I’ll be the first to admit that there’s been lots of good vibes in Nigeria’s Fintech space lately. Take payments for example – it’s like Christmas has come early! We’ve seen PayStack demonstrating that recurring payments is indeed not rocket science. Cue slew of similar innovation from folks like Amplify, SimplePay etc. Not to mention new forms of consumer payments (with support from relatively established players), bringing us PayWithCapture, PayAttitude, KongaPay etc. We’ve also had a fresh approach to short term consumer loans from Aellia, One Credit etc and even personal savings from the likes of PiggyBank.

One thing you may have noticed from above, is that a lot of the recent developments are focused on consumers. Not small business owners or enterprise. To be clear, there’s absolutely nothing wrong in focusing on consumers. They’ve been long neglected and of course ripe for tech innovation to address the areas of neglect. Instead, I want to touch on areas (and proffer solution paths), which are pain points experienced by small business owners, representing opportunities begging to be explored.

How do I know these pain points? Well, I work closely with a lot of small business owners in my startup PrognoStore. PrognoStore is a Point-of-Sale and Inventory solution which is used by small business owners (e.g retailers, fashion boutiques, hospitality etc), to run their business. But prior to PrognoStore, I’ve worked in finance at banks such as Morgan Stanley and Credit Suisse. It’s fair to say, I’ve been on both sides of the table.

Okay, with that preamble out of the way, the following are 3 examples of areas I think are fertile grounds for Fintech startups to do great things for small businesses:

Identity – Data

Identity goes beyond a photocard, BVN, salary slips etc. The question of identity has evolved from just identifying the individual. However, in reality a lot of financial institutions e.g. banks still rely on outdated documents and procedures to determine identity, character and credit worthiness of a small business owner. For instance, how do you ascertain that John has been a successful Alaba trader for the past 9 years? And that John the Alaba trader is different from John the tailor? Or that John who has grossed an average of 3 million for the last 4 years, is worthy of a bridge loan to cover next 6 months expenses? Or the probability of repayment if the loan is granted?

Did you say we have credit bureaus already? Well do they know John? Actually no one knows John except his fellow millionaire fellow traders. Talking of millions, there are literally millions of ‘Johns’, so a startup that works on cataloguing this data is striking a rich vein of gold.

Of course, no one said this will be easy. There are obvious problems with getting such real data. We (Nigerians) are distrustful of everyone including ourselves, so why should anyone trust you with their information? Illiteracy rates are high even among successful small business owners, so it’s tricky to get data if nothing is documented. Rudimentary public records like addresses are lacking, which means that logistics is a nightmare.

But the good news is that nobody has this information now. Yes, there are snippets here and there, but what’s lacking is a complete threading of John’s identity, from authenticating his identity to understanding his business. After gathering enough data about him (and others just like him), you will have the opportunity to predict behaviour and service needs.

Customer experience

Let’s be honest, customer experience in most sectors are atrocious. I’m not talking about only the sectors affected by Fintech, but nothing screams “waste of time” louder than having to wait 2 hours in a banking hall to resolve a simple issue. Or having your call put on hold for 35 minutes and unceremoniously cut-off mid sentence when you finally get through! By the way, there’s an outdated concept that customer experience can only be delivered in physical buildings e.g. banking halls. Much like identity, the real problems here are old attitudes, legacy systems and lack of fresh thinking.

So how do you tackle this? What if the banking experience moved completely to self-serve? For instance, there are mobile-only banks like Atom Bank in the U.K, Simple Bank in U.S etc. for small business owners. Yes, there are a lot of banking outlets in major markets, however the assumption that you need physical buildings to be close to your bank is being challenged on many fronts.

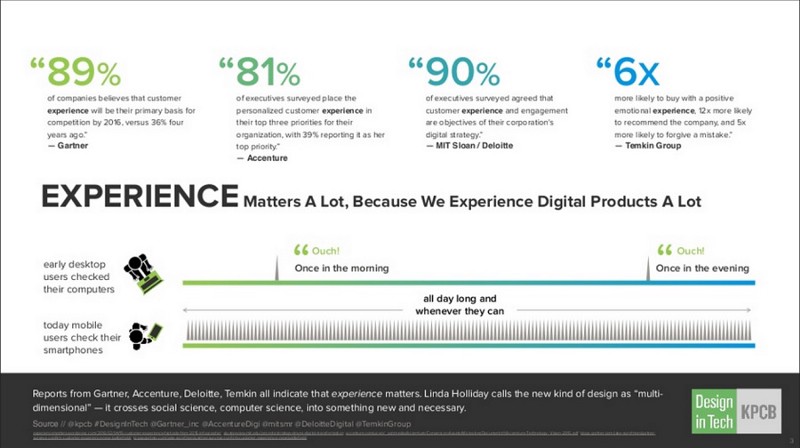

How do we know customer experience can be a differentiating factor? Look no further than GTBank. When Fola Adeola and Tayo Aderinokun started GTBank many years ago, they expressly stated their desire to be known as the bank for excellent customer service. It’s fair to say they’ve been largely successful. It’s also accurate to note that customer experience goes beyond customer service. In the new world, UX will become a competitive advantage to deliver experiences that matter. You should read the KPCB design in tech report 2016 to see how important customer experience is.

