The emergence of two fintech unicorns, Flutterwave and Chipper, this year paint the clearest picture yet of fintech’s maturity and attraction in Africa. OPay, Paga and TeamApt are talking up their billion-dollar potentials too.

But this fuzzy-rosy narrative should always be moderated by sober reflection. Because as many African fintechs rise, many also fall.

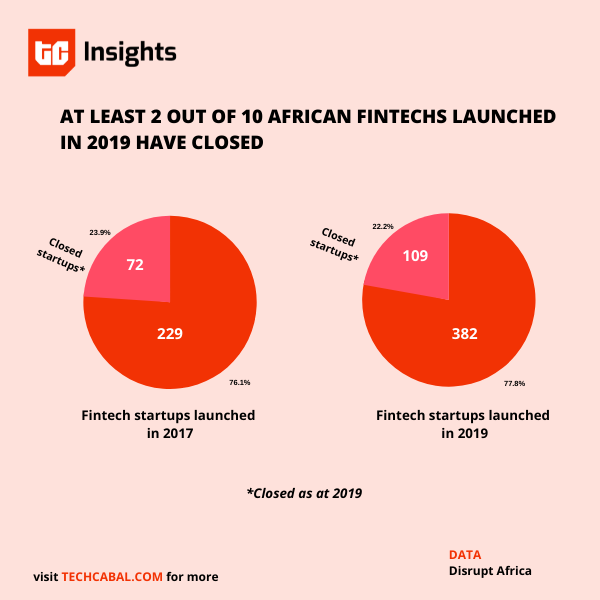

One in five failures

Out of the 301 fintech startups recorded in 2017, 72 had shut down by 2019. Out of the 491 startups recorded in 2019, 109 have closed as of today. What does that mean?

It appears that at least 20% of the total fintech startups in Africa in a given year will close in two years. We need a longer list of startups over a longer period to make definitive predictions but keep this in mind for now.

59.6% of fintech startup closures between 2019 and 2021 happened in South Africa, Kenya and Nigeria. 40.3% of those startups were in either payments, remittances, lending or financing.

According to the report’s authors, the fintech startup shutdown rate (so far) can be blamed on “unsustainable levels of competition in some sectors and geographies.” Many startups crop up to pursue similar ideas and products. Some achieve traction, while others fall along the way.

Of course that’s not the whole story. Competition is a good thing. Startups that faded due to competition were not very effective in satisfying customer demand. In reality, sometimes fintech startups – like other businesses or organizations – fail because the founders make foundational mistakes.

Like Abdulhamid Hassan (pictured at the top of this newsletter).

When he founded OyaPay – a service for offline businesses to accept payment with or without a smartphone – in 2018, the startup was hailed a fintech startup to watch. But Hassan took seed money from an uncle who would not tolerate being diluted in a subsequent funding round.

The result? Frustration and shutdown.

But even founders who are able to raise money several times may not know what to do with the money. As reported by Quartz last week, we now know that the Angolan, Nigerian and Ghanaian founders behind KuBitX – a crypto exchange that packed up this year – were high on motivation but rather low on technical knowledge and administrative capacity. The end result? $1 million in VC money gone.

Failures as seeds

We are not deep-diving into these failures here. The point really is that it is necessary to see these public accounts, from the founders but also through investigative sources.

One of KuBitX’s founders admits to making “early-stage terrible mistakes.” It could serve him well next time he joins or forms a startup. Hassan spent some time at Paystack as a product manager after OyaPay’s demise, but has gone on to found Mono, a Y Combinator-backed fintech startup driving an open banking ecosystem in Nigeria.

Where OyaPay lasted barely 365 days, Mono is being talked about as another Paystack.

It’ll be good to seek out those 181 startups that have failed in the past four years. Some of those founders and former employees have probably left fintech altogether for other causes. Maybe they’ve left the uncertainty in Africa for more security in the US and Europe.

But surely some have gone on to seed success in today’s and tomorrow’s African fintech unicorns. How do we get them to add nutrients from their failure stories to the ecosystem’s startup soil?