IN PARTNERSHIP WITH

Good morning ☀️ ️

I’m considering doing less writing and more YouTube Shorts videos.

YouTube has introduced a $100m Fund to reward creators of the most engaging and most viewed short-form videos over the course of 2021 to 2022. How much is up for grabs? $100 – $10,000.

In today’s edition:

- MTN Group moves it $280m out of Nigeria

- South African insurtech platform Naked raises $11 million

- Wapi pay raises $2.2m to ease payments between Africa and Asia

- Google to build its own smartphone processors this year

MTN and the woes of its subsidiaries

Doing business in a foreign country has consequences. Take MTN, which recently just got its 2020 $280m dividend out of Nigeria.

What’s happening?

The Johannesburg-based telecom group had been struggling to get dividends out of its subsidiaries due to the challenges of securing foreign currency in Nigeria and some other markets where it operates.

As a result, MTN was forced to suspend dividend payout for the 2020 financial year. The company also cited other reasons for the suspension, such as the timing of proceeds from an ongoing asset realisation programme and the impact of the Covid-19 pandemic.

Afghanistan and Dubai: In addition to the news from Nigeria, MTN also revealed “positive developments” in a United States court case related to the group and its subsidiaries, MTN Afghanistan and MTN Dubai.

After the news of repatriating money from Nigeria and progress in the U.S. court case, MTN shares reportedly finished 6% higher on Monday at R111.30 (around $7).

Looking forward: The group’s complete half-year results are expected to be released on August 12 and it has told investors to expect between 75% to 85% drop in profit or earnings per share (EPS). This is due to an impairment charge involving its Yemeni business and the decoupling of its operation in Syria.

The sale of MTN Group’s 75% stake in MTN Syria is part of ongoing attempts to exit markets in the Middle East over the next three to five years, with a plan to fully focus on core African markets.

Michael breaks down the different issues that MTN Group is facing with its different subsidiaries in this article.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

South African insurtech platform Naked raises $11 million to cover more Africans.

South African insurtech platform Naked has raised $11 million in a Series A round led by Naspers. Existing investors, Yellowwoods and Hollard, also participated in the funding round.

About Naked: Founded in 2018 by Alex Thomson, Sumarie Greybe, and Ernest North, Naked is a digital insurance platform covering cars, content, homes, and standalone items. The company says it employs artificial intelligence to create new processes and experiences for its customers.

Why it matters: Africa’s insurance sector is worth over $68 billion in annual gross written premiums. While South Africa makes up 70% of this market, only a fraction of personal insurance is sold without human intervention. Naked is looking to increase this fraction as there’s a growing number of South Africans who prefer to purchase their insurance online.

Naspers’ biggest investment: As per Bloomberg, Naspers through its Foundry Fund invested $8.4 million making it the largest investor in Naked. It’s also the biggest investment the Naspers’ Foundry fund has made to date in South African startups.

Zoom out: This investment is Naspers’ seventh since launching its Foundry arm back in 2019. The $100 million fund targets South African early-stage tech companies looking to “address big societal needs.”

Read more:Naspers leads $11M investment in South African insurtech Naked

Join the Future Africa Collective – an exclusive community of investors who invest in startups building the future of Africa. With a $1,000 annual or a $300 quarterly subscription fee, you get access to invest a minimum of $2,500 in up to 20 fast-growing African startups each year. Learn More

OPPORTUNITIES

Are you ready to kickstart your tech career? Application for Fellowship at The Bulb program is open! The fellowship curriculum is designed to offer practical experience in software engineering and product design to help you build a successful career in tech.

Interested? Apply here

Wapi pay raises $2.2m to ease payments between Africa and Asia

Which region of the world is the most expensive to send and receive money?

- Western Europe

- Sub-Saharan Africa

- Asia

- North America

Hint: In the first quarter of 2020, people spent an average of 8.9% to send money to the Sub-Saharan region of Africa, much higher than the global average of 6.8%.

Yup, the correct answer is B, Sub-Saharan Africa.

While there’s a lot of talk about cross-border payment between Africa and Western countries, there’s little said about the payments happening between Africa and Asia.

In the first of 2021, Africa-China trade jumped 27%, to $52.1 billion compared with 2020. Despite this high volume, the transfer cost is often as high as 20% and the wait time extends up to a week.

Wapi Pay is here to change this

Wapi Pay recently raised a $2.2 million pre-seed investment round to scale up global payments and remittances between Africa and Asia. The payment gateway for African businesses to receive and send money from Asia says it can process payments within a day and charges as low as 3%.

Read more: Kenya’s Wapi Pay raises $2.2M pre-seed for cross-border payments between Africa and Asia

How would you like to go on a financial ride with your favourite celebrity?

