TGIF ☀️

The Utiva Scholarship is still up for grabs, but it expires today! Don’t miss this chance to win a full tuition scholarship to any Utiva programme of your choice.

To enter, simply share your story with a photo of you from Moonshot on social media, tag Utiva, and use the hashtags #UtivaScholarship and #MoonshotbyTechcabal.

So what are you waiting for? Share your story!

Patricia denies having physical offices in Nigeria

If you’ve been online this week, then you’ve probably seen a TikTok where a concerned customer allegedly visits crypto startup Patricia’s office to find it empty.

If you did, we’ve got news: Patricia says it doesn’t have physical offices in Nigeria. Yesterday, CEO Hanu Fejiro confirmed to TechCabal that the startup is fully remote. “The office in the video is an innovation hub set up (we announced in 2022), to offer free working spaces to Devs and Crypto enthusiasts, Patricia does not actively operate from that office,” he said.

Fejiro also noted that the startup moved its headquarters to Lithuania in 2021 after Nigeria’s apex bank banned the country’s financial institutions from trading crypto.

A new offer for customers: The CEO also confirmed that users with assets on the platform can now exchange their assets for shares. The offer was reported by TechPoint Africa earlier this week.

In an email to TechCabal, the CEO revealed that the offer was initially proposed by numerous users. For users who agree, the shares will reportedly be managed by an SEC-licensed third-party trustee.

The big picture: Patricia may find that its offer is a hard one to swallow for several users who have had their funds stuck on the platform since April 2023. So far, little has assuaged users doubts, especially not a unilateral conversion of user funds into the Patricia token. The startup, earlier this month, announced to frustrated users that it’s raising funds that will allow it relaunch its app and repay customers.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

Kippa exits the agency banking business

Kippa is shifting its focus to its core product.

The Nigerian fintech, which provides bookkeeping and finance management tools for small businesses, is discontinuing its agency banking business, KippaPay. The startup also plans to lay off 40 employees associated with the product.

In an official announcement, the company declared that KippaPay would be discontinued starting November 15. Sources also claim layoff notices have been sent out to affected staff, with their final day set for November 30.

What went wrong? In September 2022,Kippa secured a super agent banking licence and then launched KippaPay. The startup’s late entry into the agency banking market was a disadvantage considering market leaders like TeamApt—now MoniePoint—and OPay both had headstarts in 2018. Also, the Nigerian economy was already struggling, making Kippa’s target customers price-sensitive. The devaluation of the naira made matters worse, increasing the cost of acquiring and maintaining POS terminals. This compounded Kippa’s difficulties as it competed with well-established players in the field.

However, the company says the decision to discontinue KippaPay is part of a strategic effort to streamline its product offerings and focus on the most financially viable and successful aspects of its business.

Zoom out: A source familiar with the company suggests that in the coming months, Kippa is also considering the possible discontinuation of Kippa Start, its business registration service that allows customers to register their small businesses online for ₦20,000 ($26).This would leave the company focusing on its core bookkeeping app, which has been popular among small business owners and reportedly has over 500,000 users.

Paystack is live in Kenya

After 10 months in private beta, Paystack announced that all business in Kenya could now accept payments with our growth tools. Learn more →

World Bank suggest changes to Kenya’s data protection laws

The World Bank is flexing Kenya’s data protection laws.

This week, the international financial organisation suggested changes to the Kenyan Data Protection Act of 2019, advising the Kenyan government against the localisation of data.

What changes? The global lender has asked Kenya to revoke a law that forces companies to store sensitive personal data on servers located within the country. The World Bank says the law is limiting cross-border trade in digital services.

It’s asking Kenya to upgrade its current Data Protection Act and adopt compatible and interoperable standards. It also adviced the scrapping of data localisation requirement for the Kenya’s Health Information System Policy.

The big picture: The World Bank’s report proposes a flexible and standardised data sharing system for Eastern Africa, including countries outside the East African Community (EAC). The goal is to create a unified data market in the region by facilitating the integration of data processing and storage requirements. These suggestions from the global lender, however, are questionable in a time when other regions across the world are clamouring for localised data centres to protect the interest of their citizens. Should we be asking Kenya to review laws that many other regions, including the EU, are now enacting?

Vodacom fined $52,666 for unfair contract cancellation fees

Vodacom has been caught in the act.

The South African mobile network operator has been slapped with a R1 million ($52,666) administrative fine by the National Consumer Tribunal.

Why? Vodacom was found guilty of violating sections of the Consumer Protection Act (CPA) by imposing hefty contract cancellation penalty fees.

Between 2020 and 2022, Vodacom imposed a cancellation penalty of 75% of the remaining balance of clients’ fixed-term contracts on clients that cancelled their contracts early. This effectively denied clients the right to cancel their fixed-term contracts. The Consumer Protection Act in South Africa allows mobile network subscribers to cancel fixed-term contracts before their original expiry dates. To do so, subscribers must provide 20 business days’ notice to the network operator, and a “reasonable” cancellation fee may be charged.

Upon customer complaints, the National Consumer Commission (NCC) acted swiftly and determined that Vodacom’s conduct was “unethical” as it imposed terms and conditions that negated consumers’ right to cancel their contracts.

So what’s next? The acting commissioner at the NCC, Thezi Mabuza, confirmed that Vodacom had agreed to reimburse some consumers who had cancelled their contracts. However, she emphasised that this wouldn’t absolve Vodacom of its contravention of the Consumer Protection Act. Vodacom is currently reviewing the NCC’s decision and is yet to provide a formal response.

