Do you still want to be a VC?

Ahem! We are beginning to see the contours of the venture market for both founders and venture capitalists and one thing is clear: everyone is fundraising. But at the same time, we are confidently assured of an investment tsunami waiting to happen courtesy of billions of “dry powder” dollars.

This is even as the market (read cheap-money-addicted investors) struggles to find the floor and reprice equity purchases.

To divert a bit, I believe that broadly seeking to reprice assets in investment bands to “set a standard” is essentially the same thing as what got us here in the first place. Or, to put it another way, that venture capital has extended itself into funding many different types of businesses is no excuse for seeking uniform types of valuation across deal stages. It is lazy. This groupthink-enabling “standardisation” is in fact exactly why the hot potato passing game was efficient. It was easy and popular (remember the Twitter posts arguing African valuations and urging founders not to accept less?) to adopt pervading market valuations.

Having said that, let’s dive into this curious phenomenon where both VCs and entrepreneurs are in the market for money.

Why everyone is raising?

If you haven’t noticed, more investors are talking about their firms, hosting virtual roadshows, physically travelling and generally doing the things that send the signal that they need more or new funding partners. This is especially true for emerging VCs and firms raising their first institutional capital. As early as last year, The Information reported on how US VC firms were seeking Middle-Eastern money, and on LinkedIn, family office managers and sovereign wealth funds in the Middle East flaunted their status with a flourish.

If you have been watching the news, you’ll easily recognise that venture capital is only one of the many players also in the market for capital. Government and corporate credit markets as well as private equity firms are paradoxically flush with “dry powder” and hungry for the capital they want to invest into the abundance of deals now shipping water as last year’s financial crisis deepens. Seriously there are good businesses that were unfortunately caught on the wrong side of the tide.

Everyone is raising because the world of venture capital is no longer as certain as it used to be. One way this manifests for investors is that Limited Partners’ (LPs)—the people who invest in venture capital and private equity funds—cold feet about how their money is deployed is effectively reducing the real amount of capital under management.

So despite large sums stashed away (not really, but more on this later) as dry powder, even VC partners who have raised have to basically fundraise every time they make a capital call. An example from a late 2022 Forbes article illustrates a problem that has only grown worse.

Eunice Ajim, who is raising her first fund to back seed-stage startups in sub-Saharan Africa, says that when she attempted to conduct her first capital call—in which VCs ask for LPs to wire over a portion of the money they committed—more than half of the money did not arrive. As a result, she’s been forced to make $25,000 to $50,000 investments into startups in which she’d previously been hoping to invest $100,000 to $150,000.

When investors have to rehash their pitch every time they make capital calls, it sort of grows on you—not a bad thing per se, but also not the best frame of mind from which to plan and support a portfolio.

Too many venture funds do not explain this

It’s tempting to assume that VCs are in perpetual fundraising mode because there are simply more investors. And there’s good reason to entertain this thinking. VC firms have multiplied.

In 1985, there were more than 290 active VC firms in the US, with roughly $17 billion under management, spread across 530 funds. On the eve of the Global Financial Crisis in 2008, there were about 900 managing circa $230 billion. And by 2020, active US-based venture capital firms numbered over 1,300, with $444 billion in assets under management. Since then—especially with the rise and rise of micro VCs—the number has swelled. And this is not only happening in the United States. Between 2013 and 2017, European fund managers added 1,465 new firms, bringing the number from 657 in 2013 to 2,122 in 2017, according to data from Statista.

In Africa too, more new (and mostly micro VC) firms have been set up in the last seven years than existed maybe two decades ago. And they’re active and responsible for the heavy lifting at the early stage.

Top venture capital investors in Africa participated in at least one $100K+ deal per month on average within the last 2 years. | Chart by Ayomide Agbaje — TechCabal Insights

