Good morning ☀️

As Twitter continues its rate-limiting measures, thousands of users are flying their way into the blue sky.

No, literally. Users have been flocking to Jack Dorsey’s new social media app, Bluesky, since Elon Musk announced Twitter’s new update. In fact, Bluesky—which you can only join by invitation from existing users—had to halt registrations for a while just to keep up with the kerfuffle.

Zambian fintech, Union54, rebounds with a superapp

Zambian startup, Union54, is making a comeback and building its payments service into a chat platform.

ICYMI: In July 2022, Union54 halted its services after it experienced a $1.2 billion chargeback fraud. The move saw many African startups like Flutterwave and Eversend that previously used its card-issuing services rush to find alternatives.

Now, in collaboration with global payment technology company Mastercard, Union54 is creating a super app called ChitChat.

What’s a superapp? A super app is a mobile application that combines multiple services and functionalities into a single platform, providing users with a wide range of features and capabilities.

ChitChat’s functions: The app will enable users across Africa to send messages over an encrypted platform due to Mastercard’s encryption technology. In addition, ChitChat serves as a social commerce platform, allowing users to transfer money to one another, use a dollar debit card, and make purchases from digital storefronts directly within the app.

Furthermore, ChitChat, through its partnership with Mastercard, will introduce card and payment features. These features will initially be launched in a pre-release version starting in Angola, Tanzania, and Ghana. However, the plan is to expand to additional markets throughout the year.

You’ll be in good company

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools.

Click here to open a business account today.

Nigeria’s ride-hailing union persists in pursuit of recognition

The Amalgamated Union of App-Based Transport Workers of Nigeria (AUATWON), is seeking official union registration, but ride-hailing platforms like Bolt and Uber are not having it.

The reason for the dispute: The ride-hailing companies are objecting to the union’s name and its classification of drivers as “workers” for the platforms. The companies assert that drivers on their platforms are independent contractors, not employees.

In December 2018, some drivers filed a suit seeking clarification on their employment status as workers or independent contractors.

Why the distinction is important: If the drivers are recognised as workers, ride-hailing companies may become responsible for obligations such as providing health insurance, leave allowances, stipulations for time off, and more.

Registrar of trade unions, Falonipe Amos, held a closed-door meeting on June 26 with the drivers and Uber and Bolt representatives, to discuss objections raised by the drivers aiming to progress their application. During the meeting, the drivers disputed the objections from Bolt and Uber, claiming that their chosen names were strategically selected to represent their own interests.

Zoom out: Ride-hailing drivers insist on having a voice in decision-making, particularly regarding issues such as company commissions and transparent guidelines for driver deactivation from the platforms.

Ethiopia offers a new telecoms licence

Who wants a piece of Ethiopia?

Ethiopia has kicked off the bidding process for a new telecommunications licence. This move not only brings in a breath of fresh air but also paves the way for intensified competition in Ethiopia’s telecom sector. It’s also another significant step forward as the nation continues to break free from the shackles of monopoly, in hopes of boosting its economy.

What monopoly? Well, until last year, Ethiopia’s only telecom service, Ethio Telecom, was controlled by the government. The government opened it partially to private ownership last year, selling 40% of the capital of the telecom in November and 45% in February. It also sold a telecom licence to Kenyan telecom, Safaricom last year, and soon after the operator launched its mobile network in the country in October. Now Ethiopia is about to sell another licence to another private operator to spice up the competition.

Who will be interested? Ethiopia’s large population of about 120 million is every telecom’s dream. Months after launching in Ethiopia, Safaricom has reportedly gained 2.1 million customers, with a goal of reaching 10 million next year. The telecom recently received a payment licence to launch its mobile money offering M-Pesa in Ethiopia, making it the only competitor against the state-owned mobile money provider, Telebirr.

With such an opportunity and fierce competition brewing in this telecom wonderland, who wouldn’t want to be a part of the action?

GrowthCon 1.0: Learn how to unlock 10X Growth

Connect with growth leaders, operators, and enablers to explore proven tactics for driving sustained business growth in Africa at GrowthCon 1.0. Experience curated masterclasses, case studies, a growth hackathon and more.

