There are over 200 FinTech companies in Nigeria offering financial solutions and inclusion for Nigerians and indeed Africans. As a flourishing sector, FinTech startups in Africa have raised up to $1.4 billion between January and September 2021 while in Nigeria, specifically, the industry has raised almost $800 million. This indicates that the FinTech scene is in dire need of talents, with both financial and technical skills, to meet up with the ever-growing demand for financial services and solutions.

To bridge this gap, career learning institute, CLI College Nigeria and Christ University India teamed up for a symposium tagged The Growth of FinTech in Emerging Economies: A Case Study of Nigeria and India. The webinar saw industry experts discuss the state of FinTech in Nigeria and India, the opportunities, the benefits of being a professional in FinTech and how the sector can thrive even more.

Opening the virtual event, Associate Professor, Christ University India, Prof. Jayant Mahajan said, “The FinTech industry is growing exponentially, presenting lots of business and career opportunities. The ecosystem is also changing rapidly with digital technology, innovations, regulations, market structures, and convergence with other sectors. This change is even more rapid in Africa and Asia. Thus, it became important for us at Christ University to collaborate with leading institutions such as CLI College to drive conversations and provide resources that educate youths on how to effectively navigate today’s technology-driven society and provide insights on the FinTech industries in both India and Nigeria.”

In the same vein, the Principal Head at CLI College, Tioluwalogo Olakunbi-Black said the symposium was to share knowledge and opportunities to promote the FinTech growth and contribute to the deepening of the FinTech exchanges between Nigeria and India. He said, “At CLI College, we have created a knowledge share and capacity building platform via local and international partnerships to bridge vocational and professional skills gap in critical growth sectors of our economy.”

