Good morning ☀️

So many people are worried that AI is creating more problems than it can solve.

Yesterday, Google, an investor in Open AI competitor—Anthropic—pledged $20 million for researchers and academic institutions to work together and ensure that AI is used for more good things than bad.

- FTSE downgrades Nigeria to unclassified market

- Flutterwave to digitise foreign exchange in Nigeria

- Mtn Momo downtime frustrates subscribers.

- Africa’s cybersecurity crisis

- The World Wide Web3

- Event: Moonshot Conference

- Opportunities

Nigeria demoted to unclassified market status

Down down the Naira.

The Financial Times Stock Exchange (FTSE) has reclassified Nigeria from frontier market status to unclassified market status. The FTSE classifies countries based on different criteria including the size and liquidity of the stock market, the stability of the country’s political and economic environment, and the accessibility of the market to foreign investors.

Gif source: Tenor

Gif source: Tenor

What it means for Nigeria: Nigeria’s demotion to unclassified market status was due to persistent foreign exchange shortages in the country. The loss of frontier market status could stir more despair for investors.

Nigeria relies on the export of crude oil for its foreign exchange earnings, however, this is not enough. Nigeria currently has a backlog of $10 billion unmet dollar demand from investors. In August the Naira plunged against the dollar to an all-time low trading at N950.00 per $1. The Nigeria government made several plans to get the Naira back on track including floating the naira and a publicised $3 billion AFREXIM loan to clear the FX backlog, all without yielding tangible results.

Zoom out: Nigeria’s demotion could be upturned in the coming days as the FTSE says it will continue to monitor the country’s market and that once the FX backlog is cleared it will reexamine the country’s status. Last week, the country’s apex bank declared a plan to clear the country’s FX backlog in two weeks. The CBN also launched Swap, poised to be the silver bullet to Nigeria’s foreign exchange market market problems. By digitising the foreign exchange market both the shortage of FX cash and the lack of collaboration between participating institutions is resolved.

Get a working card from Moniepoint

With the Moniepoint personal banking app, you get reliable payments every time and a card that always works. Enjoy seamless payments powered by the infrastructure that 1.5 million businesses trust. Download the app.

Flutterwave to digitise foreign exchange in Nigeria

Image source: Flutterwave

Image source: Flutterwave

Flutterwave wants to make currency swapping a breeze in Nigeria.

The Nigerian fintech company has launched Swap, a new product that aims to make the process of buying and selling foreign currency more seamless. The traditional way of buying and selling foreign currency in Nigeria is through Bureau de Changes (BDCs), but that has been very inefficient due to the scarcity of forex and skyrocketing exchange fees.

It takes a village: Flutterwave is doing thiscollaboration with Wema Bank (a commercial bank), and Kadavra BDC (a bureau de change), with support from the Central Bank of Nigeria (CBN).

How will it work? Nigerians will be able to buy and sell foreign currency online through Flutterwave’s web app. Currently, the product is only available to registered Nigerian users and only supports dollars, euros, and pounds. To use Swap, users must verify their identity and submit documentation online. This includes their bank verification number, a selfie, the reason they need FX, and supporting documentation. Once approved, users can input their account numbers and receive the money instantly. Swap will also be available for other banks via an Application Programming Interface (API).

That is not all: Starting in October, Flutterwave will provide cards for Nigerians who need quick access to their Personal Travel Allowance (PTA) and Business Travel Allowance (BTA).

Zoom out: The launch of Swap comes a week after the CBN acting governor mentioned that the central bank would resolve all foreign exchange (FX) backlog issues within two weeks.

Boost your startup growth

Boost Your Startup Growth with Verified.Africa x GDG Lagos!

Get up to $5,000 in free credits for real-time ID verification and seamless customer onboarding. Join our accelerator program, powered by Africa’s leading KYC provider, Verified.africa. Gain access to top-notch mentorship and a vibrant tech community at GDG Lagos, where developers, designers, and tech enthusiasts connect. Don’t miss out – Learn more now!”

MTN MoMo Rwanda experiences downtime

Gif Source:Tenor

Gif Source:Tenor

MoMo users in Rwanda experience hassles.

On Sunday, September 10, MTN Rwanda sent out SMS to MoMo users in Rwanda indicating that its mobile money service would be off from 1am to 5am on Monday morning.

Why? The disruption in service was due to a routine maintenance carried out by the telco. However, MTN MoMo service was yet to be restored several hours after the scheduled maintenance time.

Who were affected? This affected several of its nearly 7 million subscribers who rely on MTN MoMo for day-to-day business transactions and payment of bills.

A way out? MTN in an early tweet said its team of technicians are working hard to fully restore the service. By 3:37pm CAT, MTN tweeted that it had fully restored MoMo service in the country.

Zoom out: The recent service disruption by MTN MoMo highlights the growing reliance of businesses and individuals on mobile money services like MTN MoMo for their daily transactions. It also sheds light on the challenges telecom companies face in maintaining seamless services for millions of subscribers in today’s digital economy.

