TGIF ☀️

Inflation is eating everything up—especially everyone’s competitive salaries. In Nigeria, inflation is at 24% and in Ghana, it’s at a whopping 40%. The prices of everyday items are rising faster than anyone can keep up with.

Can fintech solutions help?

Join us today at 11 AM (WAT) for a discussion with Timi Odueso, senior editor at TechCabal, and fintech experts Seçkin Çağlın, Emre Ertan, Peter Onu and Yasmine Mohamed Henna on how to use technology to protect your money from inflation and build a secure financial future.

Patricia’s trustee withdraws interest

Patricia is planning to refund customers’ funds even with its escrow trustee, DLM Trust, is backing out.

The crypto firm had earlier partnered with DLM Trust to disburse $2 million in customer funds that it lost to a hack.DLM, however, backed out of the deal, citing “multiple breaches in the terms and conditions of agreement and trust.” A source close to the situation attributes the DLM Trust withdrawal to the recent media backlash. The withdrawal announcement was made barely 24 hours after Patricia announced the partnership.

A blindsided withdrawal: Per Patricia, DLM Trust’s withdrawal was not previously communicated to the crypto firm. Patricia told TechCabal that it observed all due processes, including fulfilling its financial commitments to consummate the contractual agreement.

Zoom out: It remains to be seen whether Patricia is on the lookout for a new escrow trustee. The firm now has a much bigger task in convincing its customers that they would get their funds back.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

Ugandan traders threaten to sue government over Facebook closure

Uganda’s Facebook shutdown is threatening its SMEs.

And now, a group of traders are threatening to sue the Uganda Communications Commission (UCC) if it does not reopen Facebook within two weeks.

Why? The notice states that the traders have lost approximately 3,874,000 clients who were active Facebook subscribers in Uganda at the time of the closure, along with 2.9 billion potential clients in the global market.

Per Luyimbazi Nalukoola, the lawyer representing the traders, the continued closure of Facebook has resulted in significant financial losses for its members, estimated at around UGX 66 billion ($17.5 million), it also extends to their supply chain, affecting 650 boda bodas, 88 lorries and pickups, and 180 taxis.

ICYMI: Facebook shutdown a network of accounts linked to Uganda’s information ministry in January 2021, accusing them of “coordinated inauthentic behavior” in the public debate ahead of the country’s 2021 presidential election. The Ugandan government responded by shutting down all social media sites and blocked access to the internet on January 13, 2021, one day before the presidential elections. However, it restored access to the internet and other social media platforms on January 18, 2021, but Facebook remained blocked.

Ugandans now use VPNs to access Facebook, while many have stopped using the platform altogether.

The big picture: Social commerce in Africa and the Middle East is projected to reach $41.9 billion by 2028, and already, 67% of traders across many African countries are using social media for their businesses. Platforms like Facebook help traders sell more, so it’s understandable why these Ugandan traders are ready to fight. But will the Museveni-led governement—which has often been accused of using oppressive means to stifle opposition—settle this amicable?

The evolution of agency banking in Africa

In this longform Decode Fintech piece, Paystack explores agent networks in Africa, how they converge with SMEs, and what the future of agency banking means for how money moves across the continent.

Botswana to leverage technology to boost diamond industry

Botswana is betting on tech to advance its diamond industry.

The country’s president, Mokgweetsi Masisi, at the ongoing FACETS Conference in Botswana emphasised the need for diamond-producing nations like Botswana to incorporate technology into the sector to foster sustainability.

A silver diamond bullet: Masisi said the use of innovations such as drone-assisted surveying to advanced water management systems could help preserve the world for generations to come. The President also said the use of blockchain technology for diamond tracing could could make the diamond supply chain more transparent.

Zoom out: President Masisi’s speech shows the country’s vision in scaling its Diamond’s industry. Botswana is the world’s largest diamond producer by value—it produces over 25% of the world’s diamonds by value—and its diamond industry accounts for over 30% of its GDP. The government in March 2023 bought a 24% Stake in HB Antwerp, a diamond cutting and technology company based in Antwerp, Belgium. The company houses some of the finest diamond processing technology including an automated diamond polishing robot, a blockchain-based diamond tracker, and a stereo microscope for diamond observation.

UK Online Safety Bill becomes law

Tech firms in the UK will have to take more responsibility for the content on their platform.

In the UK, the government has passed an Online Safety Bill that places immense responsibility on tech giants to ensure children’s safety in the digital world.

What does the Act say? Social media platforms must now take proactive measures to prevent illegal and harmful content, including content promoting self-harm, terrorism, and revenge pornography, from appearing on their sites.

They must also ensure that age limits are enforced and that children are protected from accessing harmful and age-inappropriate content. Furthermore, they must be more transparent about the risks and dangers posed to children on their sites and provide parents and children with clear and accessible ways to report problems online when they do arise.

The Act also creates new offenses, like addressing cyber-flashing and “deepfake” pornography, which utilises AI technology.

Companies that fail to adhere to these regulations would face fines of up to £18 million ($21.7 million) or 10% of their annual global earnings, potentially amounting to billions of pounds for major corporations. In severe instances, tech leaders may face jail time.

There are concerns: Messaging platforms like WhatsApp are threatening to exit the UK over the act’s controversial requirements. They argue that this new legislation means doing away with end to end encryption, as the new law would require WhatsApp to hand over the contents of encrypted material if it is suspected to contain child abuse material or other illegal content.

In April, Wikipedia also made it known it would not be able to obey some of the act such as age verification.The organisation said the bill would fundamentally change the way the site operated by forcing it to moderate articles rather than volunteers.

