When VBank owned by VFD Microfinance Bank released an upgrade of its digital banking app, I was eager to try it out. With features such as free transfers and target savings, it has been the subject of discussions on and off social media as users like myself share their unique experiences using the app.

In addition to a user-friendly and sleek interface, creating an account is very straightforward. After signing up and creating a user password, you have the option of using biometrics for future purposes. This feature is a plus because it saves users the trouble of retyping passwords each time they log in. It’s also much more convenient and secure.

Once I got to the next stage, the process of uploading my ID was quick and seamless. With the latest upgrade, all I had to do was scan and upload my information. That way, I skipped having to input my details manually, and, my, was that a relief!

Each KYC level is unique and consists of three categories that determine your transaction limit. It is also quite simple and allows you to carry out large transactions and multiple transfers simultaneously. However, what I love most is the 10-second authorization video for creating an account in my name. That alone gives the app an A for protecting the digital identity of its users, particularly in light of recent cyber threats.

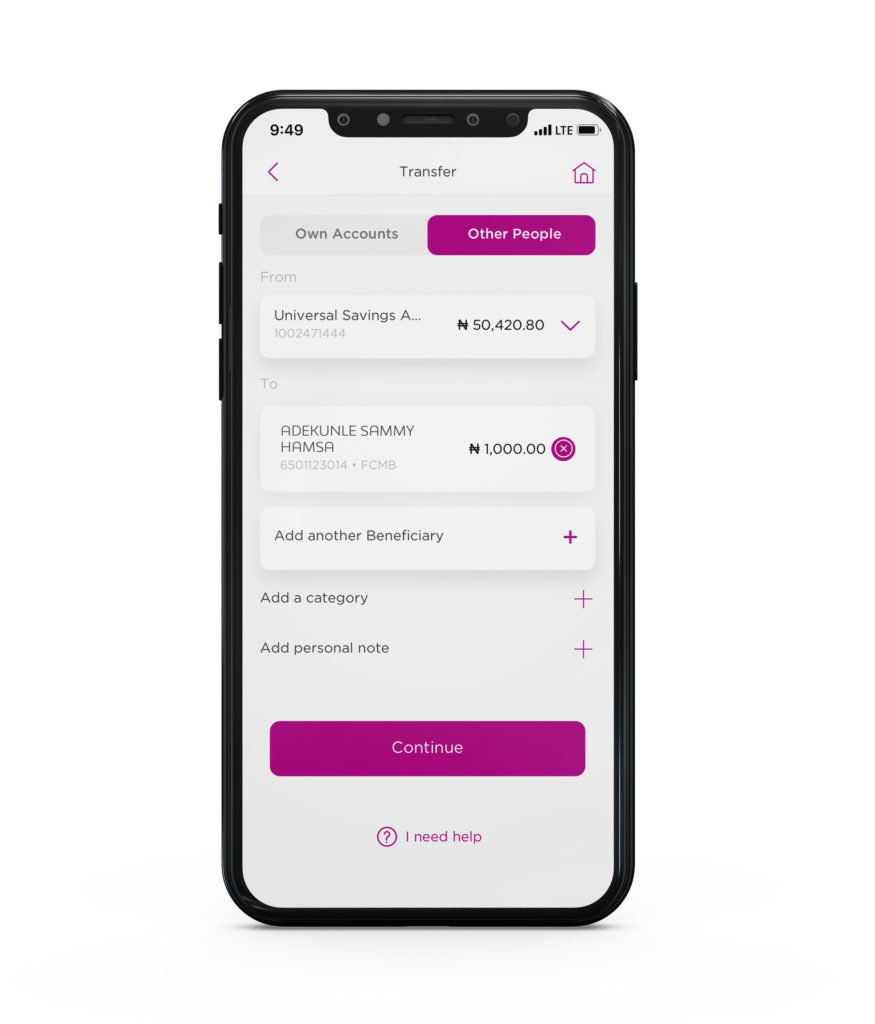

I found it quite impressive that I don’t necessarily need an account number to send or receive money. With two features on the app; Proximity Payment and QR payment, VBank app users can send and receive money to one another easily. The proximity payment feature allows users to send and receive money by just connecting in-app. But there’s a catch- recipients need to have the VBank app open and be within close range.

