promises to open up Untapped’s pioneering Smart Asset Financing investment model to the public. The company uses the model to finance revenue-generating assets or productive assets for entrepreneurs and SMEs in the world’s fastest-growing emerging markets, such as Uganda, Kenya, South Africa, and Mexico.

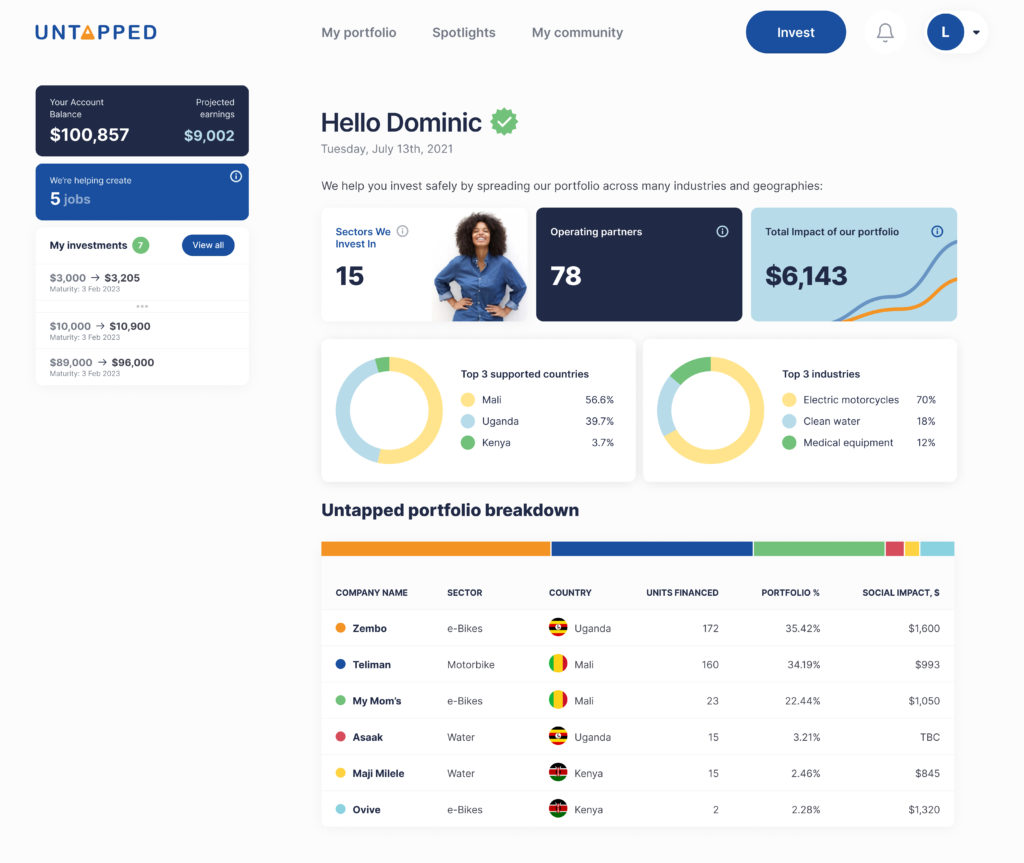

The $10.3 million pre-seed that Untapped Global closed in March will fund this new offering, according to a statement sent to TechCabal. The company has already built a digital platform that uses real-time data to earmark investment insights for local and international investors looking to tap into Africa and other emerging markets, enabling them to invest. The platform also lets investors track their investment in real time.

How the platform works

The platform resembles a real-life dealroom where investors can see and select investable assets. Untapped said it has integrated a third party tool that handles KYC and anti-money laundering (AML) compliance checks.

“It’s a bit of a hassle for investors to go through these steps but it ensures that we are in compliance with the US SEC rules,” an Untapped Global representative told TechCabal in an email.

After a successful onboarding process, users are free to begin investing. While investments can be made anytime, as with other platforms, standard rules around maturation periods still apply. This means investors will have to wait until their investment matures before withdrawing. For example, if an investor chooses a mature period of 3, 6 or more months, they must wait for that time to end before they can withdraw their funds.

The platform is currently only available online, although the representative told TechCabal of the company’s plans to eventually build a mobile app.

The platform won’t be available to retail investors until the end of the year. Jim Chu, CEO and founder of Untapped Global, said that the accelerated digitization happening across Africa and other frontier markets makes now the ideal time to explore investing in these economies.

“There’s a $5.2 trillion funding gap for SMEs in emerging markets, such as Africa, Asia, and Latin America,” Chu said. “We created Untapped to get capital to entrepreneurs in markets who are often excluded from funding opportunities, while simultaneously ensuring transparency for investors. This is just the beginning of the democratization of investing around the world. Our data has shown that for every $1 invested, more than $3 of value is created in local economies.”

Investing with Untapped requires just $300 to get started. Investors can earn a passive income of up to 10% annual percentage rate (APR). The company said it has an annual revenue run rate of $2.5 million, with a consistent profitable return on capital.

From Paga to FlexClub and Asaak, Untapped Global said it has financed assets for over 5,000 entrepreneurs across a dozen countries in Africa and Latin America who work in sectors ranging from clean water and solar to e-mobility and inclusive fintech.

Tayo Oviosu, CEO at Nigerian fintech Paga, said in the statement that their collaboration with Untapped Global helped it make access to POS systems more affordable for SMEs throughout Africa.

“The Untapped team is aligned with their [Paga] goal of making payment and access to financial services simple for 1 billion people,” he said.

The Untapped Global platform is niche, as it only allows for investment in productive assets. Nonetheless, Africa continues to enjoy the rise of investment platforms democratising investment in the continent. GetEquity, for example, helps common Africans invest in African startups. Daba, on the other hand, enables common Americans and Europeans to invest in Africa’s startups. This trend is healthy for the ecosystem, and could potentially serve as a huge benefit to entrepreneurs as they now have ample funding alternatives.