Zoom out: Communications regulator, Ofcom, will oversee the bill’s enforcement, and develop codes of conduct. The government has confirmed that a significant portion of the Act’s provisions will take effect in two months. However, Ofcom would immediately begin work on tackling illegal content, with a consultation process launching on November 9.

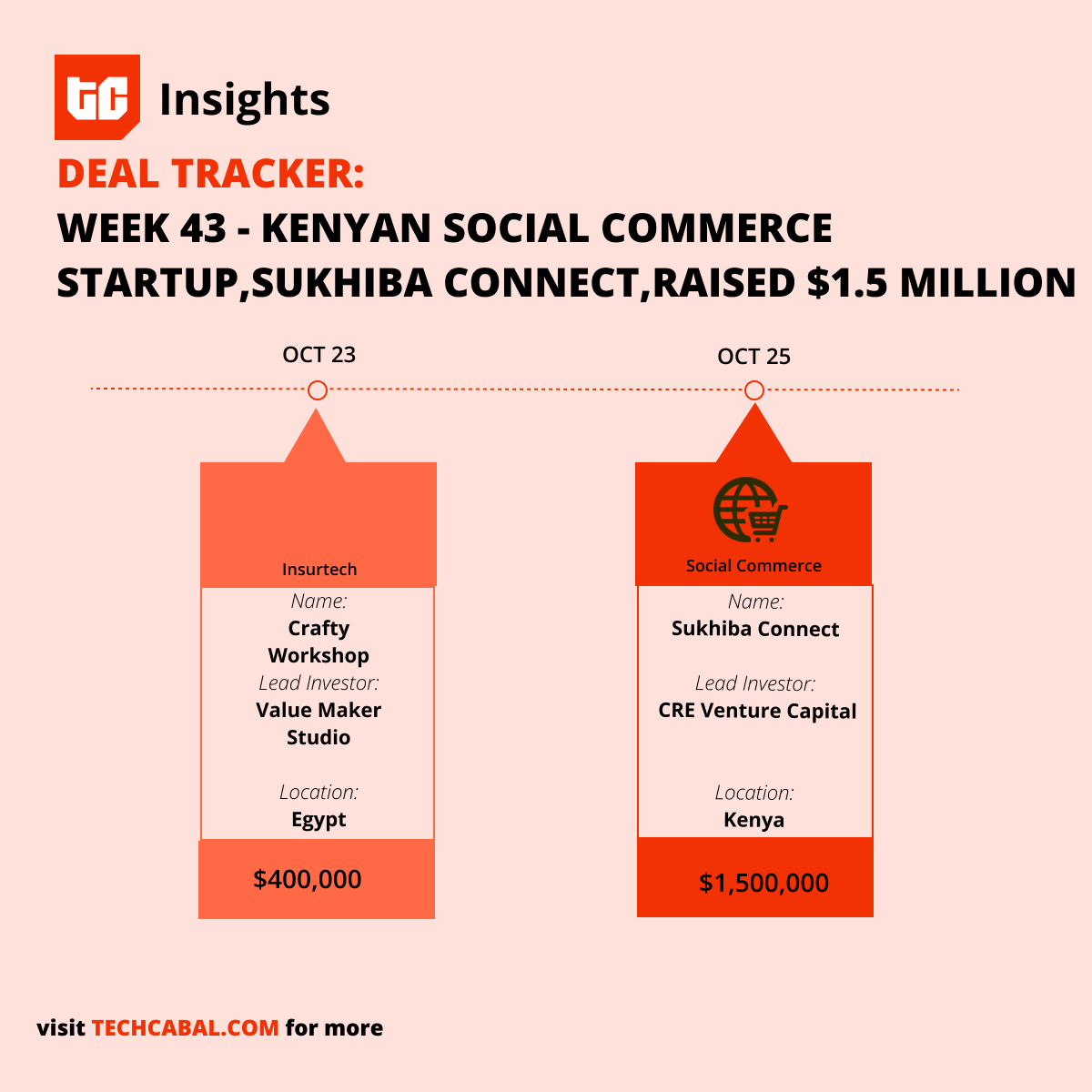

Funding tracker

This week, Sukhiba Connect, a Kenyan social commerce startup, closed $1.5 million in a funding round led by CRE Venture Capital with participation from Antler, EQ2 Ventures, Goodwater Capital, Chandaria Capital, and several angel investors.

Here are other deals for the week:

- Egyptian ed-tech startup OBM Education received a six-figure funding round from Value Maker Studio (VMS) to speed its expansion across Saudi Arabia.

- Egyptian ed-tech startup Crafty Workshop secured $400,000 in a seed funding round led by EdVentures, to expand its product offering.

That’s it for this week!

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. You can also visit DealFlow, our real-time funding tracker.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $34,061 |

– 1.77% |

+ 29.80% |

|

| $1,794 |

+ 0.22% |

+ 12.72% |

|

|

$1.21 |

0.00% |

+ 4.45% |

|

| $32.38 |

– 1.06% |

+ 71.01% |

* Data as of 06:20 AM WAT, October 27, 2023.

Elevate your business with One Liquidity’s seamless integration. Choose from 10+ services to craft a custom solution. Join Obiex, Wewire, and others in providing trading, liquidity and compliance services. Start now with zero fees. One Integration. One Solution. One Liquidity.

- CWG MARKETS LTD – Business Development Manager – Lagos, Nigeria (On-site)

- Crossover – Software Engineer – Lagos, Nigeria (remote)

- Branch International – Software Engineering Intern – Nigeria (Remote)

- Palladium Group – Backend Developer – Abuja, Nigeria

- Insight7 – Senior Product Designer – Lagos, Nigeria

- Moniepoint – Growth Data Analyst – Lagos, Nigeria

What else is happening in tech?

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.