Good morning ☀️

Heads up! Google has a new sign-in page.

It’s pretty much the same as before but everything is better aligned across devices with large screens. Your passwords, passkeys, and info are all safe. That’s it for innovation today.

How much did Cardinal Stone sell its iFitness stake for?

On Wednesday, Cardinal Stone Capital Advisers sold its 65% stake in i-Fitness to Verod Capital management, seemingly answering the question “where are the exits for Africa-focused VCs and PEs.”

But the devil is often in the details.

Per our initial report, Cardinal Stone Capital Advisers sold its stake for $12 million. That figure meant that CCA was breaking out the champagne to celebrate a 2-2.5x exit.

Here’s what Muktar of TechCabal wrote:

“Cardinal Stone, the first institutional investor in i-Fitness, typically invests between $5 million and $10 million in portfolio companies across various sectors in Ghana and Nigeria.”

But what if that exit was a lot smaller than initially thought? Two people close to the deal insisted that the deal was much smaller than we initially reported.

“Two authoritative sources shared that the deal size was less than $6 million.”

It suggests that this was not a situation where the selling party was popping some bubbly. While the five-year time horizon of the deal is typical of PE firms, there may not have been any huge exit multiples here.

Depending on what the final numbers were, this might have represented one PE handing the baton to another PE firm that may have a different thinking of how to extract juicy multiples in the next five years.

Access payments with Moniepoint

You don’t have to take our word for it. Give it a shot like he did Click here to experience fast and reliable personal banking with Moniepoint.

Binance limits USDT/NGN trading

As of January 30, the Nigerian Naira depreciated 31% to reach ₦1,400/$1, as the country’s headline inflation rose every month in 2023, hitting 28.90%, an 18-year high, in December 2023.

Amidst this economic instability, Binance, the world’s largest cryptocurrency exchange, has disabled Nigerian users from selling USDT, and limited the buying option to a set price of ₦1,802 ($1.12).

The crypto exchange, which facilitates trading between the Naira and USDT (a stablecoin pegged to the US dollar), claims that these measures are to safeguard users from fraud and manipulation. For Nigerian users, Binance disabled the ability to sell USDT and limited the buying option to a set price of ₦1802 ($1.12).

Desperate times call for desperate measures? Binance’s recent limitation on Nigerian users’ ability to sell USDT coincides with unverified claims that the Central Bank of Nigeria (CBN) and other government bodies allegedly ordered the exchange to limit Nigerian users’ ability to sell USDT. This marks the second time in six months that Binance has intervened in USDT/NGN pricing, following a similar action in December that briefly boosted the naira’s value by ₦300 ($0.19) against the dollar in one day of trading action.

Traders are now exploring alternatives, with some migrating to other peer-to-peer platforms like Kucoin, where the Naira traded as low as ₦2000 ($1.25) to 1 USDT.

Despite relaxing currency controls and implementing new policies since June 2023 to curb speculation and improve price discovery, the CBN’s efforts are hindered by persistent liquidity issues and potentially ineffective communication, affecting confidence in the apex bank. In response, the Debt Management Office has increased bond yields by 3% to address excess Naira liquidity and attract foreign investors.

Secure payment gateway for your business

Fincra’s payment gateway enables you to easily collect Naira payments as a business; you can collect payments in minutes through bank transfers, cards, virtual accounts and mobile money. Create a free account and start collecting NGN payments with Fincra.

South Africa unveils tax incentives for EV manufacturers

A wave of electric vehicle (EV) support is sweeping across Africa, with governments and businesses alike taking action to promote cleaner transportation.

In Ethiopia, the government, earlier this month, revealed plans to ban the import of gasoline and diesel cars. The country has also been offering tax breaks for electric vehicles since 2022. Kenya joined the movement by restricting the import of used EVs with less than 80% battery life on Tuesday. This decision comes alongside a recent $24 million investment secured by Kenyan EV company Roam, to expand its operations across the country.

In North Africa, Egypt’s state-owned automaker El-Nasr has partnered with a Chinese company to roll out locally-produced EVs in the country by 2025.

Now, South Africa is also joining the EV race. The country’s finance minister Enoch Godongwana, unveiled a series of tax hikes during the 2024 Budget Speech. Amidst these increases, there’s a silver lining for EV manufacturers.

What silver lining? Starting March 1 2026, companies that make electric and hydrogen-powered vehicles can get back 150% of the money they spend on their investments. This is to boost local EV production.

