Happy Friday!

…and cheers to the weekend.

This week flew by really quickly, didn’t it? Well, it must have for the 12 African startups that were selected to head to Silicon Valley, California to complete the second phase of the Microsoft-backed FAST accelerator program.

Their in-person training where they will learn how to use AI to scale their businesses starts tomorrow. You can find out which startups are participating here.

In today’s edition

- No one is buying NFTs anymore

- East Africa records 51 private equity exits in a decade

- How will Francis Dufay rescue Jumia?

- Vodacom and Maziv $698 million deal gets a date in court

- Funding tracker

- The World Wide Web3

- Event: Moonshot Conference

- Opportunities

Most NFT collections now have a value of zero Ethereum

NFTs are now almost worthless.

NFTs, once admired as darlings, are now out of favour.

According to an analysis conducted by crypto gambling website DappGambl, 95% of NFT collections are now almost worthless. The gambling platform reviewed about 69,795 NFT collections and found that they had a market capitalisation of zero Ethereum.

While some NFTs still hold their value, only 21% of the collections studied by DappGambl had 100% ownership. Findings from the analysis also estimate that less than 1% of NFTs are worth $6,000 or more.

Why the drop in value? Due to the crypto downturn in 2022, values of most NFTs nosedived leaving most investors in red. Investors who had previously bought digital collectables at high values couldn’t sell at a loss. However, DappGambl said that NFT projects that lacked clear use cases, compelling narratives, or genuine artistic value didn’t attract attention and sales.

Sidebar: Shortly after one year that YouTuber, Logan Paul purchased the Bumblebee NFT for $623,000, the NFTs are now worth a meagre $10.

Zoom out: NFTs introduced the world to a new world of owning and monetising digital assets, however, the latest findings by DappGambl remind the world of the volatility of the NFT market.

Get a working card from Moniepoint

With the Moniepoint personal banking app, you get reliable payments every time and a card that always works. Enjoy seamless payments powered by the infrastructure that 1.5 million businesses trust. Download the app.

East Africa records 51 private equity exits in a decade

East Africa’s private equity market has experienced significant growth in recent years.

How so? Per the East Africa Venture Capital Association (EAVCA), a total of 478 deals worth $8.6 billion closed over the past decade. The region also recorded a jump in exit activity in FY 2022, marking the highest numbers in a decade. Furthermore, there have been 51 private equity exits out of 427 investments in the region. The financial services sector recorded 14 exits, while the healthcare and energy sectors had nine and seven exits, respectively. Among the countries, Kenya led with 36 exits, followed by Uganda with eight, and Rwanda with three. Tanzania and Ethiopia reported two and one exit, respectively.

However, these figures may not capture all exits, as some are not officially reported or disclosed. The data also doesn’t account for investments exited via forced liquidation. Looking ahead, it’s expected that 2023 will have even more exits, and these are important for fund managers who want more money from organisations that support development (development finance institutions).

Zoom out: Private equity investors mainly exit through three avenues: selling to trade players, secondary buyouts, and management buyouts (MBOs). The surge in exits is a promising sign for the coming five years as investments made in the past seven years reach maturity, and fund cycles conclude.

Francis Dufay’s urgent plans to rescue Jumia

Since Jumia set up shop on the continent, it has not been profitable. According to the company’s most recent earnings report, it lost $167 for every $100 it earned. In the first half of 2023, it earned $94.8 million but lost $63.7 million. The e-commerce platform has also lost nearly a third of its shoppers.

A fall from grace? Launched in 2012, Jumia started operations from Nigeria and has launched into 10 other countries on the continent. Jumia suffered a decline in growth from its single biggest market — Nigeria — after the country’s unstable currency exchange system affected Jumia and other businesses alike. Jumia’s woes were not only in Nigeria; across all of Jumia’s markets the average inflation rate is 14%, and currency depreciation in nine of its ten markets shows the difficulty of its goal of moving towards profitability.

