Debit cards are mandatory for the average adult living in Nigeria for day-to-day financial activities. These activities include cash withdrawals from ATMs, POS services, and online shopping.

Paying for services with your debit card as a Nigerian at home or abroad has not been easy since the first wave of restrictions by the Nigerian financial authorities in 2020, at the start of the Covid-19 pandemic.

Naira Debit Card Restrictions in 2020

In July 2020, several Nigerian banks reduced the spending limits on debit cards held by Nigerians at home and abroad. Stanbic IBTC bank, for instance, reduced the limit from $500 to $100, while Zenith bank cut the limit down to $200.

The reason given for this reduction was that Nigeria was experiencing dollar shortages due to the steep fall in oil prices. Also, the country had paused selling forex to retail currency traders after the ban on international travel to halt the spread of the deadly coronavirus. Hence, the apex bank had directed banks to reduce the spending limit on debit cards to lessen the risk of foreign settlement difficulties.

As expected, this new financial restriction caused direct and indirect issues for debit cards holders. Nigerians abroad could no longer pay for services such as flight & hotel bookings with their cards, while those at home could no longer pay for essential services like web-hosting that usually cost more than $100.

Naira Debit Card Restrictions in 2022

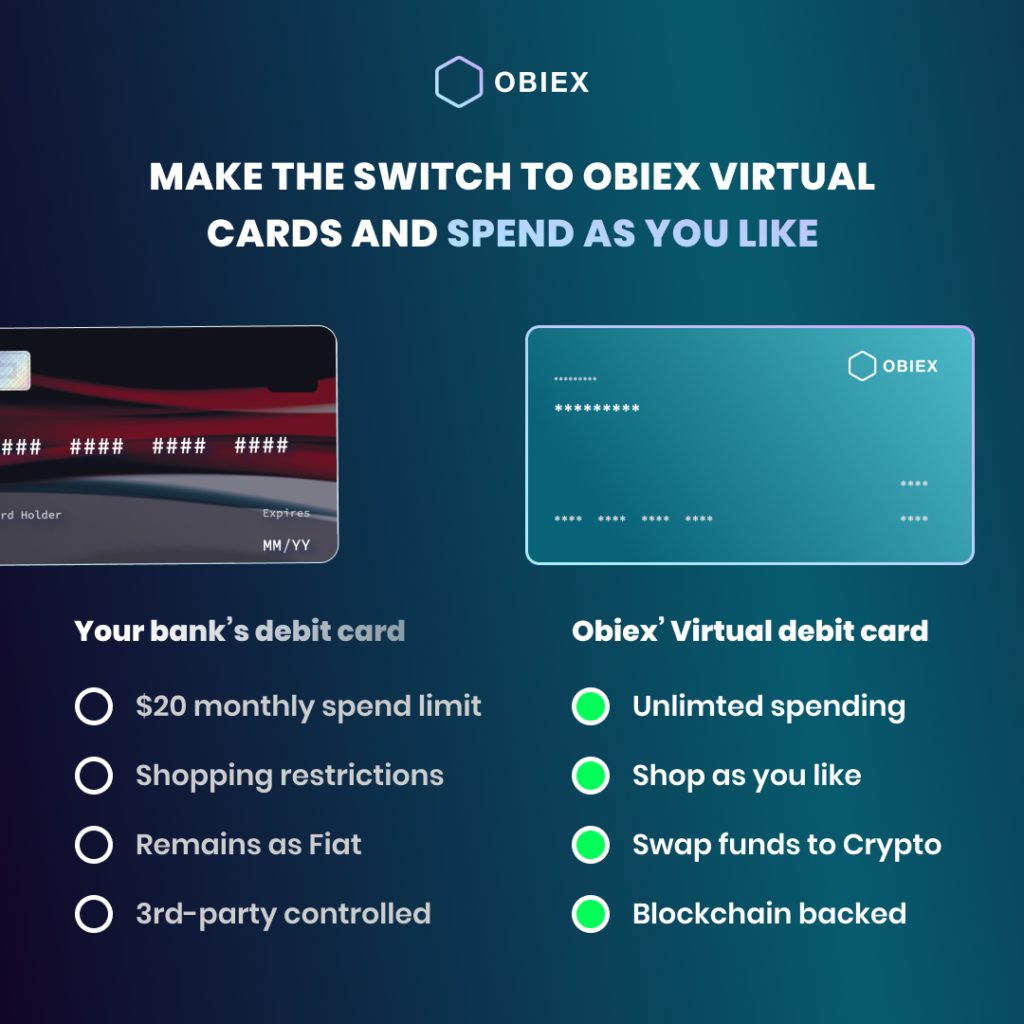

The banks struck again in the first quarter of 2022, and customers received emails informing them of (another) reduction in their debit card limit. The limits on international transactions using naira debit cards had been cut down from $100 (about ₦50,000) )to $20 (around ₦10,000) per month.

