The Nigerian digital financial service ecosystem continues to thrive as new challenger banks look to disrupt the many limitations of traditional banks. Many of these new digital banks differentiate themselves by being app-based and simplifying processes that have become bottlenecks with old brick and mortar banks.

However, as the ecosystem continues to thrive with new apps, it is also becoming evident that service offerings amongst these new players have become repetitive with quite a number of these apps offering virtually the same thing – from promising quick account opening, zero charges on transactions to virtual cards that are so limited they can only be used on local platforms.

Regardless of the clutter, one app that stands out with its positioning as the “digital bank users deserve” is gomoney. Launched in 2020, gomoney prides itself as a full-fledged digital service provider simplifying its users’ banking experience and also helping them make informed financial decisions through its robust features. While some of its features like virtual cards, sending & receiving payments, bills/utility payments are quite similar to that of other digital banks, gomoney ensures that these features are distinct and unique in their offerings enough to offer premium service to users and differentiate its app from competitors. The bank further adds an extra layer of convenience and intuitiveness to its app features which makes it user-centric and seamless to use. For example, gomoney users can receive payment by just sharing a payment link that is easily generated on the app. Or users can just tap on “share details” to share their account information with others.

Here is a first-hand review of some of gomoney’s features that standout:

- Versatile Virtual Cards

Virtual cards have become a staple offering with most digital banks. This feature is an alternative to physical debit cards in that it allows users do everything they can with their physical debit cards without the risk of the card getting lost, stolen or damaged. Today, virtual cards offered by most digital banks can only be used on local Nigerian platforms. Despite this limitation, most digital banks still charge between N500 – N1000 for virtual cards.

Distinctively, the gomoney virtual card has to be the most versatile so far in terms of its acceptance on major international and local platforms. It is a Mastercard that is issued at no extra cost to the user and each user can even request up to 3 virtual cards. The gomoney virtual card can be used to pay for Apple iCloud storage, Apple Music and Spotify subscription, and even on international stock trading platforms like Trading212 and lifestyle sites like asos.. At N440 to $1, the conversion rate is significantly lower than its competitors’ rates that fall somewhere around the N460 – N480 mark.

By simply opting to “Get a virtual card” and choosing a PIN, a user can generate a gomoney virtual card in seconds, and it automatically activates after 24 hours. Also, to ensure its security, gomoney virtual card details are by default encrypted and only become visible when users have entered their four-digit personal identification number.

- Scheduled Payments Option

What’s better than being able to make an instant payment when you want? Being able to choose the exact date your payment goes out without having to wait for that day and on top of that be able to automate the frequency of such payment. The gomoney app allows users to do all of these and more. By tapping on the ‘Payment’ icon on the app, users can choose to either schedule their payment for later date and automate such to daily, weekly, monthly or yearly recurring payment as they wish. A slight concern might the fixed cost of N8.50 that each transaction incurs but when compared to traditional bank charges, this is negligible.

Another feature available on the app via the payment option is the “split payment” or “Group bills” feature (for ios or android respectively). As the name implies, this feature allows multiple users in a group to split payment amongst themselves easily be it for a hangout or quick contribution.The app automatically splits payment equally amongst users and also logs this into users’ transaction reports tracker.

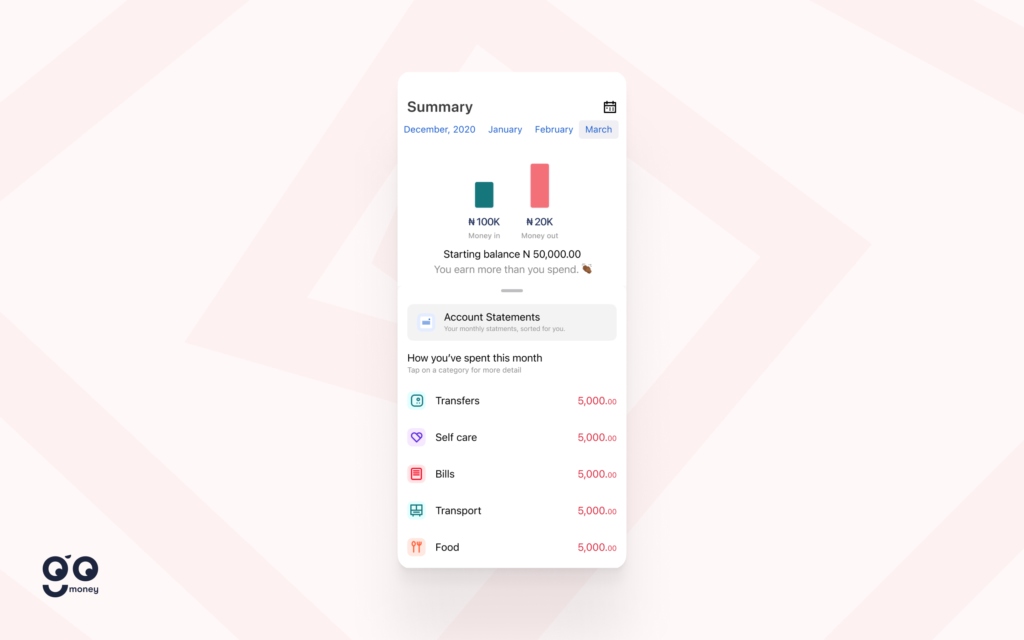

- Financial Reports Like Never Before

When gomoney describes itself as “the digital bank fostering a future where people have enough tools to make informed decisions about their money”, it must have been referring in part to the robust Report feature on its app. This feature takes a whole different approach to financial reporting. Just beside the ‘Home’ icon on the app, a click on the ‘Reports’ feature shows a categorisation of a user’s income and expenditure and a detailed breakdown of items backing this up.

On a final note, at a glance the gomoney app spots similar features to most of its contemporaries, however, the bank has ensured to differentiate itself in its offerings by building on the limitations of both traditional and digital banks to offer a truly digital financial service that does not restrict its users. While its virtual card feature is one to beat for many digital apps, it would be nice if the app offers some flexibility in terms of physical cards for those that want them.

You can download the gomoney app here