A long journey to profitability Jumia recently turned its focus to rural markets in Nigeria in a bid to ensure profitability. Over the years, Jumia has consistently splurged on marketing and advertising costs as it continues to position itself in the African market. However, in a move to ensure profitability the company cut down its advertising spend by 40% early this year.

Since Francis Dufay took the helm at Jumia, he has implemented painful cuts across the company, including laying off 900 (20%) of employees. Also, 60% of Jumia’s top management team who work from the UAE were mandated to work from the continent to save costs. Dufay also earns less than previous CEOs. Dufay’s implementation Jumia’s operating losses are down 60% this year, especially advertising spend, which declined 71.7%, compared to 2022.

Zoom out: While Dufay’s reforms of cutting costs are yielding results, the company still has a chance in the industry because e-commerce isn’t going anywhere, and Jumia is already positioned as a leader in the space.

Vodacom and Maziv $698 million deal gets a date in court

South Africa’s Competition Tribunal has scheduled May 20, 2024, as the date for the final hearing regarding a proposed transaction between Vodacom and Vumatel’s parent company, Maziv.

What transaction? The Vodacom and Maziv deal was first announced in December 2021. Under the terms of the deal, Vodacom would acquire a 30% stake in Maziv in exchange for a substantial investment that includes over R9 billion ($476,050,681) in cash and fibre assets valued at R4.2 billion ($222,261,732). The Independent Communications Authority of South Africa (ICASA) gave its conditional approval in November 2022. However, in August 2023, the Competition Commission recommended that the Competition Tribunal block the transaction, raising concerns that the deal would reduce competition in the fibre market and lead to higher prices and less innovation.

Less than a week later, Vodacom expressed its disappointment with the regulator’s decision to block the acquisition and revealed its plan to appeal the rejection.

What’s next? Applications from parties wishing to intervene must be filed by October 2nd. Following this, the Tribunal will hold hearings on November 10 to assess any further concerns or objections related to the transaction and by May 20, 2024, the Competition Tribunal will hold the final hearing for the deal.