Loans/Credit

This is what it all comes down to. Small businesses need cash! They need it to grow. They need it as bridge loans. They need it for emergencies. They need it for long term use. However, lending to small businesses is one area which we can all agree that banks have under-performed.

However, one of the main obstacles to lending is the lack of reliable identity data of small business owners (not surprisingly). No one gives money to folks they don’t know/they aren’t certain will pay back. The need for money itself is so obvious that it needs no further explanation.

Okay, now that we know all this, how can Fintech startups power small businesses in Nigeria?

1. Eliminating Friction

At first glance, removing friction seems like a simple task. However, to drive adoption of fintech products in a market like Nigeria, it is a crucial task. So before you consider the importance of design, UI/UX flow etc, you need to ask yourself this question, “What impediments will hinder a small business owner (user) from utilising my product/service?”, and solve to remove/limit those impediments with the full knowledge that Nigeria (much like other developing countries) has some unique challenges. Challenges like non-familiarity with design norms, reluctance to shop online, distrust of refunds/returns policies, substandard and expensive internet data etc.

2. Adopting the API economy

You need to think open and secured connectivity from day one. Open up your APIs. Play nice with other players. Remember it’s all about delivering value to your customers. You want an example? Well, if you provide payment solutions to merchants and open up your API to a startup like PrognoStore, then you provide even more value to your small business customers. In this case, it means the lady who has a boutique in Victoria Island selling top-end designer bags, will no longer have to reconcile her payments to Inventory.

The key point worth stressing is that having APIs enables startups (and established firms), to share services and data easily, by building applications that link to other firm’s services and data. This invariably exposes your firm to new business models and new sources of creating value.

3. Privacy and Security

This is important. And it’s one area that’s often neglected. Unfortunately, startups wake up too late to the importance of doing this right. It’s not just good ethics to get this right, it’s also a competitive advantage since customers are particularly sensitive about how you secure their data and protect their privacy.

According to the Fiserv 2014 Consumer Trends Survey over 50% of people who are not using mobile banking in the U.S say it’s due to security concerns. If you don’t take this seriously, your intended users are bound to demonstrate ‘trust issues’.

Startups have to view privacy and security from an external and internal angle. ‘Internal’ means you can’t allow your staff trample all over people’s sensitive data. It’s all about having adequate checks, firewalls and repercussions for non compliance.

4. Vertical Markets

‘Think niche. Go deep. Resurface rich.’

Don’t try to be everything to everyone. A better approach is to pick a niche, and then go deep to understand it. Doing that means chances are higher that you can be enormously successful at solving the problems faced by that specific group of small business owners.

What about Universal banking? That’s so last decade, and it’s not thinking ‘niche’. Examples of niche players are Wealthfront and SigFig catering to investment management, Ondeck providing small business loans and Zipmark making payments easy for business. If you take this route, then likely areas to service small business owners with specific products could be asset finance, invoice finance, short term loans etc.

Let me illustrate; imagine a startup called smallbizloans.ng offers invoice financing to small businesses and their USP is providing an excellent customer experience (before and throughout the life of the loan). They offer this product to meet the specific needs of small business owners, who are identified and capacity to repay verified.

Most likely for smallbizloans.ng to reach scale, it will depend on one or two banks to provide the capital and guarantee for the loans. On the customer side, it charges fees (which possibly could be slightly more expensive than going directly to the banks), to arrange loans. And on the bank side, they’re happy to provide them deal flow for a discounted rate. Whilst taking care of delighting the customers with their service.

Final word of caution, Fintech is essentially a cooperative competition model with banks or other aggregators. You will always need external players to provided end-to-end service to your customers. However, if you focus on the customer, you can successfully disrupt the Banks/Interswitch on one side, but you will bring them money on the other.

In the end, everyone wins.

[separator type=”thin”]

Editor’s note: This article was first published on Ade Olabode’s Medium page. Ade is the founder/CEO of Prognostore, a 3-in-1 point-of-sale and inventory solution that helps small business owners run their businesses smarter.