Bloc helps startups and corporations of all sizes build, launch and grow their FinTech applications in record time — less than half the usual time it takes.

TechAdvance, on Monday, September 13th, 2021, announced the official release of its product, Bloc—a proprietary suite of APIs capable of helping anyone launch a FinTech product in far less time than it usually takes. With Bloc, TechAdvance opens the door to FinTech for all and sundry—tech companies, internet startups, small businesses, and large corporations alike.

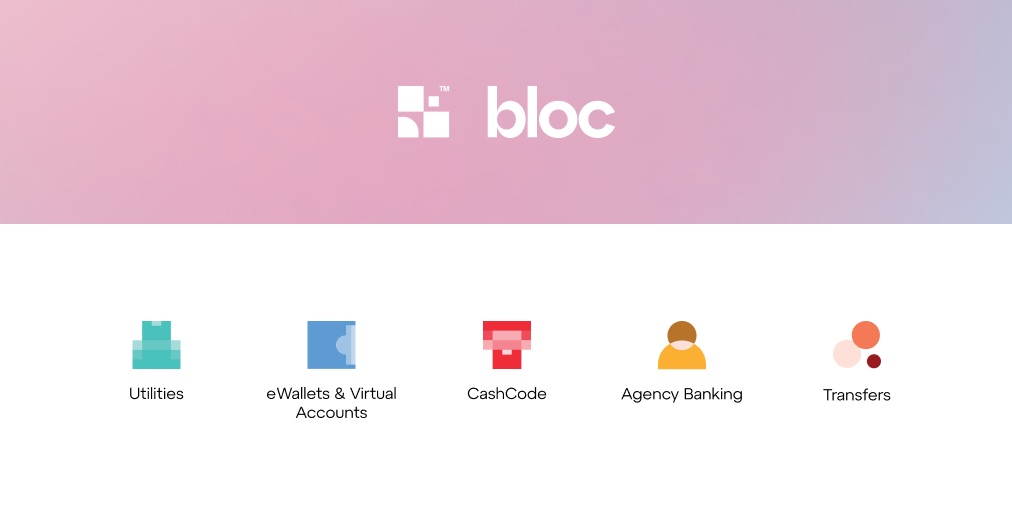

The announcement comes with the release of five API products currently live in the Bloc API suite—eWallets and Virtual Accounts, Utilities, CashCode, Agency Banking, and Transfers.

“All companies will become FinTech companies,” said Edmund Olotu, Founder and Chief Innovation Officer at TechAdvance. In an internal meeting, Edmund stated that “with our APIs, companies/startups can now offer their customers a range of banking and financial services. With cash deposits and withdrawals, local and international wallets, recurring payments, cardless withdrawals, bill payments, individual and bulk transfers—companies can increase revenue and stay profitable”.

Built for speed, ease, and compliance

Bloc gives any startup or corporation peace of mind in three ways, built with obsessive attention to detail.

- Faster time to market

With Bloc, all complexities that take time to build and launch a product no longer exist—allowing you to focus on what matters, your product. We own all the necessary licenses and are compliant with the highest security standards required to offer you our API products. - Simple to use and integrate

In minutes, engineering teams can sign up and gain access to the API products for integration. Bloc also simplifies deployment, updates, management and is very compatible with other third-party APIs. - 100% Compliant

Bloc is secure and protected by design. Always up to date, Bloc holds security certifications by ISO 27001, PCI-DSS, and licenses like the CBN-issued Micro Finance Bank License, the NCC-Value Added Services license, and a PSSP license.

More Opportunities for the African FinTech Space

For a decade, TechAdvance has actively contributed to the tech space in the country. With Bloc, we move a step in the right direction, building global infrastructure for African FinTech and providing tools for expansion beyond the continent’s borders.

From payment gateways to international payments to global digital banks to decentralized finance, Bloc is an opportunity to tap into the gold mine of FinTech solutions easily.

Moving Forward,

We are working on programs and opportunities to foster developer relations and contribute to the talent pipeline in the space. We are also committed to partnering with young startups and founders who want to build solutions with our captive banking model.

These programs and partnerships will expand critical work emphasizing the need for distributed financial services, while also advancing rapid innovation in African FinTech.