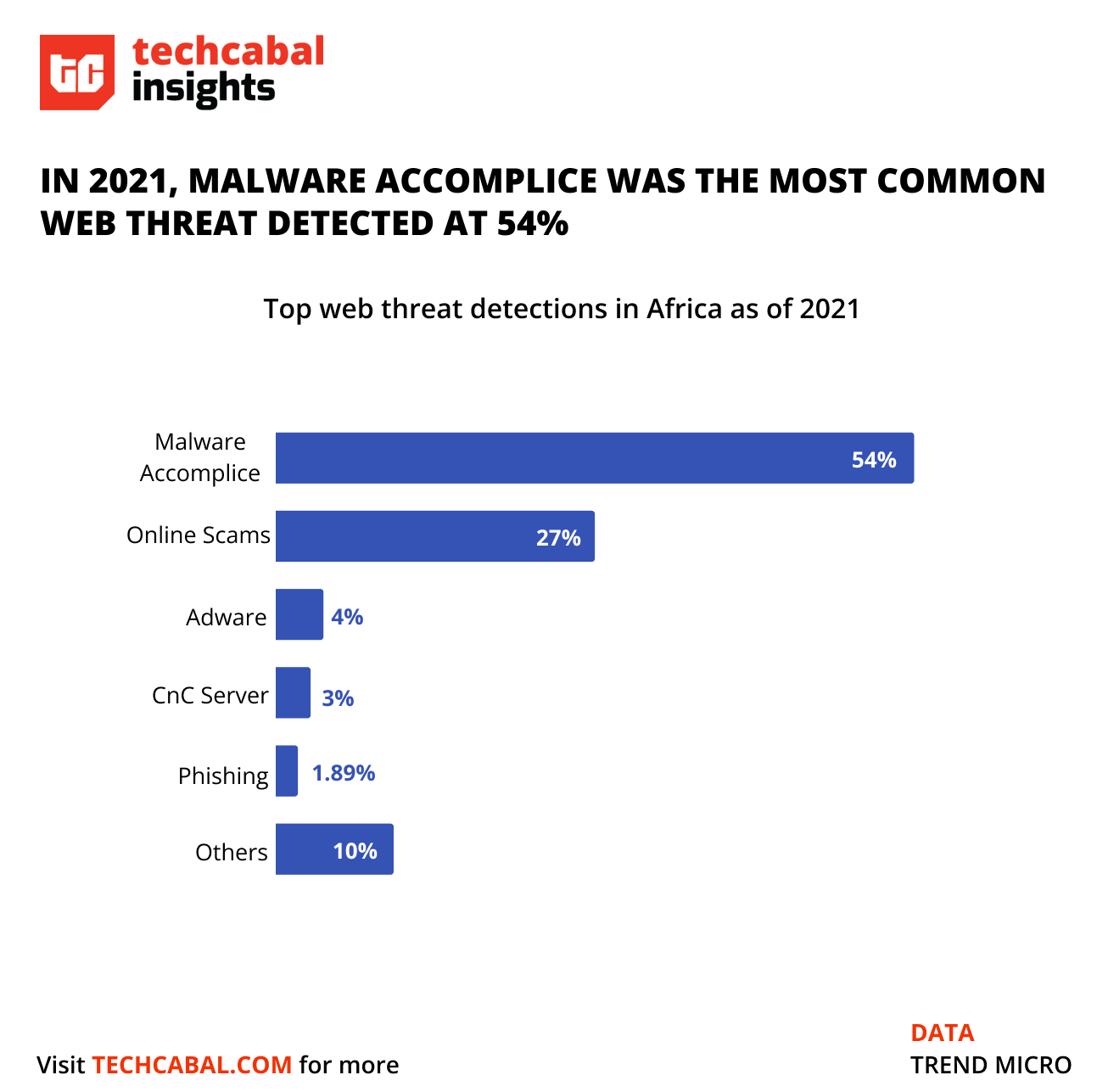

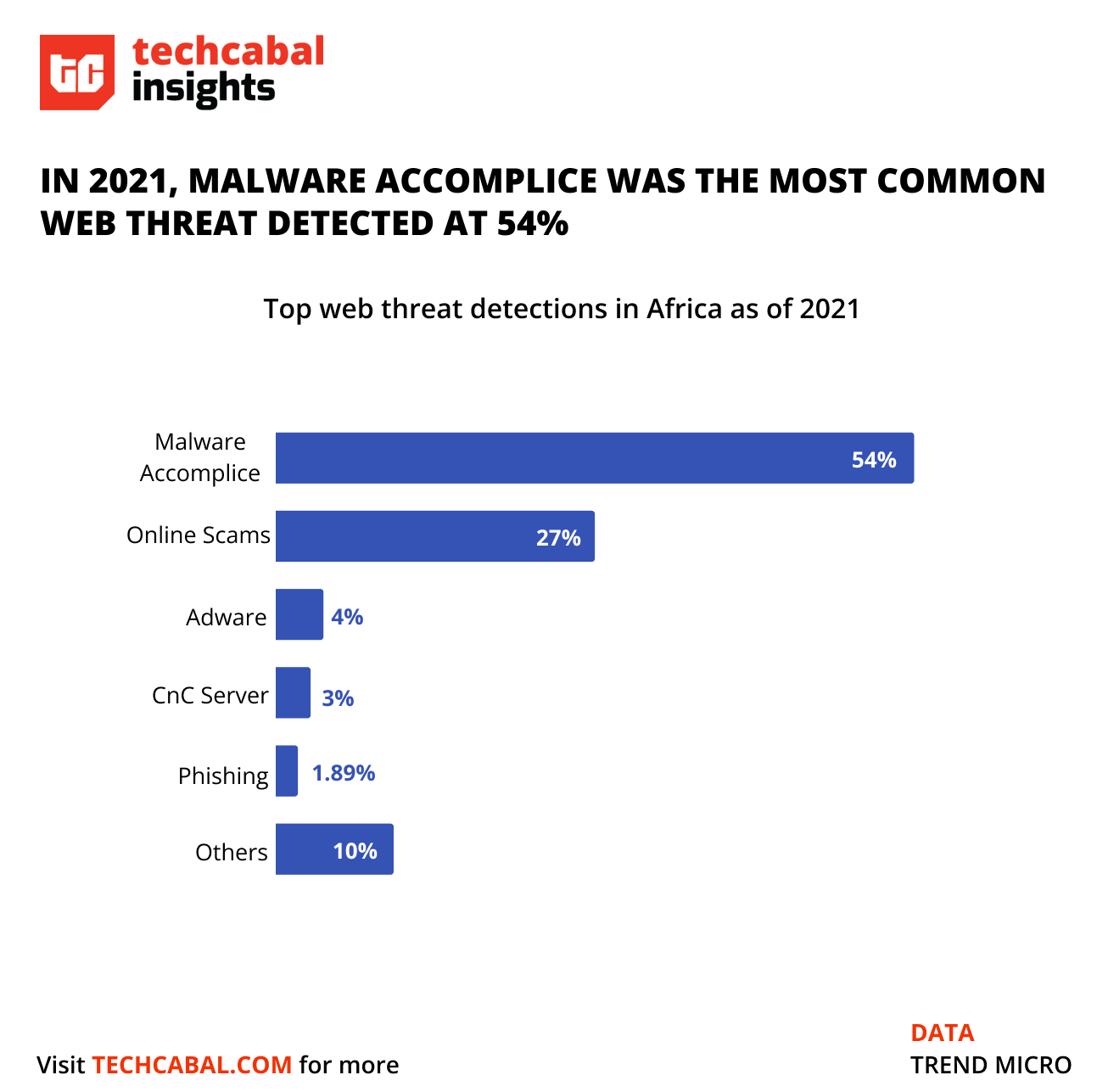

Africa’s cybersecurity crisis

Africa’s growing digital economy depends on digital tools like bank apps, e-commerce apps, and streaming platforms. However, this shift from physical to virtual comes with significant risks, including a rise in cybercrime. In 2022, internet users in Africa grew by 8.4%, reaching 570 million, yet cyber attacks have also increased. According to the African Union, cybercrime has been on the rise in Africa, particularly in financial fraud and identity theft. A recent report by Checkpoint revealed that organisations worldwide experienced an average of 1,983 weekly cyberattacks in the first quarter of 2023.

Africa now grapples with a worsening cybersecurity crisis, with approximately 90% of African businesses operating without cybersecurity protocols in place, making them vulnerable to cyber threats, such as hacking, phishing, and malware attacks. Interpol’s new Africa Cybersecurity Assessment Report further revealed an increase in cybercrime in African countries due to the rise in digital technology adoption.

Image source: TC Insights

Image source: TC Insights

Successful cyberattacks in Africa have severe consequences for organisations and society as a whole, resulting in financial losses, data breaches, service disruptions, and a loss of public trust. The economic impact of cyberattacks in Africa is substantial and could cost the African economy up to $100 billion by 2025, according to a report by the World Economic Forum.

It’s high time African organisations stopped relying on external support and invested in their cybersecurity infrastructure if they really want to combat the increasing threat of cybercrime. The lack of investment goes beyond resources, with stakeholders downplaying its impact. Without immediate action, Africa risks falling behind and becoming a haven for cybercriminals.

According to Olatunji Olaigbe, the team lead at CybAfriqué, as the global cybersecurity market grows more secure and saturated, threat actors will be forced to target less secured places such as Africa where there’s a growing use of technology and digital payment solutions — even though it means a relatively lower payout. “In developing countries, threat actors might not be stealing at the same scale as in wealthier countries, but carrying out attacks in these places also takes significantly lower effort and skill,” he wrote.

African countries’ lack of prioritisation and commitment to cybersecurity could leave them vulnerable to devastating cyberattacks. Failing to allocate resources to fortify their defences undermines their progress toward digital transformation and risks damaging their economies and societies. Collaboration is important, but ultimately, each African country must take responsibility for securing its digital infrastructure.