Raising $5 billion in 2021 did not change the game enough for African startups.

Global venture funding in 2021 shattered all records. According to Crunchbase, total dollars invested in tech and tech adjacent startups by venture capitalists reached $643 billion in 2021, compared to $335 billion for 2020—a stunning 92% growth year over year.

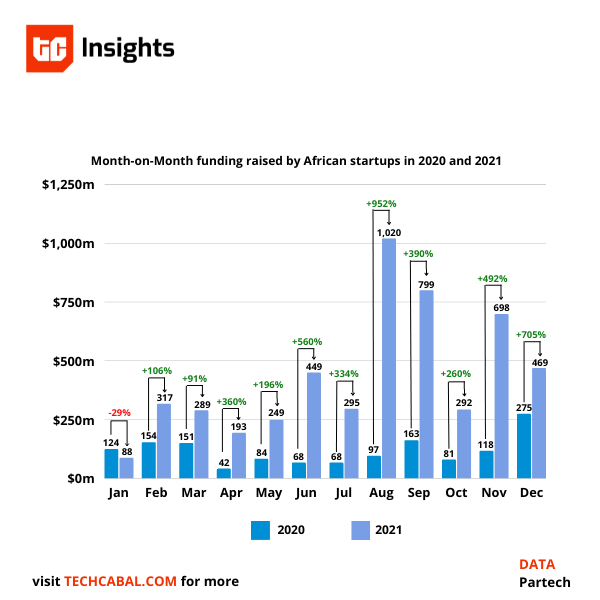

If you take Partech’s data, which is one of the most liberal interpretations of startup funding in Africa, African startups raised $5.2 billion in 2021. That is 0.8% of all venture dollars. If you go by data from Africa: The Big Deal, one of the most cited deal trackers in Africa, it’s even lower. For comparison, investors poured $14 billion into startups in Latin America, and tech companies in Southeast Asia raised a record $25.7 billion in funding.

Five billion dollars was indeed better than what was, but it’s still worth noting that Africa’s breakout year was little more than a rounding error in the world of global venture. It is sobering, and I believe more sobriety is not a bad idea for all stakeholders in Africa’s technology space.

To be fair, these other tech ecosystems are far more developed, mature, and integrated compared to Africa. And this is not to mention the fact that they enjoy far better infrastructure, policy mechanisms, and robust economies. But this is still not a sufficient excuse.

Chart by Boluwatife Sanwo – TechCabal Insights

This much is clear: Last year’s record funding inflow was a sign that “Africa’s time had come” or any of the idyllic notions that excited innovators, investors and unfortunately some rent-seekers who occupy public offices.

That record $5 billion was a seed. The largest of the pitiful handfuls since investors started paying attention, yes, but a seed nonetheless. It was also not close to being enough to meet the capital requirements that African innovation needs.

The downturn finally bites

Despite the fact that last year’s record funding was just a seed, a harvest mentality began to grow alongside the increase in deal activity and funding amounts in both innovators and governments.

Harvesting is not a bad thing. It is part of the natural cycle. However, what is important is understanding that harvests are at the end of the life cycle of the agricultural ecosystem—at least on the farm. Premature harvest thinking leads to unhealthy behaviour that is disconnected from the surrounding environment. For Africa that surrounding environment is both economical, social, and the Western apron strings to which a significant amount of Africa’s venture funding, especially growth, funding is tied.

Feasting on seeds is not illegal, but a farmer who does so won’t be in business in the near future. And the entire African technology landscape is barely seeded.

To be a bit more explicit, anyone—innovators, investors and even talent—who is building with a quick-flip mindset and looking to make a quick buck is not only in the wrong business, they are doing an entire ecosystem a disservice.

Nothing makes this clearer than tough times, and in Africa, where tough is the default, it seems like tougher times are catching up to innovation. What do you call it when tough times catch up with innovation?

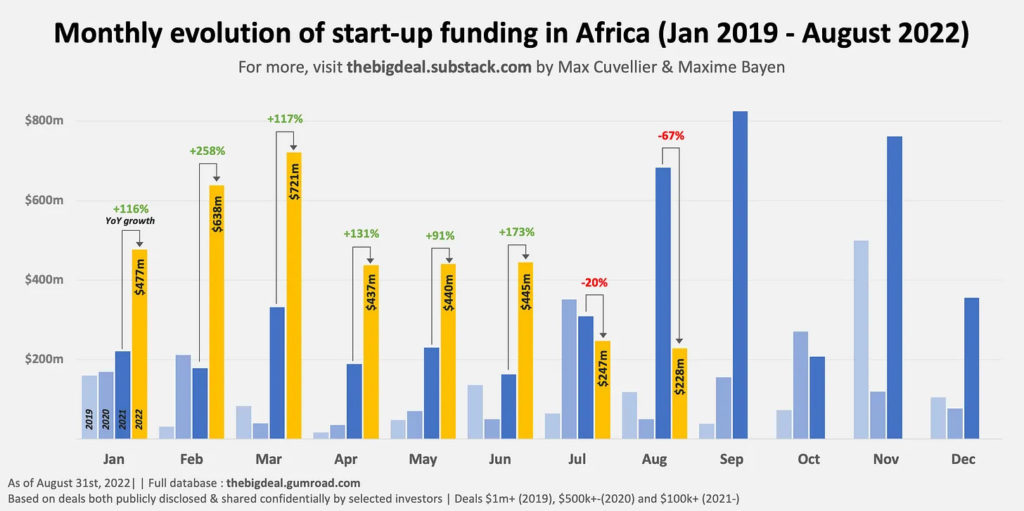

Today where innovation is synonymous with Silicon Valley-esque software businesses, you would call it a venture downturn. According to Africa: The Big Deal, venture funding in Africa in July and August fell by 20% and 67% compared to last year’s amounts, despite more deals being recorded.

Chart by Africa: The Big Deal

In general, data on fundraising globally lags, but in Africa, that lag is more pronounced. For some, it was already clear by June at least that fewer deals were being completed compared to last year. While it took a while for the money numbers to show up in venture funding trackers, other signs of the growing pain were there.

The silent down rounds and an increase in merger and acquisition activity were one sign. Layoffs were another sign. And without the PR garb of new venture funding rounds to provide cover, internal governance issues began to show up in the media and flawed business models (Kune, anyone?) began to break under the strain.

But the venture pain is only starting. Multiple macro crises are rapidly catching up with African innovation. Switching off the harvest hormone means burrowing deeper to find true depth for your seedlings. This means understanding social consumption habits, eventual obtainable market sizes and the realities of expansion. It also means deepening founder talent beyond who-you-know-isms, better middle management and curious investors at all stages.