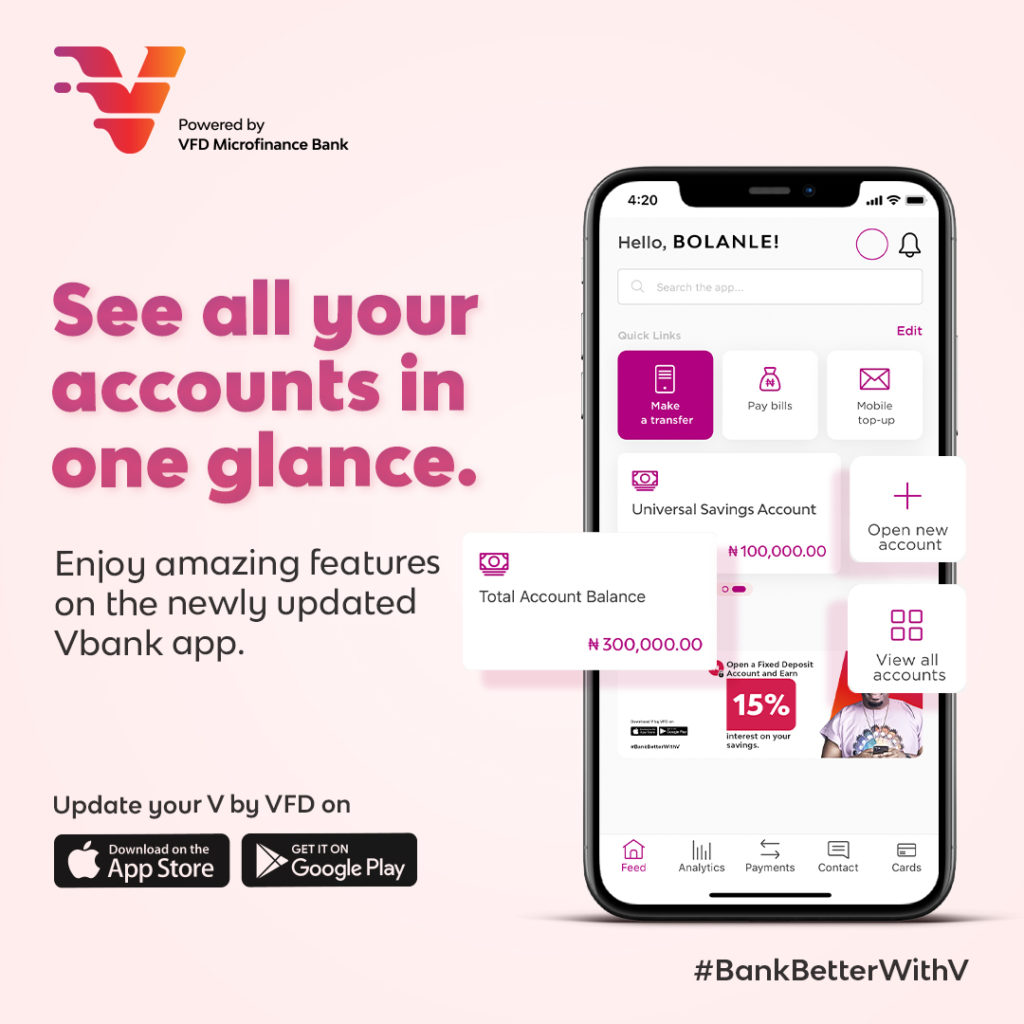

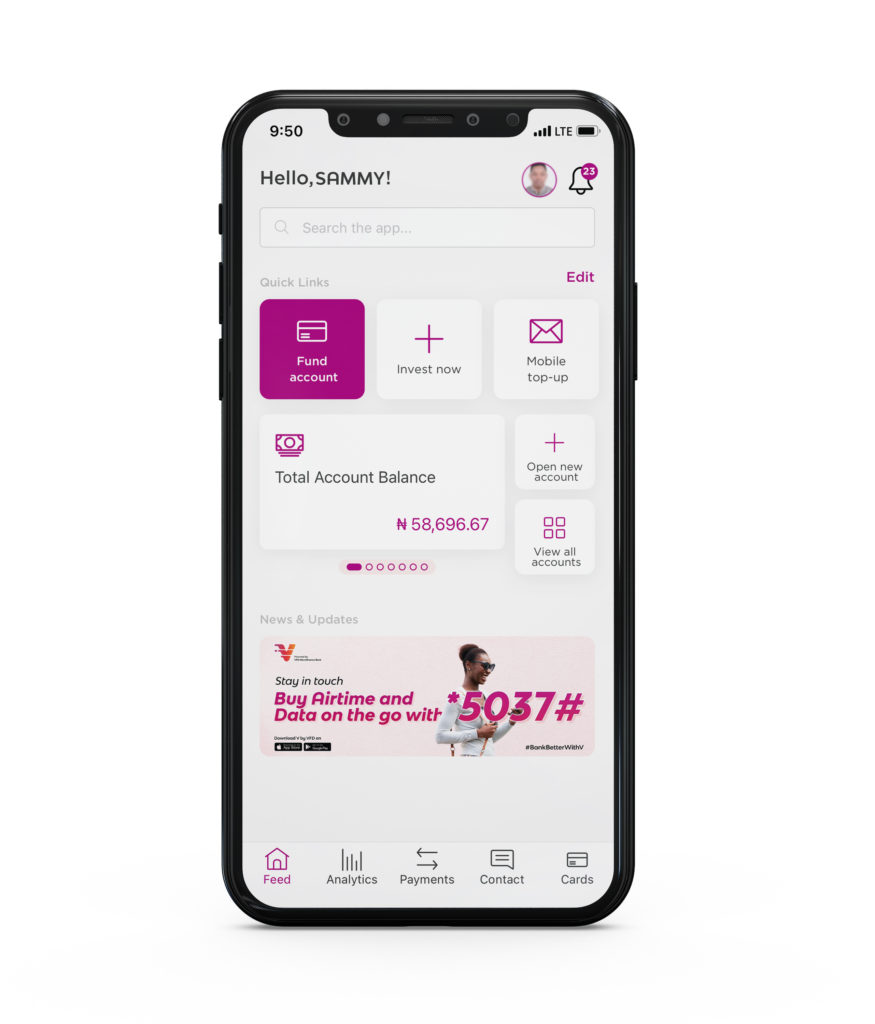

More useful to me personally is the feature that allowed me to customize my homepage showing the options that I use most frequently. Out of the three available slots, I went ahead to add quick links for bill payment, mobile top-up, and funding my account. There’s nothing better than knowing that this little trick is there if I need to attend to my needs during a hectic day. The app also offers customer service with the benefit of a quick response to whatever challenges users might face.

The advantage of a Fixed Deposit is a guaranteed return with very low risks and uncertainties compared to other investments. The VBank app is a platform to consider because users can be sure of a return on their deposit. With an FD tenure as low as 30-60 days, and an interest rate as high as 15 percent, VBank ensures that your investment amount stays unaffected by market changes. Your fixed deposit can also be rolled over easier without long delays.

Based on my time using the app, I believe VBank got it right. Another feature that stands out is the analytics which helps keep track of all your transactions. It has particularly helped me budget better, and that makes me so proud!

I’ve come to realize that for most digital platforms, it’s all about convenience and the experience of financial services provision at your fingertips- VBank offers both! The latest upgrade of the VBank app is available to download for iPhones via the App Store and Android users using Google play.

Launched in 2020, the VBank app has recorded over 300,000 users. It has also become one of the fastest-growing digital banking platforms in the fintech industry.