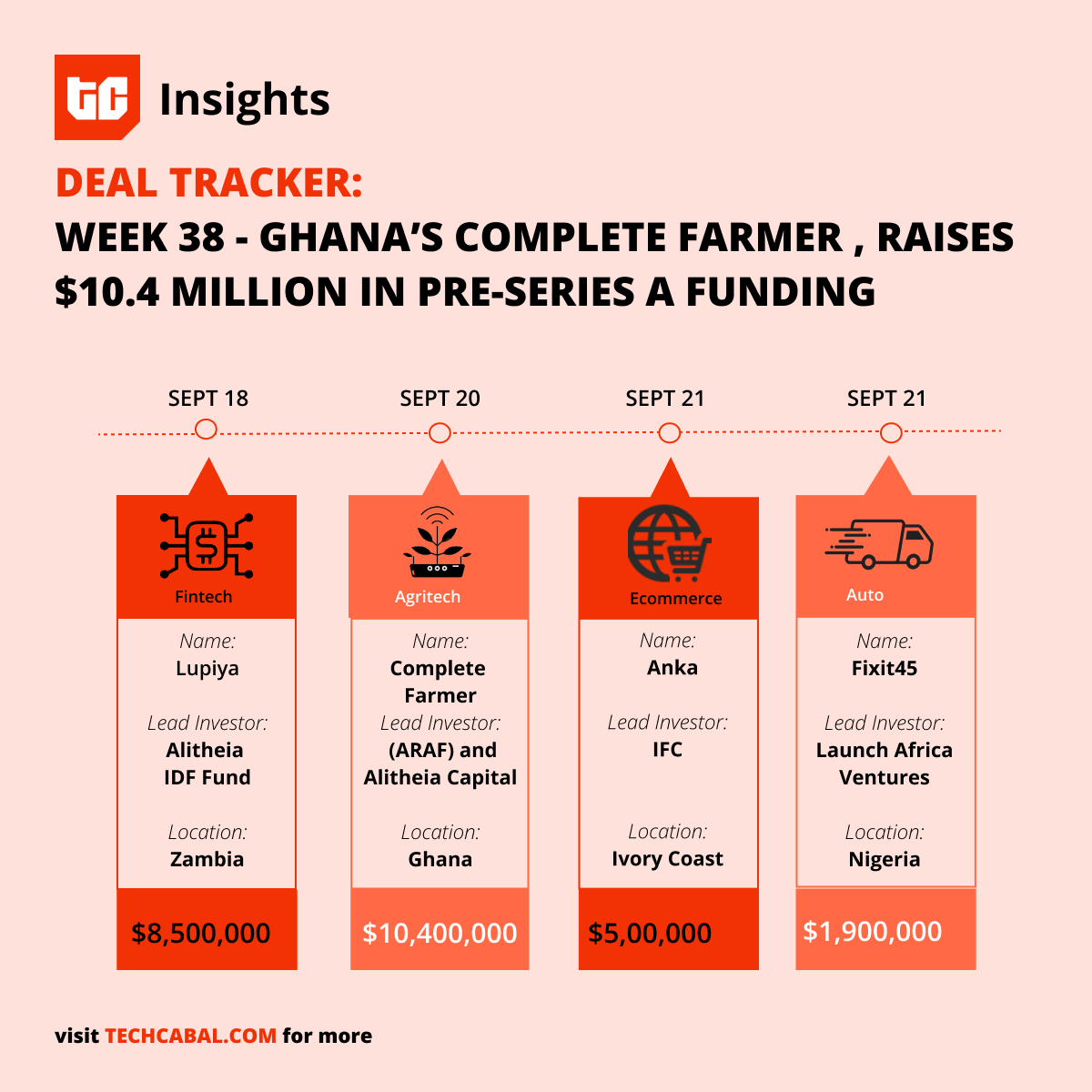

Funding tracker

This week, Ghanaian agritech startup Complete Farmer announced a $10.4 million pre-Series A funding round — $7m in equity and $3.4m in debt — to streamline its operations.

The Acumen Resilient Agriculture Fund (ARAF) and Alitheia Capital co-led the equity part of the round with Proparco, Newton Partners, and VestedWorld Rising Star Fund also participating.

Sahel Capital’s SEFAA (Social Enterprise Fund for Agriculture in Africa) Fund, Alpha Mundi Group’s Alpha Jiri Investment Fund and Global Social Impact Investments offered debt financing.

Here are other deals for the week:

- Ivorian e-commerce platform ANKA raised $5 million in an extension funding round led by a $3.4 million investment from the International Finance Corporation (IFC).

- Fixit45, a Nigerian startup that provides automotive spare parts, vehicle repairs, and maintenance services, secured $1.9 million in a pre-seed funding round led by Launch Africa Ventures.

- Lupiya, a neobank based in Zambia, raised $8.25 million in Series A funding. The funding round was led by Alitheia IDF Fund, with support from INOKS Capital SA and the German Investment Bank KfW DEG.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $26,569 |

– 2.00% |

+ 1.63% |

|

| $1,585 |

– 2.40% |

– 5.00% |

|

|

$210 |

– 1.79% |

+ 0.19% |

|

| $0.2459 |

– 2.25% |

– 6.74% |

* Data as of 12:01 AM WAT, September 22, 2023.

Events

The Moonshot Conference

Tickets are still selling out fast for the gathering of the most audacious players in Africa’s tech ecosystem.

You and your friends can get an exclusive discount to secure your seats if you haven’t yet.

- Datafin Recruitment – Digital Marketing Manager– Cape Town, South Africa (On-site)

- Wasoko – Senior Product Manager – Nairobi, Kenya (unspecified)

- uLesson – Digital Marketing Manager – Abuja, Nigeriqa (Unspecified)

- Consensys- Technical Writer – South Africa (Remote)

- Tushop – Senior Backend Engineer – Nairobi, Kenya (On-site)

- SUMMIT Africa Recruitment –Product Manager – Cape Town, South Africa (Hybrid)

What else we are reading