In furtherance of its efforts to bridge the huge financial gap and access to funds for Micro, Medium, and Small-Scale Enterprises (MSMEs) in Nigeria, Enhancing Financial Innovation and Access in partnership with GIZ is organising an innovative virtual hackathon challenge tagged: ‘MSME Finance…Breaking the Barriers’. In Nigeria, Access to finance remains a priority area of assistance for both SMEs (67.9%) and Micro enterprises (90.5%) even though the MSMEs sector contributed 46.31% to the National GDP, and accounted for 6.21% of gross exports according to the SMEDAN/NBS 2017 Survey.

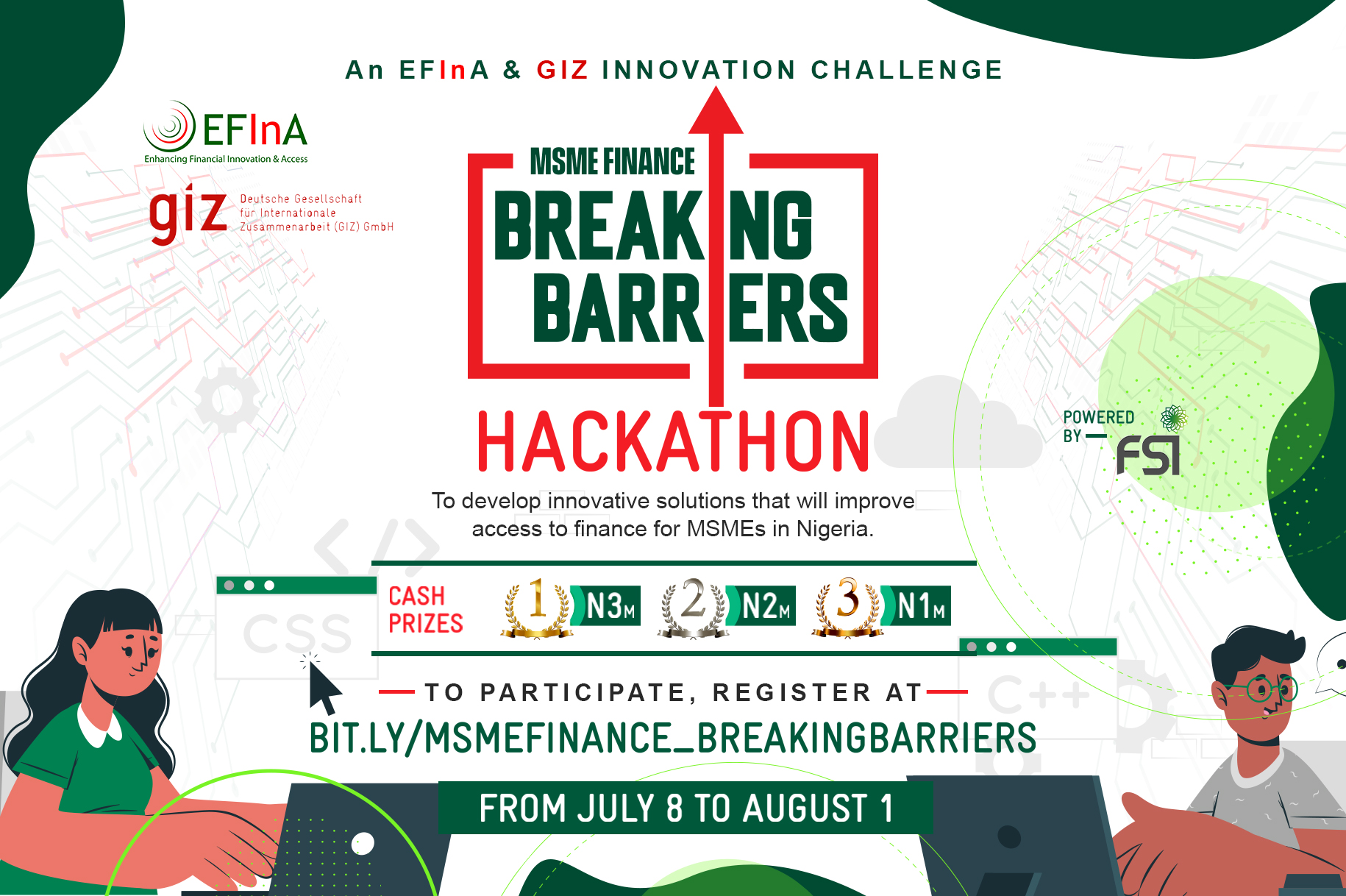

The registration portal: https://bit.ly/MSMEFINANCE_BREAKINGBARRIERS opened for participation in the hackathon, from Friday, July 8, 2022, to August 1, 2022. The hackathon will be preceded by four (4) webinars to be facilitated by industry thought leaders between July 28 and August 1, 2022.

According to the organisers, the hackathon is open to individuals who are at least 18 years old and are members of the Financial Service Innovators Association of Nigeria (FSIAN). Shortlisted candidates for the hackathon will participate either as a team of two or a maximum of five people.

Candidates will be required to take on the challenge of developing creative and innovative ideas, and MVPs that address at least one of the broad objectives for microenterprises such as Financial Management Skills Development, Digitised Credit Appraisal and Lending System, MSME Product Design Toolkit, and Alternative Collateral Options.

In a press statement issued in Lagos during the week, the Chief Executive Officer, EFInA, Mr Owolabi Isaiah, said: “We are excited to introduce the virtual hackathon challenge tagged: ‘MSME Finance … Breaking Barriers’. Despite the proliferation of credit providers in Nigeria-both regulated and non-regulated -the financing gap for MSMEs has widened due to several issues like inability to fulfil requirements (financial records, collateral), manual/rigid credit reporting system, high default rate, manual KYC verification process, lack of financial management skills, and lack of market linkages, etc.

Therefore, it has become imperative to facilitate an inclusive financial system that seamlessly avails credit to MSMEs irrespective of their size of operations, category, and availability of traditional collateral requirements in order to boost the economy, reduce poverty levels, and provide job opportunities.” He explained further that the teams would develop technological applications that solve real-life problems in suburban communities.

The participants are expected to pitch their innovative ideas virtually to a panel of judges on August 31, 2022. Criteria for judging the entries include Product design (30%), Innovativeness (30%), Scalability (30%), and Presentation (10%). The winner of the challenge will go home with ₦3million; 1st runner-up, ₦2million, and 2nd runner-up, ₦1million,” Owolabi disclosed.

EFInA and GIZ are working closely with Financial Services Innovators (FSI) to ensure the goals of the challenge are achieved.