OctaFX is making that happen with engaging forex courses taken by your most-loved lifestyle and entertainment personalities. And it all leads to one place: mastery of forex trading and financial freedom.

Start the journey here.

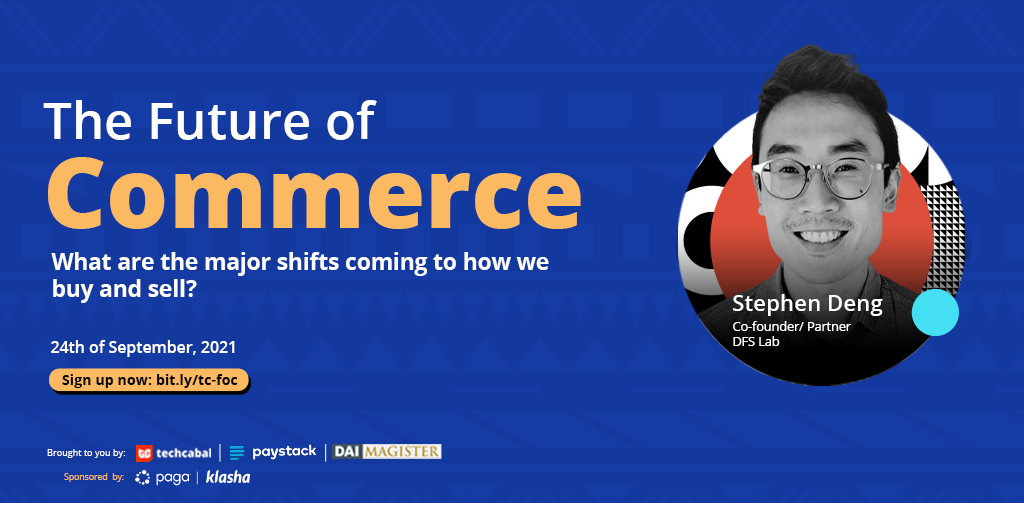

Join Stephen Deng at the Future of Commerce

Co-founder and Partner at DFS Lab, Stephen Deng, will be joining us at the Future of Commerce on September 24th.

Stephen leads DFS Lab’s investments in early-stage digital commerce startups in Africa. He has also spent time advising global clients on the growth of fintech and e-commerce in frontier markets such as those in Africa, China, and Indonesia.

He will be speaking alongside Juliet Anammah, Chairperson at Jumia Nigeria, Marcello Schermer, Head of International Expansion at Yoco, Ray Youssef – CEO at Paxful, Iyin Aboyeji – Co-founder and General Partner at Future Africa, Onyekachi Izukanne – CEO at TradeDepot, and many others.

It’s an excellent opportunity to meet and network with forward-thinking minds in tech, business, and commerce. Whether you’re an investor, a key player in e-commerce, payments, retail, logistics, cryptocurrency, or you’re innovating in an adjacent sector, this is the event you should be attending.

🔔Register your free slot now.

The Future of Commerce is brought to you in partnership with DAI Magister and Paystack and is sponsored by Paga, Chipper Cash, and Klasha.

🤝Interested in sponsoring? Send an email now to favour@bigcabal.com.

The Best Kept Secret in the World?

There’s simply no doubt about it! Trading global financial markets remains the fastest route to building long-lasting wealth. With Egmarkets, Nigerians everywhere can now trade different classes of assets such as Forex, Indices, Stocks, Commodities & even Cryptocurrencies from the comfort of their phones (or laptops) using our Naira currency or MT4 platform (dollars).

Egmarkets is celebrating its 5th year anniversary and you stand a chance of winning a Playstation 5, an iPhone 12, or a Samsung S21. To learn more on how to win, click the link here.

Google abandons Qualcomm to build its own smartphone processors this year

On Monday, Google announced it will build its own smartphone processor, called Google Tensor, that will power its new Pixel 6 and Pixel 6 Pro phones later this year.

Why so?

The current Qualcomm chips are limiting what the Pixel phones can do.

“The problem with Pixel has been that we keep running into limits with existing off-the-shelf technology solutions, and it’s just really hard to get our most advanced stuff from research teams onto the phone,” Google’s hardware boss Rick Osterloh said in an interview last week.

This move sounds familiar

Yes, Apple recently ditched Intel chips in favor of its own processors in its new computers. Google believes the new chip will help Google’s phones take better photos and videos, as well as process tasks better.

Zoom out: There’s a lingering question of whether the new chips will be enough to get people to buy a Pixel over an iPhone or a Samsung Galaxy device. I guess in a few months time we’ll have this answer to that.

Read more: Google will abandon Qualcomm and build its own smartphone processors this year.