Francophone Africa is home to an island country where many African startups register their headquarters. Two days ago, this country reopened its borders to vaccinated tourists, which may include people founding new companies and seeking a tax-friendly environment.

Yes, Mauritius.

Between 2015 and 2019, startups and SMEs in francophone Africa received $417.9 million, according to Briter Bridges, a research firm. 89% of that money went to businesses domiciled in Mauritius.

While it’s a high-income economy, Mauritius has only about 1 million people which is not a huge market. So where does the real action happen in the region?

We’ll use Partech Africa’s report on venture capital funding in 2020.

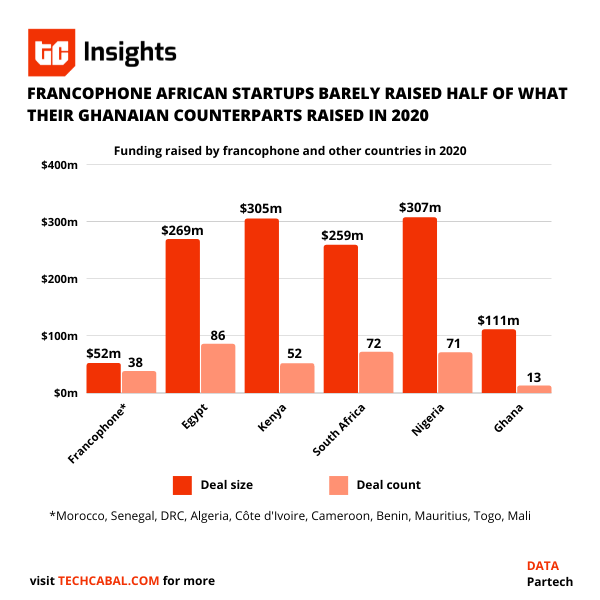

Morocco ($11.2m), Senegal ($8.8m), Côte d’Ivoire ($6.5m), Algeria ($5.5m) and the Democratic Republic of Congo ($4.6m) are the top five for venture capital funding. Rounding off the region’s top ten are Cameroon, Togo, Tunisia, Benin and Mauritius (startups that operate there, not just domiciled).

The $52m raised by all ten countries combined is far less than what Nigeria, Kenya, South Africa, Egypt and Ghana raised.

Boluwatife Sanwo/TC Insights

This is where I clarify that Partech only counts equity deals that are at least $200,000 in size; such investments must be in tech or digital startups. So there could be $15k to $50k grants or loans being written for innovative food processing companies or waste recyclers that are not captured.

That said, we can definitely say that startups in Africa’s 21 french-speaking countries trail behind the top five where tech investment is concerned.

If we exclude Morocco, Algeria and Tunisia, francophone Africa is a near 300 million market: the seven countries using the West Africa CFA franc (~125 million people), six Central African countries using the Central African franc (~55m people) and DR Congo which, at about 100 million, is Africa’s third largest country after Nigeria and Ethiopia.

[Read: A spotlight on DR Congo’s early-stage tech ecosystem]

Some startups have taken note of this relatively homogeneous culture and currency and leapt into the region.

Gozem, a ride-hailing company which also offers ecommerce services, launched in Gabon, its third francophone country, this year with eyes on Cameroon and Dr Congo. Bizao, a cross-border payment company, has stretched across 10 countries.

Djamo (founders pictured at the top of today’s edition) is building a finance app to cover the region and became the first francophone African startup to be accepted into Y Combinator. Two Cameroon-based fintech companies, Maviance and Diool, have raised at least $3m each this year for continental ambitions.

These ventures, it must be said, are the exception.

Francophone Africa is dogged by lack of clarity around regulations, language barriers and limited networking opportunities, per Briter Bridges report. Presidential power play in the DRC and an anglophone crisis in Cameroon are examples of the region’s uncertain business climate.

These concerns will take some time to quell, so maybe unicorn bells won’t ring in francophone Africa anytime soon.

But 2021 could be the region’s best funding year yet; a big french bank is set to invest in a West African francophone VC fund this year, according to a source familiar with the matter. So watch out – and maybe prepare to join my plane.