TGIF 🎉

Cheers to surviving another week of work emails, meetings and existential dread. Enjoy your 48 hours of freedom before we do it all again next week!

Duke Ekezie departs Kippa and embarks on a new venture

Duke Ekezie, co-founder of Kippa, the Nigerian fintech startup, has taken a surprising turn out of Kippa and into a new venture, even as the company embarks on a bold pivot to edtech.

Here’s what you need to know: Founded in 2021 by Duke, his brother Kennedy Ekezie, and Uche Jepthat, Kippa was initially a bookkeeping startup that freed entrepreneurs from the drudgery of spreadsheets. In September 2022, Kippa secured a super agent banking licence and then launched its agency banking product—Kippa Pay— which was overseen by Duke. Jepthat left the company in November 2022, shortly after Kippa announced an $8.4 million funding round.

In October 2023, due to fierce competition and unprofitability, Kippa discontinued Kippa Pay and laid off 40 employees. In December, Kippa transferred the operations of Kippa Pay to Gpay, a payment subsidiary of Bloc, a Nigerian fintech about to launch banking services.

Kippa also struggled to make severance payments to its laid-off employees after it suffered a ₦30 million ($33,516) internal fraud, discovered a month after it shut down Kippa Pay.

Knowing when to persevere and when to pivot. On Wednesday, Kippa reportedly pivoted into providing edtech services. One day after the bold new chapter, Duke has decided to step down. While rumours of his departure swirled for months, Duke confirmed his exit and revealed he’s pursuing a new, undisclosed venture. He remains a shareholder and advisor in the company.

Moving forward: According to Duke, after closing the agency banking business, he and Kennedy revisited their strategy and identified two key problems during discussions with SMEs and large businesses. Duke mentioned, “One aligned with my goals, and the other with Kennedy’s, so we’ve decided to solve them individually.”

He declined to share specifics of the problem he’s looking to solve with his new venture.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

Airtel Africa reports a 99% plunge in profits in 2023

Last year, Airtel Africa, a telecom company operating across 14 African countries faced headwinds from Nigeria’s naira devaluation and reported a loss after tax of $151 million in its Q1—April 1 to June 30, 2023 results.

It seems 2023 continued to prove turbulent for the telecom giant as the company recently released its 9-month financial report ending December 2023, of a profit before tax of $2 million—a significant decline from the $523 million profit it recorded in the same period in 2022.

Currency devaluation’s sting: Airtel witnessed a significant drop in profits last year due to the decrease in the value of currencies in some of its main markets: Nigeria, Malawi, Zambia, and Kenya. Without these currency impacts, the profit before tax for the nine months ending December 2023 would have been $840 million.

The company experienced a 99% decline in profits, mainly due to the devaluation of Nigeria’s naira which cost Airtel $301 million. The country’s apex bank recently injected $500 million to address a lingering FX backlog, as the naira reached ₦1,421 per dollar on the official market this week.

Challenges beyond profits: Overall revenue dropped by 1.4% to $3.8 million from $3.9 million in 2022. Despite these external pressures, Airtel Africa boasts a 9.1% growth in its customer base, reaching 151.2 million. This growth was fuelled by a 22.4% surge in data subscribers and a 19.5% increase in mobile money users.

Undeterred by the profit decline, Group CEO Olusegun Ogunsanya says it won’t impact their growth plans. The company plans to focus on capital allocation priorities, repay debts, and invest in new opportunities like their recently launched data centre business, Nxtra by Airtel. Airtel Africa’s board also intends to return value to shareholders through a share buy-back programme of up to $100 million starting in early March 2024 over 12 months.

CBN scraps exchange cap for IMTOs

Nigeria’s apex bank is taking a gamble to resuscitate its ailing currency.

The news: The Central Bank of Nigeria (CBN) yesterday eliminated the cap on exchange rates quoted by International Money Transfer Operators (IMTOs).

What does that mean? CBN previously controlled the exchange rate at which International Money Transfer Operators (IMTOs) like Western Union and MoneyGram could sell foreign currency to Nigerians. Now, these companies can set their own rates within a certain range. The CBN previously allowed the IMTOs to deviate from the official rate by a maximum of 2.5% (-2.5% to +2.5%).

Per local media, the new development is in response to suspected hoarding of foreign currency by Nigerian commercial banks. The FG earlier gave a directive to commercial banks to release non-essential foreign currencies—currencies not needed for legitimate import payments, overseas travel allowances, or student tuition fees—to tame the naira’s depreciation against the dollar.

Why is the FG doing this? The latest development represents the government’s attempt to resuscitate its ailing currency. The naira has suffered its worst devaluation in recent times, depreciating over 40% against the dollar since June, when the Central Bank adopted a more relaxed exchange rate policy

By allowing IMTOs set their own rates, the move could bring about increased competition, leading to lower exchange rates for Nigerians receiving money from abroad. This policy change could also incentivise IMTOs to bring in their foreign exchange holdings to Nigeria, potentially boosting domestic forex inflows.

Zoom out: The CBN’s move to scrap the IMTO exchange cap, while aiming for stability, could bring unintended consequences. Cheaper transfers might come at the cost of volatile exchange rates, hurting average Nigerians. Worse, the freedom from the cap could give unruly IMTOs room to charge excessive fees. Only time will tell if this gamble pays off, or if it creates more problems than it solves.

