Good morning ☀️

Lagos is one of the most popular tech ecosystems in Africa. However, there are tech ecosystems budding in other states in its home country Nigeria. Here are some of the interesting innovators in Abuja, the country’s capital.

Also, If you are a founder, please take this survey to tell us what you are looking forward to next year.

M-PESA to roll out plastic cards

Hey Kenyans! No more fumbling with a bulky wallet at your favourite Kenyan shop.

M-PESA, Kenya’s biggest mobile money platform is set to disrupt the country’s cash-loving retail sector with roll-out plastic cards. Until now, M-PESA only provided virtual cards called GlobalPay, but they could not be used at many local kiosks, market stalls, fancy boutiques, and physical shops as many sellers preferred hard cash. The GlobalPay virtual cards were limited to purchases from online platforms like Netflix, Amazon, and others.

Sidebar: Virtual cards haven’t exactly had a stellar track record with reliability and fraud risks. Companies like card issuing startup Union54 learned that the hard way. Physical cards are much safer, however, but it also turns out that Kenyans aren’t exactly plastic pals either. Only 6.35% of Kenyan adults use a credit card, and debit cards sit at a lukewarm 22%.

Can M-PESA make it work? If the numbers are anything to go by, it is M-PESA if anyone can make it work. The mobile money company holds 97% market share in Kenya in its really big hands. But can M-PESA overcome the trust issues left by virtual cards and convince Kenyans to join the plastic party? Only time will tell, but one thing’s for sure: the game is changing, and the future of Kenyan payments is about to get a whole lot swipier.

This is great for everyone involved. If these plastic cards melt Kenyans’ distrust of cashless payment away, M-PESA’s chokehold of the East African country will get exponentially tighter. It is not only M-PESA that will grow. Visa, the card processing company that created M-PESA’s virtual card and its new physical card will also expand its footprint across the country and, consequently, Africa.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

Zambia’s Starlink giveaway

Tech billionaire Elon’s dream is coming true in Zambia, but at what cost?

Two months after Starlink launched its satellite internet service in Zambia, the country’s government is handing out the internet device like party favours—one Starlink kit for each of its 150 constituencies.

Why? Well, Zambia’s internet situation is really bad. Over 20 million people, most of whom are in rural areas, stare down a measly 21% internet penetration rate. The cost of maintaining Internet infrastructure in the country discourages Internet service providers. In several interviews, including this one with tech journalist Kara Swisher, Elon Musk, the owner of Starlink has said that the satellite internet service was designed for these kinds of underserved populations. The country’s decision to distribute free Starlinks will see his dream come true.

But at what cost? The hardware costs ZMK 10,744 ($505) and the monthly subscription fee for Starlink is ZMK 771 ($36). In a Twitter post, the Zambian minister of technology and science said that it would bear the cost of both for a year. But considering that Zambia is the 16th poorest country in the world, a giant question mark hangs over the sustainability of the decision. About 64% of Zambians live on less than $2 per day. Will they be able to afford to pay for the service when the time comes?

Here is another question: Is it even worth it at all? While the ministry says that Starlink can connect 300 devices per router, each router only handles 128, per the Starlink website. This means that, across all 150 constituencies, only 19,200 devices can get online at once. This is not exactly the internet revolution Zambia’s minister of Technology and science is painting it to be.

Checkout the Paystack Terminal experience

Paystack Terminal helps you accept in-person payments. We released updates that help you easily access receipts, customise reports, and shorten the length of receipts. Learn more about Paystack Terminal →

OPay’s KYC is enabling impersonation

OPay, a Chinese-owned mobile money platform, is using elaborate marketing schemes and easy-peasy sign-ups to charm millions of people into creating accounts on its platforms—including those who have never had a bank account. But here’s the rub: in its eagerness to woo the unbanked, OPay might have opened its door wide for impersonation by removing strict requirements for identity verification.

