MyManilla is a digital financial platform driven by modern technology to eliminate all forms of barriers faced by users while trying to access financial services. MyManilla is a product of Manilla Digital Application Ltd; a tech company based in Abuja, Nigeria.

The purpose of MyManilla is to create a platform that eases access to financial services for everyone; especially those in the informal financial sector. With this, petty traders, civil servants, students, artisans, cooperative societies, trade unions, and other income earners can have unhindered access to necessary financial services.

According to a PwC fintech and banking report done in 2020, the Nigerian fintech industry investments over the past eight years stood at $204 million. Nigerian fintech secured $103.4 million in funding by end of the year 2018. This represented more than half (58%) of the total start-up funding in the same period under review.

This goes on to show that the nature of financial services is fast-changing, and with time, access to these services will completely become virtual. MyManilla is at the forefront of these advancements with cutting-edge technology aimed at eliminating all forms of stress associated with accessing financial services.

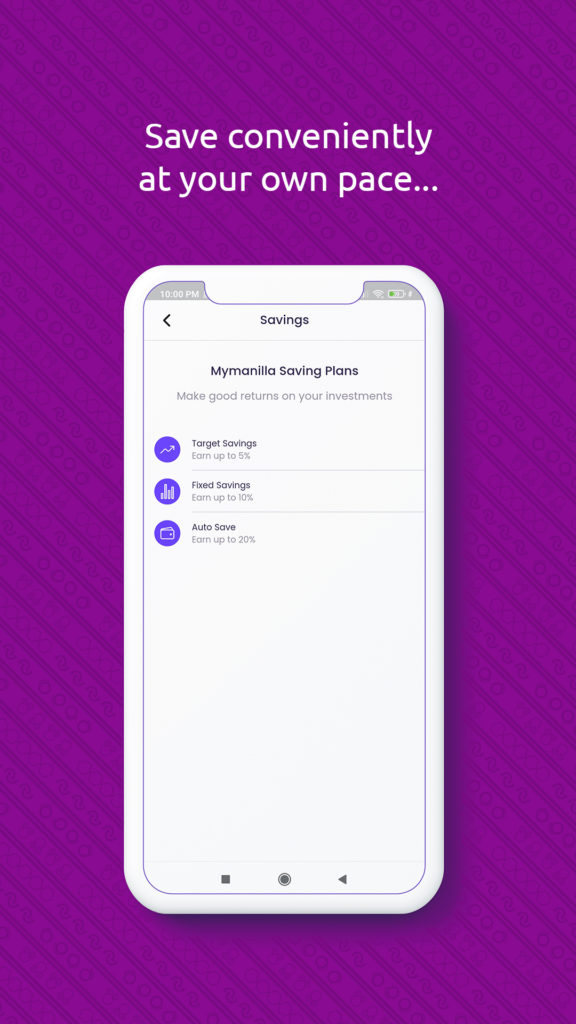

MyManilla provides uncommon benefits compared to using the conventional financial institutions. Some of these benefits include – easy and seamless account opening, zero hidden charges, bills payment, automated savings, insurance and a lot more. “We are very keen on making life easy for our customers and consumers and we are making sure that this will provide them with the ease they need for accessing financial services to cater for their daily needs”. – ‘Goke Alade Olateju, Co-Founder/CEO, MyManilla.

Manilla Digital believes that MyManilla is the future of financial technology as we have created an All-In-One digital financial platform that focuses on driving inclusiveness, financial literacy, support for cooperative communities and automation of their processes, low interest loans, secured pension schemes amongst other features. We are delivering the future of finance today; “No queues, just clicks”.

Consequently, Manilla Digital recently signed an agreement with Federal Civil Service Staff Multipurpose Cooperative Union which has over 150 cooperatives and in excess of over 100,000 individual members. This agreement is aimed at making savings, loans, bills payment and other financial services easily accessible for these cooperatives and their members.

According to Maimuna Sabo Abubakar, the Co-Founder/ Chief Growth Officer, agreements and collaborations like this, would further close the financial gap in Nigeria especially within the northern region of the country. She expressed confidence that within a few years, there will be significant growth in financial literacy within this region which will result in an upward progression of people living below the poverty level.

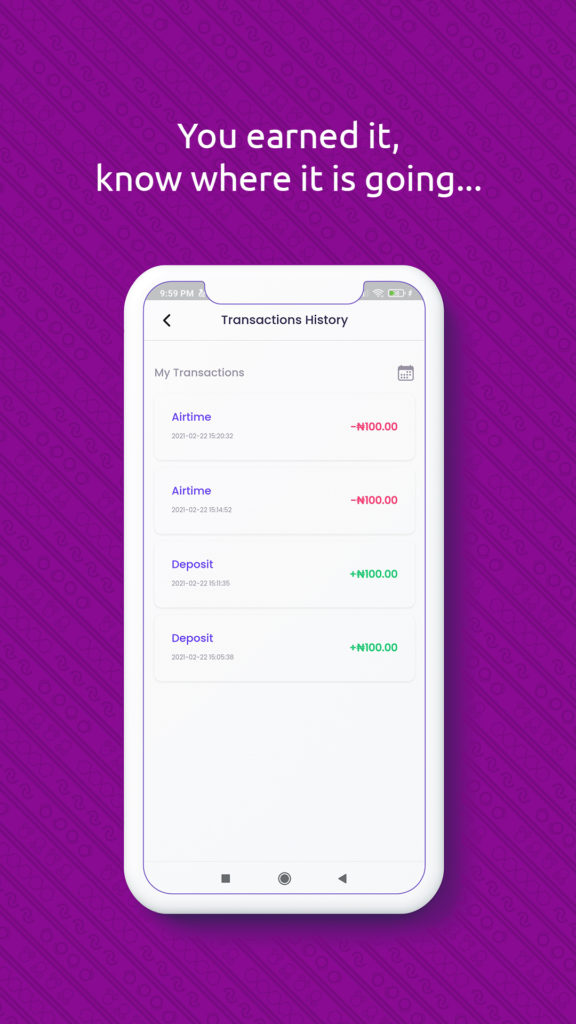

In these days where financial activities are heavily scrutinized and with an increasing level of distrust among consumers, we have created a very transparent process to help you keep your money, guide you on where to invest it, and help you prepare for a financially secured future. You don’t have to worry about how to invest because we will constantly present you with safe investment opportunities and guide you every step of the way.

The MyManilla website and application launched earlier in March 2021 and is now accessible to people of all age brackets, works of life and social class. The beta version of the application has been released and made available first to Android users on Play Store, while the iOS version will be released very soon.

MyManilla is set to change, forever, the way Africa and Africans see and access financial services. It is set to be Africa’s foremost all-in-one digital financial platform, driven by technology to ease access to financial services for the common man, in other to help them cater for their daily needs.

Follow us on our social media platforms @mymanillang, or send an email to info@mymanilla.co for further enquiries.

Built for the future; delivered in the present. Welcome to the future