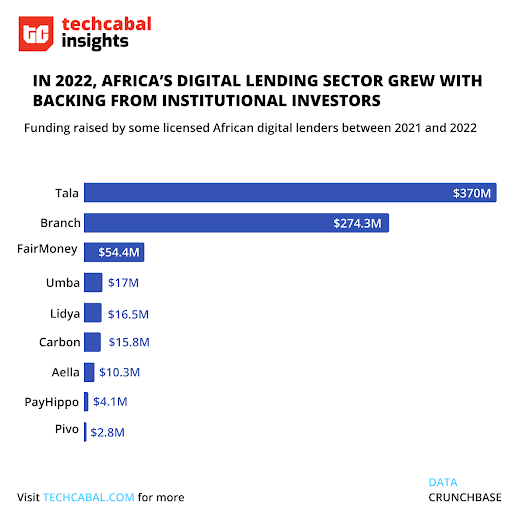

Regulating African digital lenders

With a fast-growing digital finance consumer market in Africa, digital lending offers alternative funding options to Africans with flexibility and speed. This sector has also attracted large sums of investment to become a key growth driver in revolutionising the continent’s overall consumer credit market. According to surveys by the Commonwealth Chamber of Commerce, 40% of Africans prefer online financial platforms, contextualising the 102% increase in online alternative financing from $104 million in 2017 to $563.8 million in 2022.

By deploying credit-worthiness models based on borrowers’ data, digital lending startups have become attractive to small businesses and individuals looking for quick loans. These startups have grown with strong investors’ backing.

There is not enough legislation on the regulatory framework for companies offering digital lending services in most African countries. Kenya and Nigeria are two of the most prominent African markets for digital lending, where most loan apps belong to unregistered and unlicensed tech companies, making users susceptible to privacy abuse.

Efforts to crack down on the illegal operations of unlicensed digital lenders have not brought the desired outcomes. But Nigeria’s regulator had fully or conditionally authorised the operations of 106 digital lenders as of January 2023. Also, the Central Bank of Kenya (CBK) has approved only 22 in its country, while nearly 300 startups await the apex bank’s approval.

Babatunde Akin-Moses, co-founder and CEO of Sycamore, a peer-to-peer lending platform, says, while the regulation of Africa’s digital lending sector is experiencing a state of awakening, the sector is currently receiving attention. “Thanks to a wave of alleged consumer complaint claims in the form of abusive follow-up messages to borrowers who default on loans. This is a big part of what has led to the recently increased oversight by regulators, but there is also the slow pace and high cost of regulatory compliance.”

He however believes there are several products and services that the digital lending market needs that the licensed entities are not able to deliver based on regulatory constraints. “When you have such unmet demand in a big market, some will likely step in to plug this gap in ways that may blur the lines between being fully regulated or otherwise,” Akin-Moses said.

Meanwhile, the app marketplaces like Google PlayStore and Apple AppStore wield significant powers with their market share to impose regulatory standards on African digital lenders and remove unlicensed apps. For instance, Google PlayStore is the biggest platform for discovering digital services in Africa. And since January 31, 2023, Google has strengthened its screening process to mandate digital lenders to obtain approval from local regulators.

While it is necessary to tackle the illegal operations of digital credit providers, an attempt to create excessively stringent laws will not only stifle the market but also limit the funding to small businesses and individual consumers in a tough economic environment. Regulators and digital lenders must work together to accelerate the transformation of Africa’s financial lending markets towards equitable and fair digital lending.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $31,071 |

+ 1.08% |

+ 14.74% |

|

| $1,953 |

+ 0.14% |

+ 3.11% |

|

|

$245 |

– 0.86% |

– 19.75% |

|

| $19.18 |

– 1.65% |

– 9.89% |

* Data as of 05:55 AM WAT, July 4, 2023.

Event: The DBN Techpreneur Summit

Join Olu Akanmu, president and co-CEO of Opay, and other distinguished speakers today at the highly anticipated DBN Techpreneurs Summit. This event is a gathering of technopreneurs, industry experts, and government officials focused on crucial topics like accessing debt finance, uncovering valuable mentorship opportunities for MSMEs, and addressing growth obstacles to foster innovation and sustainable partnerships.

If you are a startup founder or executive, this is an event you simply can’t afford to miss! Register to get your special invite.

- The AAAS Kavli Science Journalism Awards 2023 ($5,000 prize) is now open to applications from reporters doing work for independent news organisations around the world, with articles readily accessible to the public by subscription, newsstand sales or online access, with the submitted work available in English are eligible to Apply by August 1.

- If you are a young (no older than 24 years of age) and emerging photographer looking to embark on a career in the world of photojournalism, the Ian Parry Photojournalism Grant 2023 (up to £10,000) is open for Applications. Apply by August 31.

- Applications are open for the L’Oreal-UNESCO Young Talents for Women in Science Program – Maghreb 2023. Awarded doctoral and post-doctoral candidates will each receive an endowment of €10,000. Apply by July 30.

- Applications are open for the Sir Harry Evans Global Fellowship 2024 for Early-career Journalists (Stipends available). The fellowship has a monthly salary of £4,444, a £1,250 per month living stipend, and a one-off payment of £1,800 for travel and related expenses. Apply by July 10.

What else is happening in tech?

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Weekender: weekly roundup of the most important tech news out of Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 12 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.