In many Nigerian cities, commercial and agent banks are ubiquitous and financial service delivery is robust. But when you move away from these urban centres into the rural areas, they begin to thin out or are absent altogether.

Since its Nigerian debut in 2013, agency banking has become an important part of how commercial banks serve retail customers, especially since commercial banks themselves are few and far between in rural communities. And in many rural communities, savings and credit cooperative organisations (SACCOs) and small microfinance banks (MFBs) fill in the financial gaps caused by the absence of commercial banks. However, the manual methods these local institutions employ to deliver financial services—painstakingly recording transactions with ink and paper, poor IT infrastructure—and their inability to expand to effectively serve rural areas limit how well these organisations can serve their communities.

Now Grupp, a grassroots banking-as-a-service startup, wants to help these microfinance banks, credit unions, and cooperatives digitise their processes and provides software that enables MFBs to leverage their intimate knowledge of their communities to own—not just operate—agent banks. Led by Olamide Akinbande, former Head of Growth at Nomba (formerly Kudi), a Lagos-based fintech he had helped set up their agency banking unit, Grupp provides software and white-label hardware that help small microfinance banks in rural and semi-urban communities offer financial services digitally and automate previously manual processes.

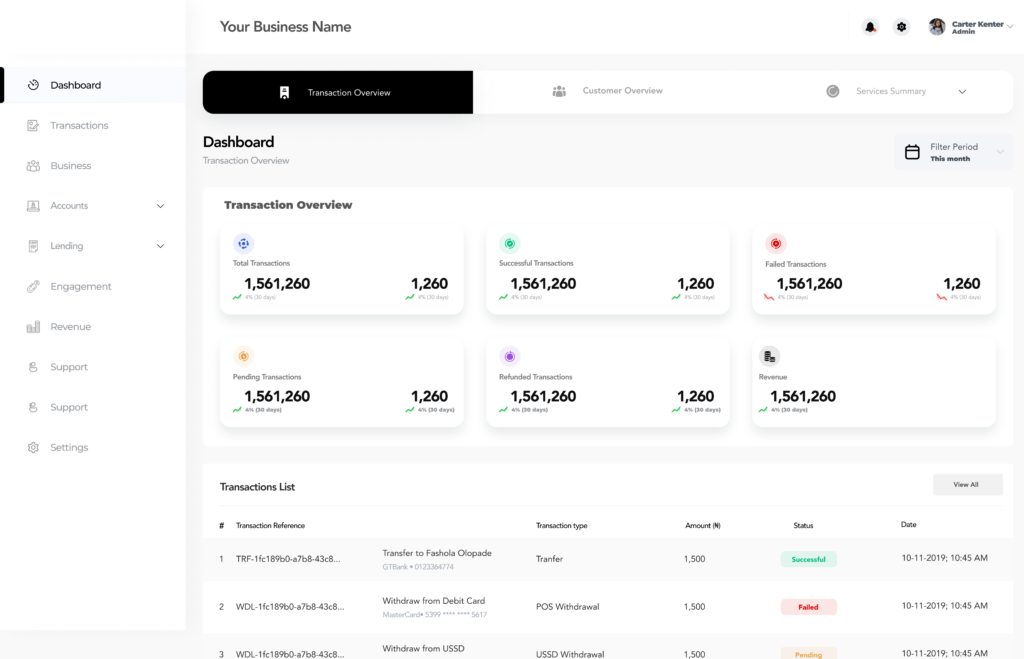

Essentially, Grupp provides end-to-end white-label hardware (POS) and software infrastructure for financial institutions in rural areas. White label means, Grupp simply provides customised and unbranded software and hardware that other businesses rely on to create an agent banking network.

“We’ve automated operations [for MFBs and credit unions],” Akinbande tells TechCabal over a call. “The only thing they [Grupp’s users] just have to do is to manage their customers. They understand [rural banking needs] better than anyone,” he says.

Akinbande says that his experience working on projects in underserved communities in northern Nigeria showed him the limitations of urban-first national agent networks. After exiting Kudi, he co-founded Mikro Solutions, a service that helped retailers accept payments through mobile point-of-sale devices.

White label community banking infrastructure for local players

Since launching its beta late last year, Grupp has signed up more than a dozen microfinance banks, including Accion, FidFund, VFD Microfinance, and several cooperative and credit unions.

Michael Obode is a member and administrative officer of the Young Entrepreneur Multi-Purpose Cooperative (YEMPCOO) society in Otefe Oghara, a college community in Delta state, Nigeria. He claims that since members of the cooperative started using Grupp’s community banking-as-a-service product in December 2021, more than 150 agents in different states have handled more than ₦1.2 billion in transactions. He is brimming with excitement as he declares, “We just started in December. Look at the numbers we have, look at the few terminals we have, look at the numbers we’ve gotten.”

According to Obode, most YEMPCOO members are experienced agent bankers who switched from other platforms because of the sense of ownership and control Grupp’s headless agent bank product provides.

Selling ownership works

Besides the practicality of allowing experienced hands to brand and operate agent banking in their communities, Grupp’s play is an interesting go-to-market trick. By white labelling their community banking offering, Grupp is filling a convenience need for microfinance banks especially. There are 916 licensed microfinance banks in Nigeria. But most do not have a Nigerian Uniform Bank Account Number (NUBAN), and so are not listed on the NIBBS Instant Payment (NIP) platform. The NIP is the fund transfer platform that enables instant settlement in Nigeria. Grupp clients like Fidfund MFB who use its direct NUBAN integration, are listed on the NIP platform, and Fidfund’s customers can make instant transfers directly to their Fidfund account instead of through other banks. Grupp also offers this service to other fintech companies.

Femi, a staff of Accion Microfinance Bank says, “On Grupp’s agency banking platform, transfers are going to all banks listed on NIP. So far as your financial institution is listed, whether it is a bank or fintech or a mobile money platform, you’re able to send money to them. But on the former platform that we had, we were restricted; we could only transfer to a few commercial banks,” he says.

In a WhatsApp voice note, Femi explains that Accion had previously operated agency banking as an aggregator and even deployed an internal platform before becoming a Grupp client. According to him, one problem they faced was that Accion agents could not access enough transaction data and history. But Grupp’s community banking software allows its agents to retrieve transaction data for up to 3 months.

Chasing elusive financial inclusion

Akinbande is almost poetic when he talks about financial inclusion and reaching underserved communities. He says he’s always wanted to build a Grupp from the early days of building Sanwo TouchtoPay, a contactless payment system for university taxis. While working on a separate project to digitise revenue collection for a state in northern Nigeria, he realised that no one was offering headless infrastructure for the financial institutions in rural areas. “POS is not an infrastructure for the underserved guys,” he says. According to him, Grupp’s primary purpose is to serve as the IT infrastructure that helps local financial institutions tackle financial inclusion for underserved communities.

If you step away from the financial inclusion speak for a moment, it seems that while Grupp’s silent middleman strategy helps MFBs offer financial services in communities, and even set up local agent bank networks, agency banking is becoming a commodity. Grupp does more than enable institutions to set up agent banks, true. But offering plug and play solutions for agency banking raises an interesting question. By enabling any financial institution that sufficiently understands the local nuance in Nigeria’s villages and towns to “own” an agent banking mini-empire outside the big cities, is the “Agent Bank” in Nigeria signalling that we are approaching saturation point? It is either this or—considering that agent banks are primarily used for withdrawals despite being conceived as a cash digitisation initiative—agent banks are demonstrating an increase in the demand for cash.