19th February 2024

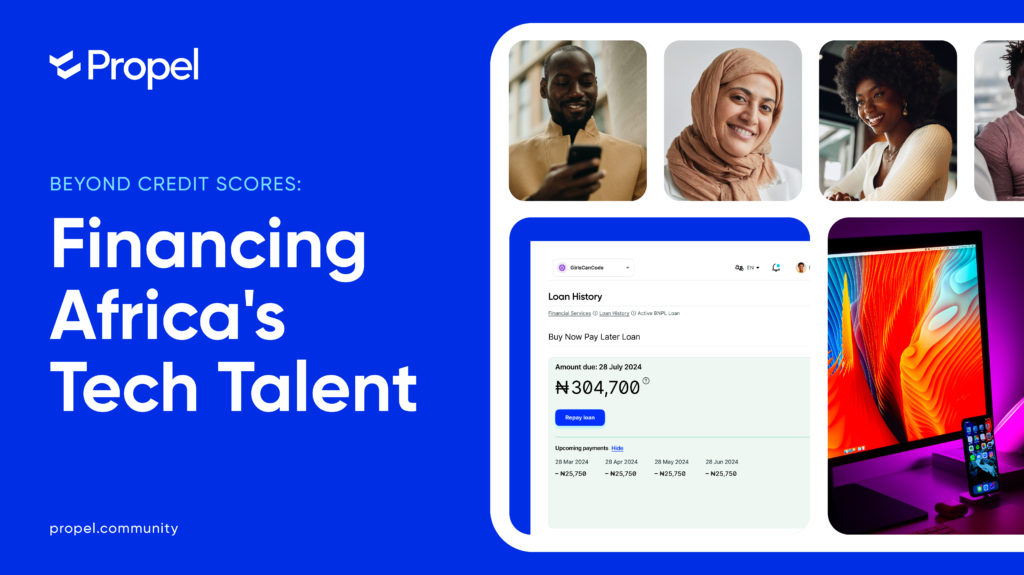

As part of its efforts to empower millions of tech professionals across Africa and solve last-mile problems faced by tech talent communities, Propel has announced the launch of its ‘Embedded Finance’ offering – the first service being a Buy Now, Pay Later (BNPL) feature that will provide tech talent with accessible financing options for essential work tools and resources.

Africa’s economic landscape has been marked by rising inflation rates, currency depreciation and other macroeconomic hurdles. In countries like Kenya and Nigeria for example, high inflation and currency depreciation have significantly impacted the cost of living – and naturally this has made it increasingly difficult for people who are looking to build a career in tech to afford the tools necessary to grow or thrive in their careers.

Recognizing the need to remove these financial barriers, Propel has launched its Buy Now, Pay Later solution as part of its broader ‘Embedded Finance’ framework for tech communities.

“In Africa 8 out of every 10 people looking to start their careers in tech start out by joining a community.” said Sunkanmi Ola, Co-founder and CEO of Propel. “These communities do incredible work in discovering, mentoring, training or upskilling talent. However, they have a number of last-mile challenges that they aren’t particularly equipped to solve – like helping their members access job opportunities, finance, and other resources that contribute to career progress. Propel is solving for this, so communities can stay focused on just the things they do best.”