Additionally, the National Treasury has reallocated R964 million ($50.8 million) to the EV industry to support the transition to EVs.

Zoom out: In more renewable energy news, Teraco, an African carrier-neutral colocation provider is investing over $100 million in building a 120MW solar power plant in South Africa, to add clean energy generation capacity to the national grid. This highlights the growing interest in renewable energy solutions across Africa, which aligns with the broader shift towards cleaner transportation and environmental sustainability.

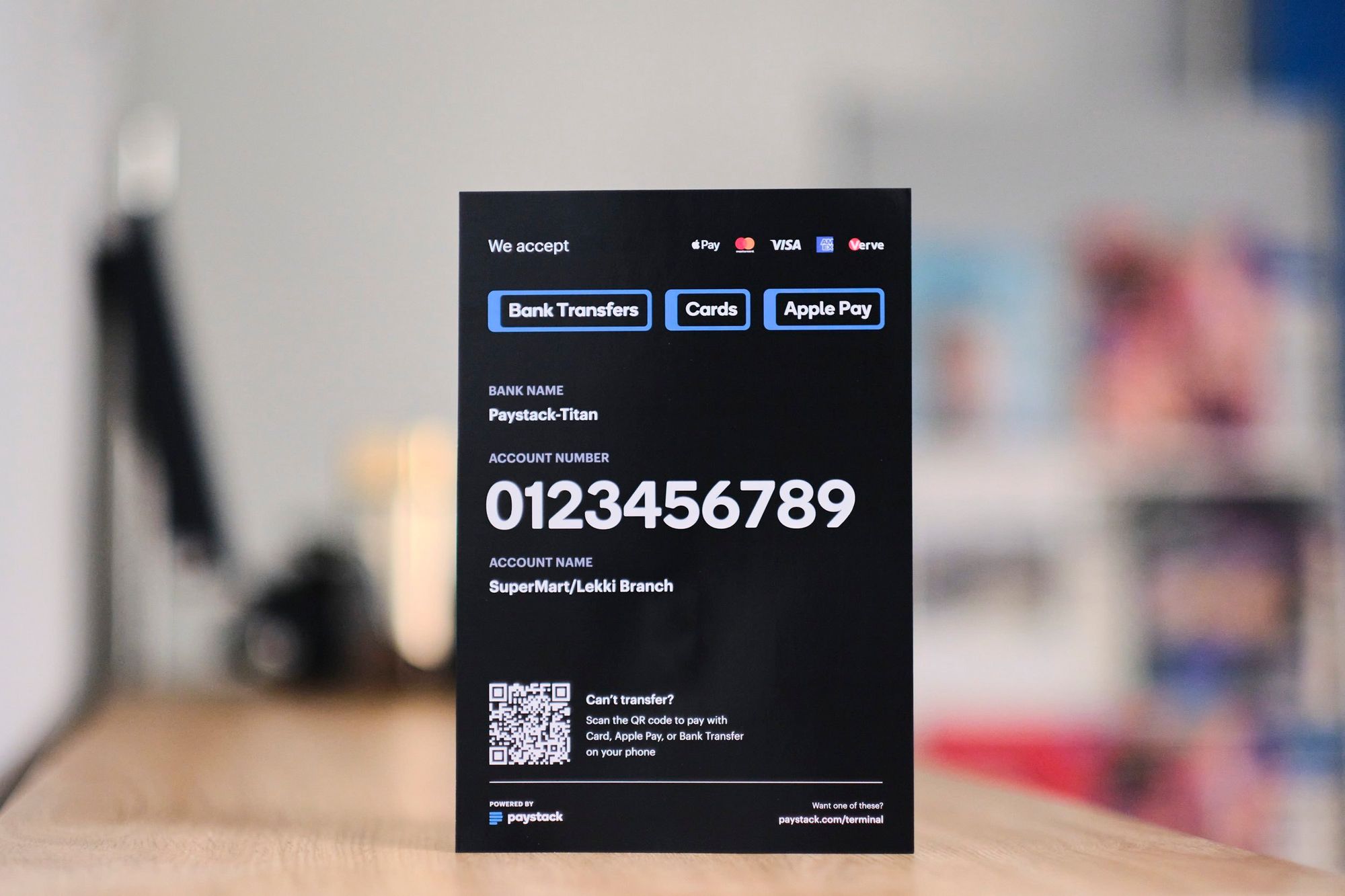

Accept fast in-person payments, at scale

Delight your customers by allowing frontline staff and sales agents confirm bank transfers, instantly. Learn more →

South Africa implements tax hikes on inefficient light bulbs

Here’s some more news on SA. The government is taking steps to encourage citizens to switch from inefficient incandescent and fluorescent light bulbs to light-emitting diode (LED) lamps. This move aims to tackle rising electricity demand and the ever-present threat of load shedding.