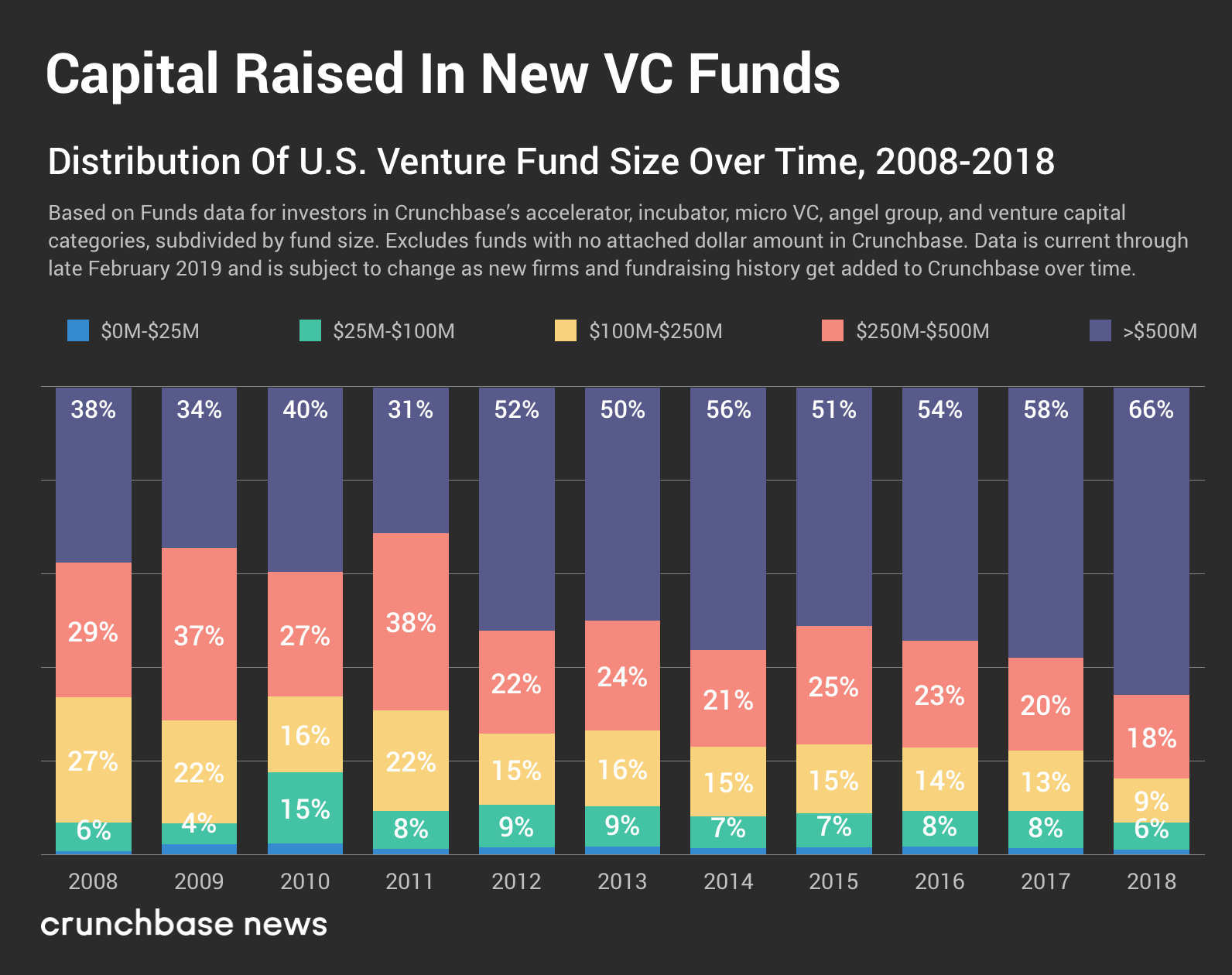

But the increase in the number of firms is not exactly why everyone is raising capital because both small fund managers and the big guys seem to all be running the race for more capital. Emerging managers will not find consolation in the fact that LP allocation to sub-$25 million firms has consistently been low since at least 2008. Or that they have to compete, even now, with firms that boast huge sums under management. But the biggest firms (and funds) have always taken most of the capital pie as we see in the chart below.

Source Crunchbase

Larger funds are typically older, with deeper LP linkages and have longer frames of reference that appeal to staid LPs—some of which (like pension funds) are battling economic fiascos themselves.

But even this does not explain why both small and large firms are in talks for raising more capital. After all, the $585 billion in dry capital available (per data from Pitchbook) is more than the capital startups raised globally last year at $445 billion (per Crunchbase data).

Slow LPs, slow VC-ing and the myth of dry powder

So why are LPs declining capital calls? The answer is, as I mentioned earlier, LPs like pension funds are all suffering from the economic malaise currently mauling high finance streetspeople. Remember I said, VCs are not the only ones looking for cash? One of the central ills in the global economy today is the scarcity of cash—or illiquidity. LPs who invested in bonds and other financial instruments have seen some of their capital vapourised, and once bitten are twice shy—even when it makes sense and deals are aplenty

Michelle Valentine, CEO of Anrok, explains better. Emphasis (bold) mine.

Typically, the funds are distributed from the LPs to the fund in thirds over the course of the fund’s lifetime. So while an endowment might commit $50 million to a fund, they would only wire a fraction of the money to the fund in the first few months. The remaining $33 million is called and wired at intervals over the next few years.

Calling capital only when required allows LPs to maintain control of their capital for longer and continue to earn returns on the capital through short-term investments. In addition, the capital call math conveniently produces a higher internal rate of return for the venture fund.

It wasn’t that long ago when we experienced a liquidity crunch on a mass scale. Let’s look at what happened to capital calls in 2008.

Spoiler alert—the capital was not actually there.

When the market crashed in 2008, so did many investment holdings. The S&P 500 lost more than 50% of its value from the peak. Some investments went to zero.

Remember those LPs who still had two-thirds of their capital obligations to venture firms outstanding and decided to invest in short-term holdings to earn interest in the meantime? Their short-term holdings are now worth a fraction of what they originally expected. They may be forced to sell positions at a loss. In some cases, they simply may not have the capital to commit.

Like venture firms, there is a spectrum of the caliber of LPs. For tier-one venture firms who have built up relationships with LPs over decades, the agreements could be more ironclad. For the 12,000+ new firms that came into existence in the last six years, it is less clear how well-managed and what pressures exist to salvage their investment positions.

As LPs decline capital calls and force the size of funds to effectively reduce, it becomes more obvious that for VCs to meet their investment goals, they will need more capital.

Why is this important to highlight? African VC investors should know better than cross fingers and wait for things to get better. For a continent where micro VCs and angel networks are doing the heavy lifting—with the assistance of the two handfuls of growth-stage firms and private equity firms—recognising early that dry powder is mostly a coping mechanism will spur a more aggressive search for capital.

If you add the worsening outlook across major African markets, African venture capitalists face an uphill battle to prove the continent’s potential to LPs.

If VCs really believe all the glib stories we read on LinkedIn about the continent’s potential, then it is a small price to pay to realise that uncalled dry powder (that is capital that VCs have not yet received from their LP investors) is as good as the powder forgotten on the shore. That is to say useless. Recognizing this means African VCs like everyone else will need to dig deeper for capital—from everywhere, with the usual caveats. Thought-leading is out of fashion (though still relevant if it is data testable, a pressing challenge even today). More rainmakers are needed on deck.

We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Writer, TechCabal.