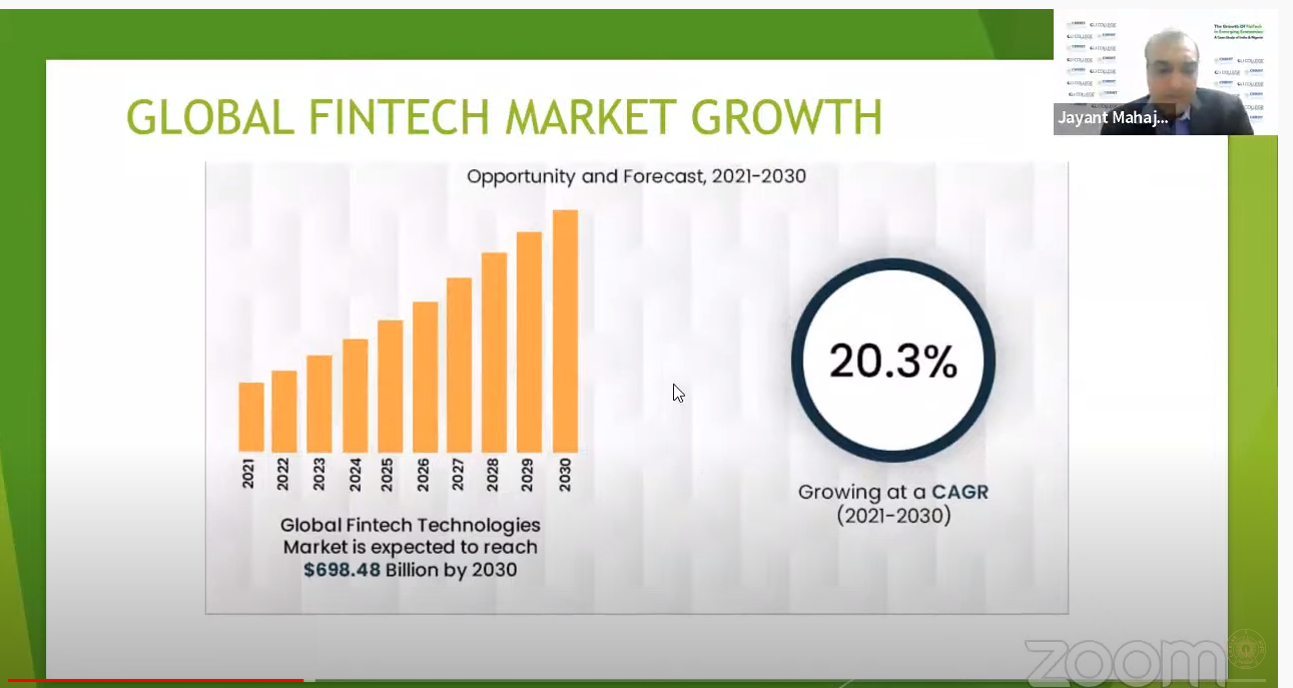

Explaining what FinTech entails, guest speaker and seasoned Techno Commercial professional, Abhilash Chatterjee stated that FinTech involves enabling financial products reach the maximum/targeted population in a swift and agile manner using technology smartly. He emphasized that the Global FinTech market is growing fast and is expected to reach almost $700 billion by 2030. “This is a big opportunity for entrepreneurs and prospective entrepreneurs or those who want to get into the FinTech space in terms of career options and available jobs.” added Chatterjee.

In the area of FinTech funding, Chatterjee, revealed that ideation contributes significantly to investment. He said “If your ideation is on the right path, the venture capital and seed investors will come. Also, there are global funds focused on the FinTech industry.”

In addition to securing funds for FinTech startups and products, Kartik Swaminathan, the author of 3F- Future FinTech Framework, said that founders must first convince themselves before attempting to sell their ideas to others and to do so, their ideas must be impressive enough to attract investors. He also stated that founders and entrepreneurs should reach out to capitalist firms and investments with their ideas. The guest speaker said, “Every country has some venture capital players, and accelerators. There are funding networks of people that you can also reach out to. Banks are also interested, especially if your product is good, so you can approach them.”

The CEO of Sparkle, a mobile-first platform using technology to power financial inclusion, Uzoma Dozie spoke further on funding. He shared that the first stage is talking to one’s circle of friends and acquaintances. “If I’m going to invest in anyone, I’m going to look at how much has been invested and who has invested in them. If your friend is not investing in you, why should I? It is a simple fact of life.”

The Sparkle chief and former Group Managing Director of Diamond bank, also touched on the relevance of business story. He mentioned that there are lots of funds that are looking to develop startups but people have to understand and write their stories. “You don’t have to only know what you want to do with your startup but also how you are going to tell the story to people. That’s the most important thing.”

Addressing how FinTech is merging both the modern and traditional ways of solving problems, guest speaker Uzoma Dozie cited his Sparkle model, saying “ We provide services that are complementary to your existing bank. That way clients can get richer data and better insights on making decisions moving forward. That is the service we provide since we are more agile, and mobile compared to the existing traditional banks. We, as a platform, also look for ways to partner with traditional banks in order to provide holistic benefits for customers. In the end, we have to earn that trust and that involves putting processes in place, and the required capacity.”

To conclude the symposium, Chatterjee highlighted the need for more people to embrace FinTech. ”We are in a very interesting phase of FinTech. The industry is evolving and it has come to a point where we are now seeing a lot of global activities in the FinTech space, most importantly, investments in the emerging markets. Google and Apple are looking at Africa as a very important market and even incubating centers for FinTech.” he said.

To prepare those interested in having a career in FinTech, CLI, Nigeria and Christ University, India is launching a three-month weekend certificate program called FinTech for Business Professionals, here in Lagos, Nigeria. See more information here (Link below)

The fact that FinTech is affecting every industry and aspect of our lives is one of the many reason people should be interested in the sector as it immensely adds value to the way we do business and work.

YouTube link for the recap: https://bit.ly/CLIfintechsymposiumrecap

Program Link for more information: https://clicollege.com/cli-college-technology-fintech