What’s new? The South African government has implemented new regulations to ban the sale of inefficient bulbs for general household lighting from May 24, 2024. The Treasury has also proposed raising the tax on incandescent bulbs from R15 ($0.79) to R20 ($1.06) per bulb from April 1, 2024.

Why the switch? A typical LED light bulb reportedly uses about 10 watts, compared to about 60 watts for most incandescent bulbs and 13-15 watts for fluorescent bulbs. Incandescent and fluorescent bulbs are still widely used despite being less efficient and consuming more electricity compared to LED alternatives. LEDs are significantly more efficient than incandescent and fluorescent bulbs, consuming around 10 times less energy.

This comes after the country’s Trade, Industry & Competition Department set new energy efficiency standards for light bulbs in May 2023.

What are the standards? The first phase of implementation, starts May 24, 2024, and will require regular electric lamps to have a minimum luminous efficacy of 90 lumens per watt (lm/W), a target currently attainable only by LEDs.The second phase, beginning three years after publication, will further increase the minimum efficiency to 105lm/W.

These regulations will effectively prohibit the sale of non-LED bulbs for general household lighting in South Africa, excluding studio lighting, theatre lighting, and medical use.

d.light raises $7.4 million

d.light, a global provider of affordable solar-powered solutions, has raised $7.4 milllion in a securitisation deal led by Lagos-based investment group, Chapel Hill Denham.

d.light claims it learned from its experience of using this type of funding for off-grid solar in other sub-Saharan African countries, now it wants to use the same formula to expand access in Nigeria.

A securitisation deal? Imagine d.light has a bunch of “micro-loans” they’ve given out to people to buy their solar-powered products. These loans bring in money over time as people pay for their solar devices, but d.light needs some cash right now to expand their business and provide more products. That’s where securitization comes in.

d.light groups those loans together, label them as “coupons” and sell them off to an investor. These investors are buying a piece of the future payments d.light will receive from the original borrowers.

So, in this case, the finance came from Chapel Hill Denham’s investment, but instead of giving d.light a loan, the investment group bought coupons on the promise of future payments from d.light’s customers. This way, d.light got $7.4 million cash upfront, and Chapel Hill Denham will get a return on its investment.

More money to keep the lights on: d.light says it will use the funds to expand its access to its solar-powered products for low-income households in Nigeria. D.light with nearly 30 million products sold has ambitious plans of reaching 1 billion developing countries across the world.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $51,481 |

– 1.17% |

+ 26.17% |

|

| $2,931 |

– 2.51% |

+ 25.01% |

|

|

$1.84 |

– 9.19% |

– 21.61% |

|

| $7.28 |

+ 7.02 |

+ 217.02% |

* Data as of 06:10 AM WAT, Febraury 22, 2024.

Experience the best rates and enjoy swift 6-24hrs delivery times. Elevate your business with OneLiquidity–get started today.

- The Africa Fintech Network (AFN) in partnership with Cenfri and the Africa Digital Financial Inclusion Facility (ADFI) is developing Africa’s first regional Fintech Platform! The Africa Fintech Platform will serve as a one-stop-shop for information, resources, and networking for fintechs, fintech associations, and other stakeholders on the continent. Take this 15-minute survey to help us better understand the needs of the African fintech ecosystem. Take the survey here.

- Applications are now open for the 2024/2025 PTDF Overseas Postgraduate (Masters & PhD) Scholarship Scheme. The award includes the provision of flight tickets, payment of health insurance, payment of tuition and bench fees (where applicable), and the provision of allowances to meet the costs of accommodation and living expenses. Apply by March 18.

- The 2024 OWSD Early Career Women Scientists (ECWS) Fellowship Programme ($50,000 award) is open for application. The fellowship programme supports early-career women scientists to lead important research projects in those countries which have been identified as especially lacking in scientific and technological resources. Apply by March 14.

What else is happening in tech?

Written by: Olumuyiwa Olowogboyega, Mariam Muhammad & Faith Omoniyi

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.