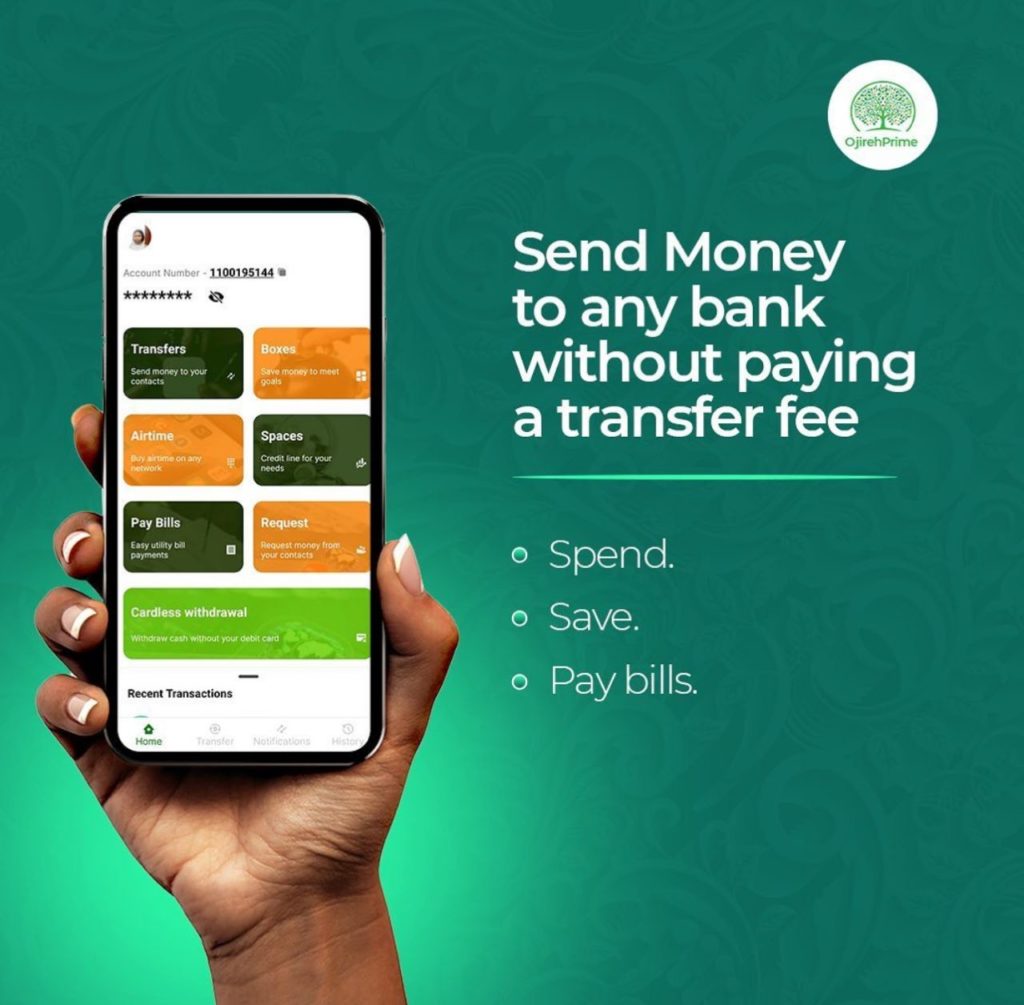

OjirehPrime, a digital bank in Nigeria, is offering customers free transfers, innovative savings and a seamless banking experience with its modern banking products and technology. The company recently launched its new banking feature called Boxes, an innovative way to save for your dreams.

The OjirehPrime story is the quintessential Nigerian story of bootstrapping against all odds and exceeding expectations, all while solving Nigerian banking problems. Founded in 2016, the company began by providing e-commerce services. Over time as they interacted with customers they noticed some common payments and banking problems. Because customers were afraid of becoming victims of card fraud from inefficient banking security, many Nigerians were making payments through bank-to-bank transfers which cost more and posed its own set of risks. OjirehPrime’s pivot into finance was spurred by this desire to solve essential customer banking problems. This foray into fintech began in 2018 with debit cards and wallets that were not connected directly to bank accounts and could be funded separately.

Over time the company has expanded its services to include savings and other digital banking services. As a people-oriented brand, they provide seamless banking services to customers including:

- Free transfers: OjirehPrime doesn’t charge transfer fees to enable customers get better value for their money and also save more without fear of bank charges depleting their money over time.

- Savings: With their new savings technology, “Boxes” customers can download the IOS or Android app and create a savings box, set a goal, name it, and start saving. Think of it as a digital kolo of sorts. You know the feeling of having a square wooden bank when you were younger and you slipped money for December or another special occasion in it? With Boxes, customers get the same feelings and motivation to save without the temptation to break the box.

- Seamless transactions: OjirehPrime provides its customers with the best available digital banking experience, with easy-to-use services and fast transactions. If you had your ear to the ground and were out in the streets recently, you’re aware of and probably suffering through the old-note, new-note naira debacle. If you’ve also paid attention you’ll realize that digital fintech came in handy for their users during this time. Ojirehprime was one such fintech company offering smooth banking services, from e-commerce payments to taxi rides, and restaurant stops, their customers have been buying and paying with zero hitches all year.

- Excellent customer support: This building from the ground up has made them attuned to the people they’re serving. One problem with many traditional banks that the team at OjirehPrime discovered was poor customer support services. Some traditional banking customers have reported harassment from bank security in this season of cash scarcity. OjirehPrime provides ample customer support by keeping itself attuned to its customer’s needs and evolving and scaling organically while solving their banking problems.

OjirehPrime also provides credit cards without charges with free delivery and flexible loans. Savings accounts on the platform are powered by Solid Alliance Microfinance Bank and deposits are insured by the Nigerian deposit insurance corporation (NDIC).

Visit the app store to download the OjirehPrime IOS or Android app, or click here to find out more.