Good morning ☀️

TC Daily has a new look!

Quite a number of things have changed, including the overall layout of the newsletter, language options, content tags and share buttons.

The most exciting change, though, is the referral system. You asked us to incentivise sharing the newsletter and it’s here! Starting today, everyone who signs up with your unique link will bring you one step closer to winning cool gifts.

You can read more about the changes here.

In today’s edition

- Tingo denies all allegations

- Safaricom receives $257 million from IFC

- E-hailing drivers strike in Nigeria

- TC Insights: Fraud risks in Africa’s virtual cards

- The World Wide Web3

- Event: The Moonshot Conference

- Opportunities

Tingo denies all allegations

Days after a report by US investigative firm Hindenburg Research accused it of fraud and misrepresentation, Tingo Group is denying all allegations.

ICYMI: Last Tuesday, the research accused Tingo and its CEO Dozy Mmuobosi of several fraudulent activities including lying about creating Nigeria’s first payments app, falsification of a PhD degree from a Malaysian university, and photoshopping its logo for TingoPay on other POS devices.

Hindenburg also alleged that Tingo’s claim of generating $128 million in revenue in the first quarter of 2023 via its telecoms business is false. Another claim, that its agritech business Tingo DMCC was on track to deliver over $1.34 billion in 9 months, was also reported false.

The company’s share prices dropped by 55% within hours of publication of the story. What’s more, Hindenburg published the report a day before Tingo was set to hold a shareholder meeting.

The aftermath: Last Friday, Tingo responded, denying all allegations made by Hindenburg. The company, in one press release, refuted all the claims, calling them misleading and libellous. In a second statement, it announced that it would undergo independent research with transnational law firm White & Case LLP at the helm of its investigation.

The company also noted that the Hindenburg team made no attempt to verify the claims it made, and that the report was an attempt to “damage its reputation maliciously”, at the expense of shareholders.

While Tingo Group is yet to refute the claims with any hard proof, the group states that it will do so in “due course”.

Moniepoint ranked 2nd fastest-growing African company

Moniepoint is Africa’s second-fastest growing company, as shown in FTs latest report. We also processed 1 billion transactions worth $43 billion in Q1 alone.

Safaricom receives $257 million for Ethiopian expansion

Safaricom’s expansion into Ethiopia is getting a major boost.

Last week, the International Food Court International Finance Corporation (IFC) announced that it would invest Ksh21.8 billion ($156.9 million) in Safaricom, in exchange for 7.25% of the company’s equity. IFC will also loan Safaricom a further Ksh13.9 billion ($100 million).

Safaricom in Ethiopia: In May 2021, Safaricom won a bid to become the first external—and second overall—telecoms company in Ethiopia. Prior to Safaricom, state-owned telecoms Ethio Telecom had a monopoly of Ethiopia’s telecoms market, with 54 million subscribers.

In 2021, Ethio Telecom sold part of a 40% stake to Safaricom for $850 million. By October 2022, Safaricom launched in the country, acquiring 2.8 million subscribers by March 2023.

Seven months later, in April, it announced that it had paid another $150 million to obtain a mobile money licence in Ethiopia. With it, Safaricom will launch M-Pesa to compete with the Telebirr service presently offered by Ethio Telecom.

The company’s launch of M-Pesa partly drives the IFC’s investment. Per Kenyan publication The Standard, Safaricom will use the investment to drive 4G and 5G functionality across rural and urban areas in Ethiopia.

Zoom out: While Safaricom has spent a lot on its expansion into Ethiopia, it has seen significant interest in its business including a Ksh69.5 billion ($500 million) loan which has not been finalised. The company also recently bought M-Pesa Holding Company Limited (MPHCL), the company that manages all M-Pesa deposits, to Safaricom from Vodafone for $1. The acquisition also means Safaricom has €1.2 billion ($1.3 billion) in customer funds, which it could invest in short-term securities.

E-hailing drivers strike in Nigeria

Ride-hailing drivers in Nigeria are bumping fists heads with their companies.

What’s up? Fuel prices are!

In his inaugural speech, Nigeria’s new president, Bola Ahmed Tinubu, announced the removal of fuel subsidies. Subsequently, the cost of fuel skyrocketed to over ₦600 ($1.60) per litre from ₦185 ($0.40)

Days later, logistics companies announced that customers should expect a 20–50% increase in delivery prices. Bolt, for example, increased its base fare from ₦650 ($1.4) to ₦800 ($1.7). Uber increased its from ₦700. ($1.5) to ₦800 ($1.7) while LagRide instituted a 16.6% increase.

It’s not enough: For the drivers, though, these price increases don’t reflect the economic realities on ground. Per the Amalgamated Union of App-Based Transport Workers of Nigeria (AUATWON), if the price of fuel has tripled, so should fares.

Last week, the association asked all ride-hailing companies to institute a 200% increase with ₦2,000 ($4.3) as the new base fare, a position which corporations like Uber and Bolt, in rejecting the notion, said would reduce demand for their services and cost the drivers even more.

The drivers , last week, embarked on a nationwide strike until the fares are increased. Alongside the 200% increase in base fares, the drivers also asked for Bolt to reduce its commission fees from 20% to 10%.