Beem is live in Kenya

Beem has officially launched/expanded to Kenya. Introducing their flagship product Moja. Learn more here

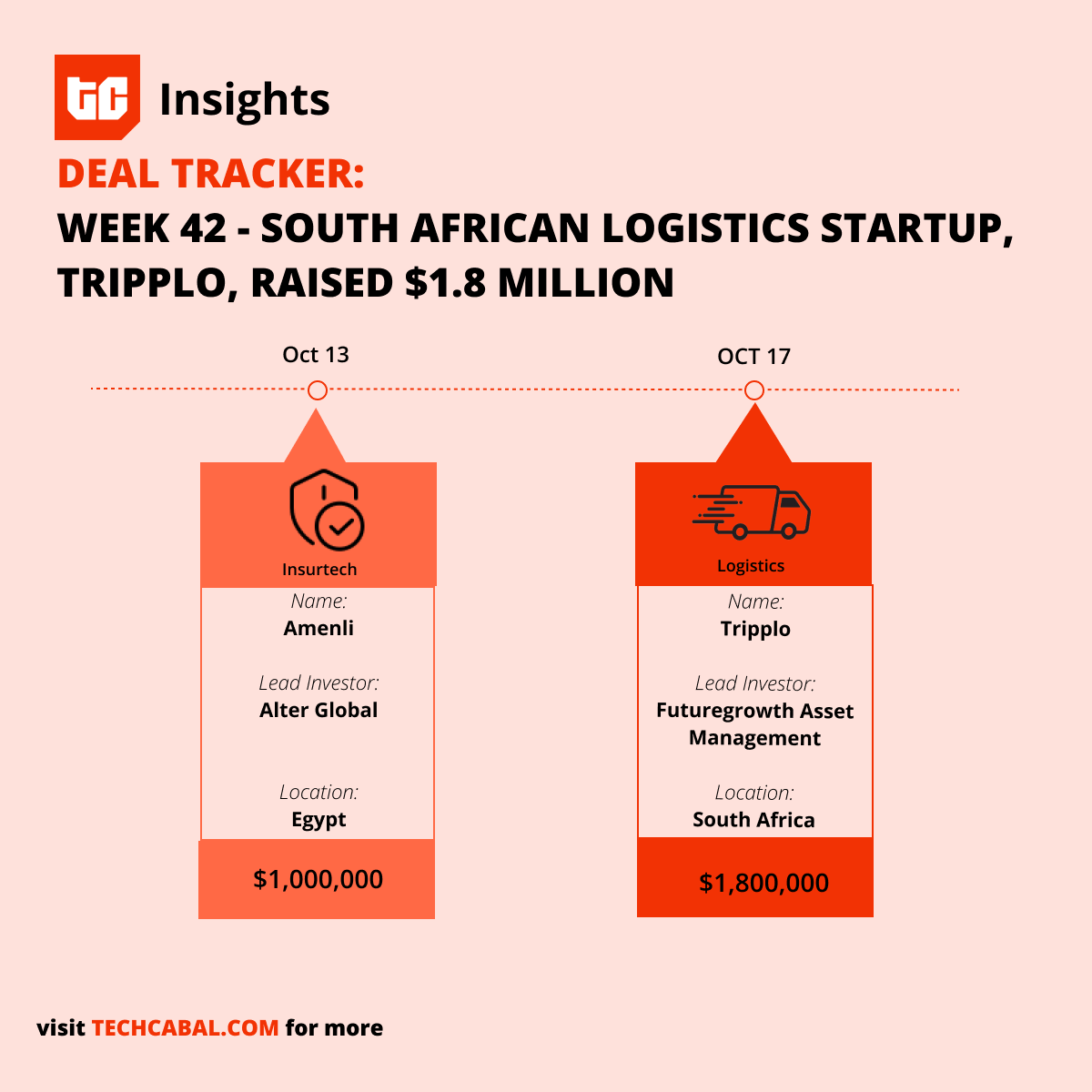

Funding tracker

This week, Outsized, a leading talent-on-demand platform, closed an undisclosed amount in Series A funding round led by Knife Capital. Other participating investors include Adrian Durham, founder of the global wealth management platform FNZ Group.

Here are other deals for the week:

- South African logistics startup Tripplo, raised $1.8m in funding in a round led by Futuregrowth Asset Management (via Old Mutual Life Assurance Company South Africa). Other investors include including Galloprovincialis, Founders Factory Africa, Digital Africa Ventures, and Standard Bank of South Africa.

- Amenli, an Egyptian insurtech startup, secured an equity funding round of $1 million from Alter Global, an international venture capital firm.

That’s it for this week!

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. You can also visit DealFlow, our real-time funding tracker.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $28,606 |

+ 3.49% |

+ 8.20% |

|

| $1,583 |

+ 2.04% |

– 3.23% |

|

|

$0.20 |

+ 1.32% |

– 10.08% |

|

| $0.51 |

+ 7.26% |

– 0.57% |

* Data as of 06:10 AM WAT, October 20, 2023.

Elevate your business with One Liquidity’s seamless integration. Choose from 10+ services to craft a custom solution. Join Obiex, Wewire, and others in providing trading, liquidity and compliance services. Start now with zero fees. One Integration. One Solution. One Liquidity.

- Moniepoint – Growth Data Analyst – Lagos, Nigeria

- Tech Genius – Business Development Manager – Lagos, Nigeria (On-site)

- Crossover – Software Engineer – Lagos, Nigeria (remote)

- Branch International – Software Engineering Intern – Nigeria (Remote)

- Palladium Group – Backend Developer – Abuja, Nigeria

What else is happening in tech?

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.