Secure payment gateway for your business

Fincra’s payment gateway enables you to easily collect Naira payments as a business; you can collect payments in minutes through bank transfers, cards, virtual accounts and mobile money. Create a free account and start collecting NGN payments with Fincra.

MultiChoice to invest $89 million in Showmax

MultiChoice says it will make a new $89 million cash injection in Showmax, its streaming platform, by the close of March 2024. The latest development comes as Showmax gears up for its February 12 relaunch.

MultiChoice looks juicy to everyone: As users await the streamer’s upcoming update, investors are also looking to the future. MultiChoice is now in talks to be acquired by Canal+ after the French giant offered to acquire all outstanding shares they don’t already own in the company for R105 ($5.65) per share—an increase from the broadcaster’s current share price of R79 ($4.25). Canal+ began acquiring shares in the South African company in 2020, and steadily increasing its stake to 31.7% by June 2023.

In its 2023 financial results, Vivendi, owners of Canal+ stated that it was increasing its stake in MultiChoice for international expansion. This triggered speculation about a full takeover, fuelled by Canal+’s ambitious expansion plans into sub-Saharan Africa. Per South African laws, a shareholder is mandated to make an offer for a takeover when it reaches a 35% stake in a listed entity.

Zoom out: With Showmax’s relaunch in the works, MultiChoice is betting on it to become Africa’s premier streaming service. MultiChoice has revamped Showmax content offerings with new partnerships. The streamer will now offer a mobile-only English Premier League-only package, data-saving streaming bundles, and content from NBCUniversal’s subsidiaries, SKY and HBO.

The company is betting on Showmax to help it deliver its ambitious goals of having 50 million subscribers, earning $1 billion in revenue within five years, turning a profit by 2027, and making even more money as its business grows bigger.

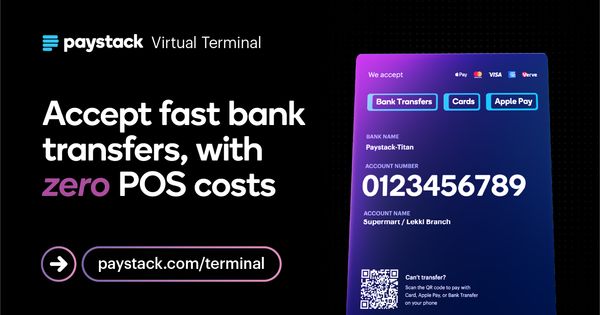

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

Funding tracker

This week, Kenyan agritech startup Apollo Agriculture raised $10 million in debt funding from Swedfund and ImpactConnect, with implementation facilitated by DEG.

Here are other deals for the week:

- InspiraFarms Cooling, a Kenyan-based cooling solutions provider, secured a $1.09 million investment from investors, including the Foundation for Clean Energy and Energy Inclusion for Africa (CEI Africa), KawiSafi, and Factor[e].

- Egyptian delivery management startup Roboost closed a $3 million investment round led by Silicon Badia, with participation from RZM Investment, Flat6Labs, and Saudi Angel Investors.

- Senegalese B2B commerce startup ProXalys, raised $500,000 in a funding round led by 216 Capital, a Tunisia-based seed fund. It also features Haskè Ventures and Digital Africa through its FUZE programme.

Before you go, our much anticipated State Of Tech In Africa Report for Q4 2023 is now out. Click this link to download it.

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. You can also visit DealFlow, our real-time funding tracker.

Dive Deeper with Semafor Africa

Dive deeper — our friends at Semafor Africa bring forward original reporting and insight on the world’s fastest-growing economies. Sent to your inbox 3x a week, Semafor Africa discusses the impact African business, politics, tech, and culture have on the world, shedding light on ever-changing power dynamics of the global economy. Subscribe for free.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $43,019 |

+ 1.00% |

– 1.62% |

|

| $2,299 |

+ 0.48% |

– 1.82% |

|

|

$0.9998 |

– 0.02% |

– 0.03% |

|

| $300 |

– 0.22% |

– 4.02% |

* Data as of 22:02 PM WAT, Febraury 1, 2024.

Effortlessly make global settlements in over 30 currencies across 120+ countries spanning four continents, delivering cost-effective and reliable solutions to your clients, suppliers, and customers. Get started today.

- The 6th Africa Tech Summit Nairobi is set for February 14–15, 2024. The Summit will connect tech leaders from the African ecosystem and international players under one roof. Network with key stakeholders including tech corporates, mobile operators, fintech, Web3 ventures, investors, innovative startups, regulators, and industry stakeholders driving business and investment forward. You can also get a 10% discount when you use the code “TECH10”. Register here.

- Think securing funding guarantees your startup’s success? Think again! Register for this free webinar by BrandOn on “Why Startups Fail Even After Raising Capital”. On February 10, you’ll get to learn from Gerald Black (Black Ops), Oluwadunni Fanibe (TechStars), and others. Register here.

What else is happening in tech?

Written by: Faith Omoniyi & Mariam Muhammad

Edited by: Timi Odueso & Kelechi Njoku

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.