While it looks like the corporations will not budge on the situation, Bolt, on Friday, offered its drivers an incentive—a ₦6,000 daily bonus if they complete 7–9 trips, accept 90% of orders, and work at least seven hours per day.

The drivers, who are unimpressed with the offer, responded, asking Bolt to instead organise a roundtable with the drivers—or their reps—and hear their terms. This week, though, the drivers returned to work despite their needs being unmet.

Fraud risks in Africa’s virtual cards

According to the Global Findex Database, the average financial inclusion rate in Africa grew from 63% in 2020 to 68% in 2022, experiencing a transformative shift and breaking away from its reliance on traditional banking services.

Yet, Africa has one of the lowest debit and credit card penetration rates in the world. Only a small percentage of Africans have access to these financial tools. For instance, only 10% of Zambia’s adult population uses banking cards. However, fintech-provided virtual cards is serving as a lifeline for many African individuals and businesses, replacing the use of local bank alternatives for international payments. This was due to a number of factors, including the penetration of mobile devices, rise of e-commerce, growing popularity of online travel agencies, and the increasing availability of virtual cards from fintech providers.

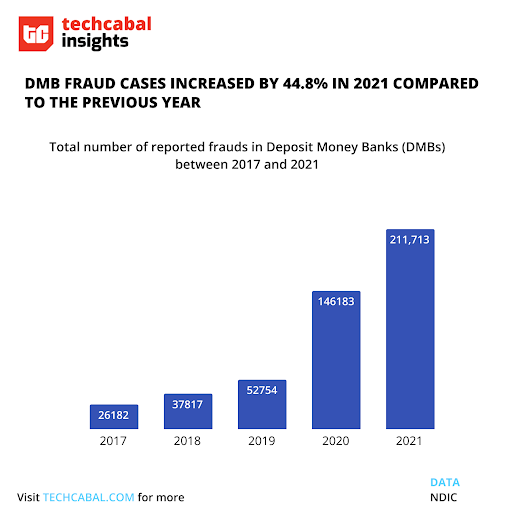

However, as the adoption of digital transactions grows, so does the concern for security and the rising threat of fraud. While virtual credit cards offer convenience and flexibility, they are vulnerable to cyberattacks, leading to potential risks related with data breaches and financial losses, according to a report by the International Monetary Fund. For instance, between 2020 and 2021, fraudulent activity recorded by deposit banks rose to 211,713—a 44.8% jump.

Last year, Union54, a fintech startup whose APIs allow other companies to issue physical and virtual debit cards, experienced an increase in chargeback fraud, according to a report by TechCrunch. The bank reported a rise in fraud cases originating from its Bank Issuing Number (BIN), as fraudsters used their cards for transactions without the knowledge of the original cardholders. In 2022, this surge in chargeback fraud led African fintech companies like Eversend, Busha, GetEquity, and Payday, which rely on Union54’s service, to halt the issuance of virtual cards.

Lanre Ogungbe, the co-founder of IdentityPass, a Nigerian digital compliance and security company, believes this calls for better Know Your Customer (KYC)/Anti-Money Laundering (AML) compliance checks in the card-issuing space. “KYC is not the A-Z of security checks, but what it does is trace and backtrack a fraudulent transaction. Many fintechs in Africa should prioritise compliance and security on their virtual card offerings over aesthetics,” he said.

Despite the transformative shift in financial inclusion in Africa driven by the emergence of digital services and the demand for diverse payment options, the rising adoption of virtual credit cards is accompanied by a dark side.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $25,913 |

– 0.82% |

– 3.25% |

|

| $1,738 |

– 1.80% |

– 3.80% |

|

|

$230 |

– 3.42% |

– 26.29% |

|

| $15.14 |

– 4.71% |

– 27.21% |

* Data as of 22:30 PM WAT, June 12, 2023.

Binance is having a hard time globally. Days after the US Securities and Exchange Commission (SEC) sued the platform for offering unregistered securities to the public, Nigeria’s Securities and Exchange Commission, on Friday, declared the platform illegal.

Per the SEC, Binance Ltd. is neither registered nor regulated by the SEC. It warned the Nigerian public against investing on the platform, and ordered Binance to stop operations in the country immediately.

The Moonshot Conference

This is Moonshot by TechCabal.

Moonshot is a conference that will bring together Africa’s tech ecosystem to network, collaborate, share insights and celebrate innovation on the continent.

Click here to join the waiting list to get more news and updates about this conference.

- The SaaS Accelerator Programme: Africa 2023 has opened applications for its accelerator programme to enable early startups in Africa to receive funding. Selected startups will receive up to $70,000 in funding. Apply by September 7.

- Wise Guys SaaS Accelerator Program is looking to help SaaS startups level up through tailored guidance and support from world-class mentors and experts. Apply before September 7.

- The AAAS Kavli Science Journalism Awards 2023 ($5,000 prize) is now open to applications from reporters doing work for independent news organisations around the world, with articles readily accessible to the public by subscription, newsstand sales or online access, with the submitted work available in English are eligible to Apply by August 1.

- Applications are open for the US $100,000 Africa Food Prize. Applicants must contribute to reducing poverty and hunger, or improving food and nutrition security in measurable terms. They must also make a contribution to providing a vital source of income or employment in measurable terms. Apply by June 17.

What else is happening in tech?

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Weekender: weekly roundup of the most important tech news out of Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 12 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.