How bad is it? Fraudsters can create fake OPay accounts and start using them to move cash around in about 60 seconds. OPay uses a tiered verification process—ranging from tier 1 to 4—allowing users to access a larger suite of services once they submit a National Identification Number (NIN), a bank account number or a bank verification number (BVN). Users must also submit a real-time facial verification to confirm their identity. But its tier-1 account seems to have more holes than a basket.

First, the system’s blind as a bat. It allowed a man to create female accounts even after going through OPay’s facial recognition system. In another test, OPay allowed a user to create a tier-1 account using basic personal information, name and birthday, about a celebrity to register. While OPay requires users to submit either a bank account or phone number for verification, the app did not proceed to verify the details. This tier-1 account allows users to deposit up to ₦300,000 ($378) in their mobile money wallets, and make transactions of up to ₦50,000 ($63). While these transaction limits are restricted, the ease of creating dozens of fraudulent OPay accounts raises concerns about security practices at the company.

Nigeria’s regulator is having none of it. Weeks ago, the Nigerian Central Bank (CBN) raised a bright red card on dodgy verification, demanding stricter KYC checks across all financial services. The banking regulator also tasked all financial services to disable bank accounts or mobile money wallets that have yet to be verified with a BVN or a NIN. Financial services like OPay are expected to comply before the deadline in April 2024.

