Africa’s payment ecosystem has evolved significantly over several decades from 1885 when the British built Africa’s first bank in Egypt. The progress over time is underpinned by continuous innovation as the continent’s economies grew through a series of improvements in banking services and payment methods, on the one hand.

On the other hand, advances in ICT have served as a catalyst for advancement, especially the advent of the Global System of Mobile (GSM) telecommunication on the continent in the late nineties/early 2000s, which has since boosted digital transactions, particularly in mobile payments.

The era of the inglorious ‘tally numbers’ in African banks, when people wasted precious human hours waiting endlessly in queues to cash cheques or conduct transactions, is now a distant memory. Digital payment systems, driven by Mobile Network Operators (MNOS) and other fintech platforms, have grown and are in rude health.

Analysts have attributed African countries’ embracing digital transactions, including mobile payments, to increasing internet penetration, an improving regulatory environment, and the rise of fintech services and products. Others are regional integration through bodies like the West African Economic and Monetary Union (WAEMU) and, recently, AfCTFA and demographic structure.

Affirming the popularity and growth of mobile payments in its 2021 report entitled ‘The State of Instant Payments in Africa: Progress and Prospects’, independent African-led organisation, AfricaNenda asserts: “mobile payments currently represent the lion’s share of instant payments on the continent; most systems, however, also support online or app-based payments. Mobile payment accounts in Africa in 2020 saw a total volume of 27.5 bn transactions and a total transaction value of USD 495 bn, a 15% and 23% year-on-year increase from 2019, respectively.”

Despite this encouraging state of affairs, there’s still a long way to go with payments because approximately 57 per cent of Africa’s population does not have traditional bank accounts. Consequently, credit and debit card penetration in Africa constantly hovers around three per cent, compared with Europe’s 90 per cent.

A significant hindrance to a deeper spread in adoption on the continent is the fragmentation of the payments market, with users and countries having different preferences. Sometimes, various providers and telcos cover peculiar solutions; hence businesses find it inconvenient and costly to receive payments from other countries.

A pivotal company in the vanguard of enabling sustained growth in digital transactions/mobile payments is the leading pan-African payments company, Cellulant. Established in 2003, Cellulant provides locally relevant and alternative payment methods for global, regional and local merchants across Africa.

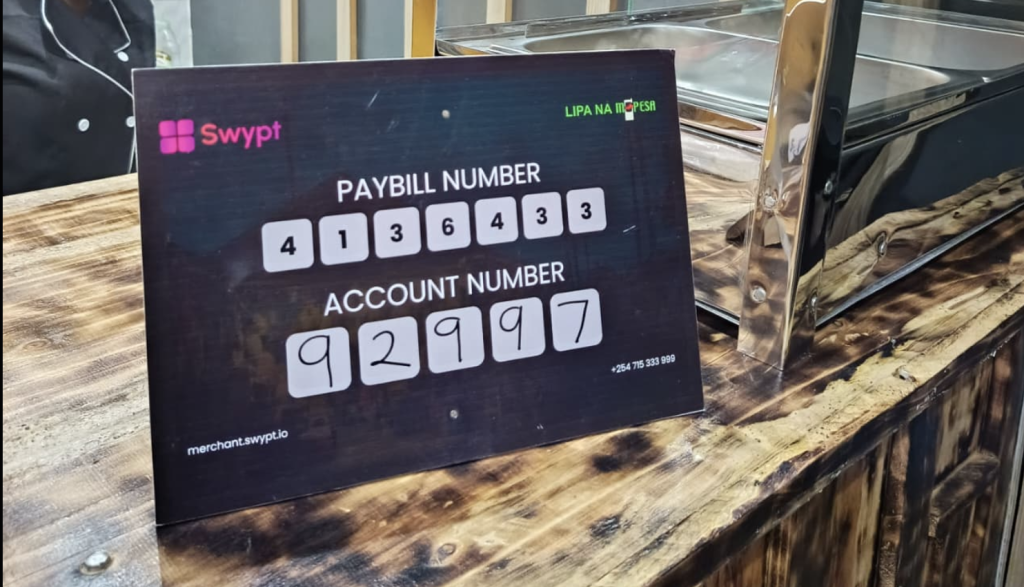

Cellulant has since established impressive footprints across diverse sectors on the continent. Its single API platform enables companies to collect payments online and offline while allowing people to make payments from their mobile money wallets, local and international cards, or bank accounts.

With a physical presence in 18 countries and active processing of payments in a total of 35 across the continent, Cellulant’s growth story affirms the truism of the saying that from little acorns, giant oaks grow. With careful nurturing and dynamic management, it has become a critical catalyst in boosting trade on the continent by digitising payments for the biggest economies in Africa through convenient, locally relevant payment methods.

The company founded by two visionary entrepreneurs over coffee has become invaluable for consumers across Africa. For example, it helps people in Kenya and others move money from their bank accounts into their mobile money wallets by interconnecting banks with relevant payment services. This has further driven the adoption and usage of mobile payments across Kenya, East Africa and the wider sub-Saharan Africa region.

Through its Tingg platform, which integrates 46 mobile money operators, 150 million mobile money wallets, 211 connected banks and 75 million bank accounts across the continent, Cellulant helps stitch together the fabric of Africa’s commercial landscape.

Before the company’s solution, disruptions occurred at the Point of Sale (POS) and in the back office. At the POS, the salesperson needed to operate three phones with distinct log-in details and user interfaces; meanwhile, back-office teams have had to reconcile these payments from different providers, dealing with data trapped in other systems and formats. These differences create similar issues when managing chargebacks, reversals, refunds, or disputes.

Cellulant’s API eliminates the need to sign up for multiple payment providers, including mobile money and Mobile Money Operators (MoMos). It also streamlines businesses’ administration processes while expanding the range of payment options they can offer consumers, ensuring maximum choice and flexibility offline and online.

The company strives to unite Africa’s fragmented payments ecosystem through strategic alliances with banks on the one hand and partnerships with merchants that extend to other sectors such as remittances, water, aviation, transport, and retail. Ultimately, this smoothens trade and lets customers conveniently make purchases and pay their bills. In aviation, for example, it powers payments for airlines such as Emirates, Ethiopian Airlines, and Dutch KLM.

In Zambia, Cellulant has made life easier by resolving merchants’ inconveniences in receiving consumer payments from three mobile money providers. It has a digital payment partnership with five leading water utility companies: Nkana Water, Kafubu Water, Mulonga Water, Chambeshi Water and Western Water. This allows customers to conveniently pay their water bills with their preferred mobile money and selected bank accounts through Tingg.

It renders a range of similar services in Nigeria, powering payments of businesses such as Coldstone, GIG Logistics, Bolt and Grey Finance, among others.

Fittingly, the Afrocentric firm’s excellence and innovativeness have not gone unnoticed. In July, it won the ‘Best Online Payments Solution Platform [Merchant] Africa 2022’ and ‘Best B2B Payments Platform Africa 2022’ prizes at the Global Business Magazine Awards.

The Global Business Magazine Awards in 2022 is another of the several recognitions Cellulant has earned across Africa in nearly two decades of remarkable impacts.

With its demonstrated commitment to innovation and resourcefulness, Africa has an excellent payment platform in Cellulant.