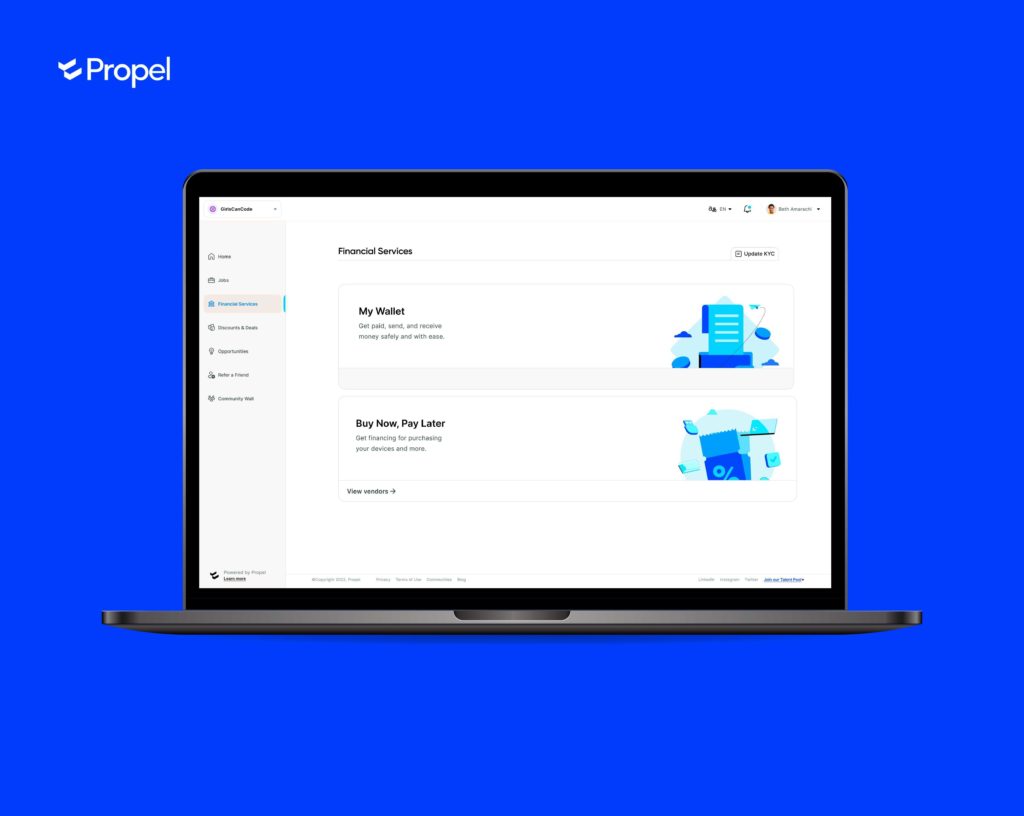

Essentially, tech communities can now leverage Propel’s infrastructure to extend financial services to their members, rather than needing to build out their own technology, liquidity, or disbursement/collection channels. And with Africa’s tech ecosystem growing rapidly, the inflow of people into communities has also grown. Financing is usually one of their biggest needs, especially at the onset of their careers.

“There are a handful of existing BNPL offerings out there, but these solutions do not take into consideration the nuances of people in the open talent economy or the unique challenges they face – like non-structured jobs or irregular income.” said Seun Owolabi, Propel’s Co-founder, giving some insight into their unique approach. “What we’ve done is to build alternative scoring algorithms and profiling frameworks that consider individual potential, using factors such as learning paths, community participation and more. Effectively, we’re making access to finance a fairer, more accessible and equitable process – especially for the people that need it the most.”

Propel’s BNPL solution operates through a simple application process accessible via the Communities’ Dashboards. Upon approval, users receive a voucher code representing the approved loan amount, which can be redeemed with verified vendors for the purchase of work devices – computers, tablets etc. The program’s structure and flexible repayment schedules aim to ease the financial burden on tech talent while promoting inclusivity and accessibility within the industry.

“With our embedded finance infrastructure, we’d effectively be able to turn Tech Communities into ‘neo-banks’ for their members…” Seun said. “And the Buy Now, Pay Later is just one tool in a roadmap of critical infrastructure we’re building for the tech talent ecosystem.”

Propel’s infrastructure is currently used by 200+ communities spread across 22 African countries, some highlights including SheCodeAfrica, GoMyCode, Ingressive For Good, Friends of Figma and various Google Developer Groups. They started out with their “Access to Work” feature – helping connect talent within these communities with jobs. And so far they’ve matched over 2,000 people with jobs at global companies like Porsche, Farfetch, Mercedes, Orange and Stepstone.

“Africa has the potential to become the world’s tech powerhouse, having the youngest population on the planet. And one of our key goals at Propel is to make it the most sought-after continent for tech talent globally within the next decade,” said Sunkanmi Ola. “By removing key barriers through our Embedded Finance stack, we’re now enabling more individuals to access the tech industry, excel in it, and realize their full potential. With this, we can turn a looming crisis into a definitive opportunity – for Africa itself, but also for the world.”

Propel, who recently raised 2.5 million Euros to strengthen their ability to support tech talent ecosystems, has since been able to expand their platform with a wider variety of global opportunities. Today, they support tech communities with the jobs, technology and support they need to equip their members for success in their careers. Access to Finance is the next piece of the puzzle.

About Propel:

Headquartered in Berlin and with offices in Lagos and Lisbon, Propel is a future of work startup dedicated to empowering tech talent within emerging markets and underrepresented communities.