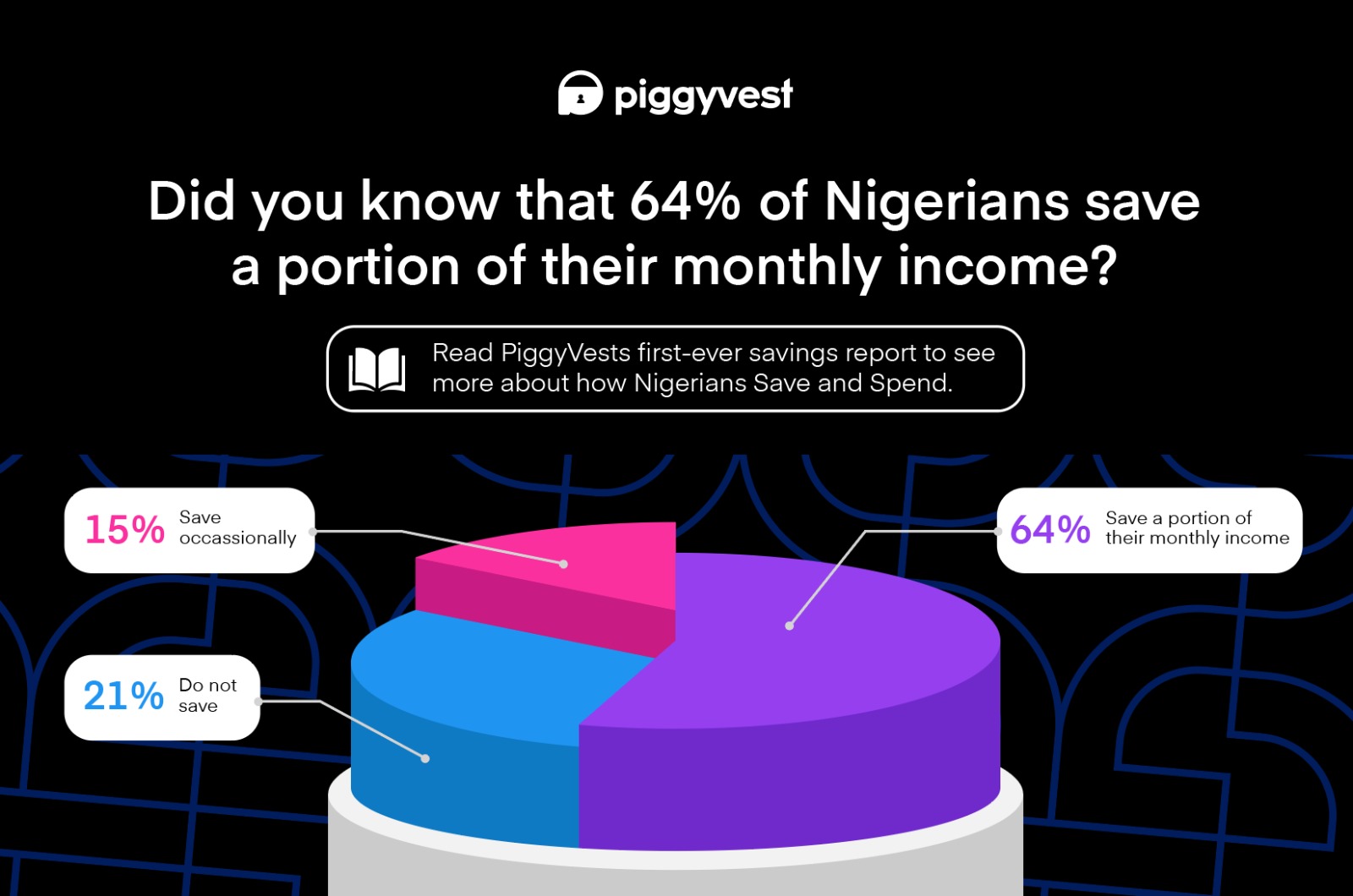

How do Nigerians save and spend?

Did you know that 64% of Nigerians save a portion of their monthly income? Read PiggyVest’s first-ever savings report to see more about how Nigerians save and spend here.

What should Africa prioritise?

Africa’s digital skeleton is gradually adding flesh to bone. Countries like Rwanda and Ghana are doing more to achieve digital transformation across basic yet tedious processes, with the former launching a one-stop platform for accessing public services in 2015, and the latter digitising national identification.

But there’s still more to be done to drive development, job creation and economic growth, and there are different areas that African countries who are trying to achieve these could focus on.

An expert survey by the OECD in 2020 showed that policymakers and other stakeholders believe that when it comes to creating more jobs, providing digital infrastructure should receive greater priority over digital skills, digital solutions for agriculture and anything else.

Digital infrastructure is a core need and the foundation for a lot of these other areas to function. However, focusing solely on building infrastructure over other components of digitalisation could have more delayed, long-term effects on economic growth, compared to others like improving access to finance.

Take South Africa, for instance. Ninety-eight percent of businesses are SMEs, and they contribute 39% to the country’s GDP. Yet, South Africa has a $30 billion SME financing gap, and analysts predict that about 60% of businesses could shut down due to the spending contractions imposed by the pandemic.

Unlocking growth in South Africa will clearly require paying more attention to SME financing. A priority area should therefore be to enable easier access to credit since traditional financial institutions are historically averse to financing SMEs. This would then mean driving compliance with the country’s Protection of Personal Information Act, which came into effect in 2020, as companies need data to give loans.

In some economies, it is clear what they should focus on. Ethiopia’s economy, for instance, is largely dependent on agriculture (40% of GDP and 75% of the workforce). So perhaps Ethiopia should focus on providing adequate digital solutions for smallholder farmers.

On the other hand, countries like Sudan or Cameroon with no specific data protection laws in place should consider drafting and implementing legislation for that first, because with further digitalisation comes the risk of data leakage.

Every country should recognise where they fall short and first direct their efforts at those areas, instead of applying a one-size-fits-all approach.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $41,577 |

– 1.47% |

+ 13.68% |

|

| $2,205 |

– 0.84% |

+ 12.76% |

|

|

$240.08 |

– 1.83% |

– 1.77% |

|

| $71.56 |

– 2.45% |

2.31% |

* Data as of 00:31 AM WAT, December 18, 2023.

Effortlessly make global settlements in over 30 currencies across 120+ countries spanning four continents, delivering cost-effective and reliable solutions to your clients, suppliers, and customers. Get started today.

- Deputy CTO @NEXT BASKET

- Brand Designer @Code for Africa

- Chief Product & Technology Officer @Adeso

- Business Development Executive @TeamAce Limited

- IT Manager @Creative Associates International

What else is happening in tech?

Written and edited by –

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Weekender: weekly roundup of the most important tech news out of Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 12 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.