Once again, the scarcity of foreign exchange was cited as the new limit. However, this time, the rationale behind the move seemed mind-boggling because there had been an increase in global energy prices. Yet Nigeria, one of the biggest oil exporters, faced forex challenges.

The Challenges of the Naira Card Restrictions

As a result of this newly imposed limit, Nigerians have found it frustrating and impossible to pay for most online services. The new debit card restriction seems to be a giant headache to Nigerians that use their debit cards for business and personal transactions.

These debit cards now exist only to serve cash withdrawal and local payment purposes (if the network permits).

One could wonder if these cards truly fulfill the reason for their creation as a better alternative to cash payments.

To put the effect of the card limitations in more material terms, here is a shortlist of what Nigerians can no longer pay for with their debit cards – Online courses on platforms like Udemy & Coursera, Online shopping on stores like ASOS, Shein & AliExpress, Instagram Ads, Facebook Ads, Streaming platform subscriptions to Apple Music, Spotify & YouTube Music, Online Gaming subscriptions, Audible & Medium Subscriptions, Shopify, Web hosting & Server space subscriptions.

From the above list, it would not be dramatic to consider owning a Nigerian bank-issued Naira debit card a liability rather than an asset. When one also considers the present state of the Nigerian economy, it isn’t easy to foresee these debit cards becoming useful anytime soon.

A Better International Payment Alternative for Nigerians

The question now is, what can Nigerians use as an alternative to these card restrictions? What is the solution to the headaches and difficulties currently faced by holders of local debit cards? The typical answer to these questions would be to get a borderless card- one that works anywhere

But how about taking things a step further and signing up for one that doesn’t require you to own an account in a bank or do a lot of paperwork and can quickly be funded with crypto? How possible is that, and how would it work? Obiex has it all figured out.

It’s as simple as creating an Obiex account that lets you set up a dollar card that can be funded with cryptocurrency like USDT (a stablecoin pegged to the dollar’s value).

Why use the Obiex Virtual Card rather than other dollar cards?

With an Obiex virtual crypto card, you will be able to spend crypto as fiat all over the world instantly.

It is necessary to mention that you don’t need to be a crypto trader to use the Obiex Dollar card. The cards were created to be used by anyone who needs a fast, easy and innovative way to make international payments.

The Obiex virtual debit cards will pay for anything and everything to encourage limitless, borderless, and hassle-free payments and provide access to a broader range of e-commerce services.

Some more benefits of using the virtual crypto dollar cards include:

Costs less than bank cards

Unlike traditional debit cards, the Obiex Virtual card has only a one-time creation fee of $2 and zero maintenance fees. This makes owning the card easier to manage financially and relieves you from worrying about monthly deductions for “card maintenance.”

Instant Activation

You don’t have to fill out any forms or join a queue at the bank to get an Obiex virtual crypto card. You have to sign up, input the required information, receive confirmation, and your card is ready for use.

Easier Access to Crypto

Rather than withdrawing, converting, and sending your fiat to your regular prepaid debit card, you can simply fund the Obiex card directly with any amount of crypto you need for your transaction.

No Restrictions

Once your Obiex Virtual Card is activated, you can use it to pay for services on as many online stores, shops, and platforms as possible. You no longer have to be anxious or frustrated about card spending limits or geographical restrictions.

Create your card today by downloading the app from Google Play Store for Android devices or App Store for iOS devices.

What about Physical Obiex cards?

According to Obiex’s CEO, Jerome Okeke, physical cards will be available to the first 500 people to create and use an Obiex virtual dollar card. Once you create a virtual card and fund it, you will automatically be added to the waiting list for physical cards. The physical cards will allow you to spend money directly from your crypto wallet anywhere.