“Collaboration is pivotal to the emergence of the possibilities, we want to see in the FinTech ecosystem of the future”- Ade Bajomo, President FinTech Ngr.

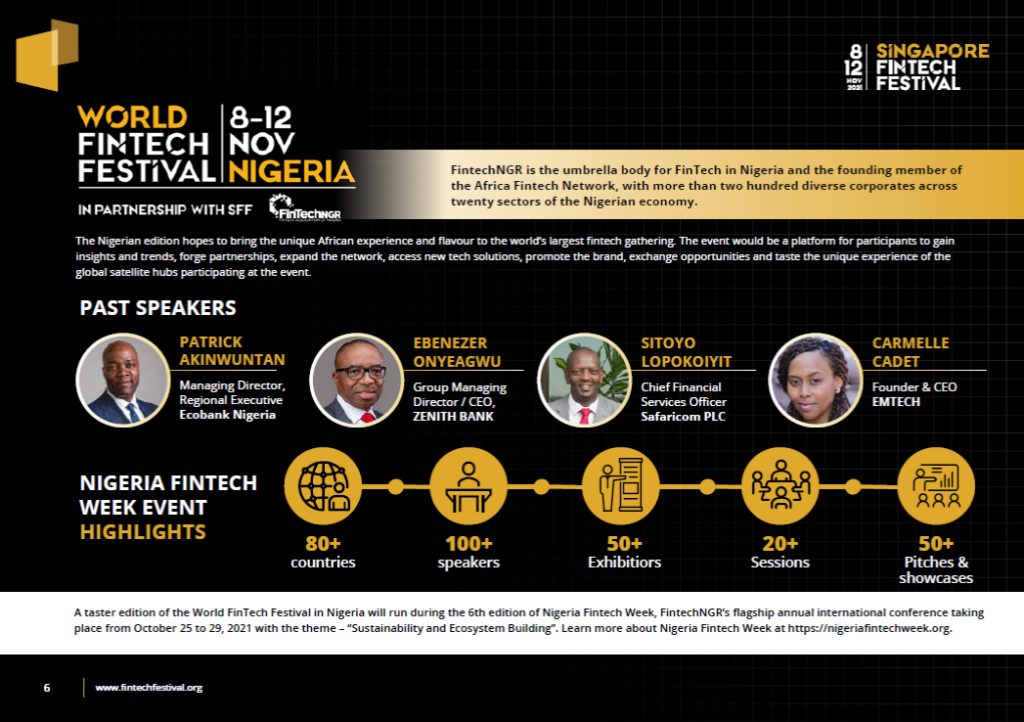

With the aim of driving collaboration and partnership in the Fintech ecosystem, Access Bank through its Fintech arm, Africa FinTech Foundry (AFF) is partnering with Fintech Nigeria (FintechNGR) to bring the World Fintech Festival to the shores of Nigeria popularly known as “The Giant of Africa”. Singapore FinTech Festival (largest FinTech gathering in the world) is driving a global tour (named World FinTech Festival) which showcases the strengths and opportunities of various global FinTech ecosystems. Only 11 countries have globally been identified for this and Nigeria is one of them, this is being organised in conjunction with FinTech Association of Nigeria. From previous editions, Singapore FinTech Festival has representation from over 140 countries, over 60,000 participants, over 500 Fintech’s, over 100 VC’s and 3.5 million online views

Collaboration with Fintech should be at the forefront of the digital transformation happening in the Nigerian financial landscape. This will allow banks to accelerate digital transformation and enable transactions through mobile quickly, safely, and efficiently. Also, Fintechs can help banks reach 40% Nigerians that are financially excluded; those untapped and excluded markets in Africa. Banks will be able to create an all-inclusive economy where people can contact their bank through their mobile devices and get access to different services instantly.

Fintech can help banks explore new products and services to offer to their customers. Using new and emerging technologies, banks can create more innovative and personalized services to help attract new customers and retain old ones. Banks will be able to offer combined services to not only individuals but also small and medium enterprises.

Apple identified this opportunity by partnering with investment bank Goldman Sachs to launch the Apple Card, a revolutionary digital payments solution, which also avoided certain regulatory requirements. By relying on already existing banking infrastructure, tech companies can focus on what they do best – creating novel products – while still being able to compete with traditional banks – and an increasing number of companies now consider this to be the next logical step to add products to their core business models. Local banks have the capacity and resources to build innovative and sustainable economies- Disruption and adaptation will occur at a faster pace.

At Access Bank, we understand that FinTechs play a role in the innovation ecosystem and have the potential to provide customer centric solutions. Accordingly, the Bank launched the initiative known as Africa FinTech Foundry (AFF). It is a Pan-African start-up accelerator that consists of an ecosystem of founders, mentors, investors, and partners, whose aim is to find, curate, invest in and package Fintech start-ups for growth and scale. The lab also invests resources in the development of world-class digital assets.

The primary focus of the innovative FinTech lab is to scout the start-up ecosystem, conduct open application processes, and leverage off partner networks (global accelerators, financial and technology partners, government and donor agencies et al) in order to assist start-ups to scale. The AFF is also responsible for the Bank’s innovative payment systems. The strategic objectives of the AFF lab are:

- To serve as the number one platform provider for technology start-ups with innovative solutions that are capable of tremendous scale and profitability.

- Develop a centre of excellence for innovation in financial services and financial technologies through thought leaders, start-ups and FinTech players.

- Benefit from technology integrations with FinTech-driven companies to tap into their digital ecosystems and supply chains of SMEs, merchants, and consumers.

- Gain commercial relationships with FinTech-driven companies to generate revenue opportunities, assets, deposits, and customer acquisition.

- Effectively sharpen and utilise talent

- Enable Access Bank to be a key player in Africa’s FinTech ecosystem.

- Increase digital revenue growth across Africa and the rest of the world.

From inception till date, the lab has accelerated 16 start-ups – a move which has helped to keep digital talents within the continent, as many other start-ups previously sought acceleration from foreign technology labs. The start-ups have access to market, they have better refined products, have their company registration and legal issues sorted out, and learn human resource management, finance, and operations for start-ups.

Through AFF, Access Bank is collaborating with other players in the ecosystem such as FinTechNGR, a pioneer member of the Africa FinTech Network (32 countries), Global FinTech Hub (72 countries). Membership is open to start-ups, investors, Corporate bodies, and professional individuals and the whole aim to leverage our various capabilities to create value for the ecosystem.