Nigeria’s apex bank has moved to improve the public’s access to mobile money services in Nigeria.

Released on the 9th of July, the Central Bank of Nigeria uploaded its Framework and Guidelines for Mobile Money Services to its website. The 40-page regulatory framework aims to help Nigerians access financial services and products through mobile money.

In Ghana, mobile money services are widely used because they provide unconventional services, such as inter-bank transfers to their customers. In Nigeria, they are popular because banks are hard to access in rural areas.

Going forward, services like First Bank’s Firstmonie, Kudi Mobile, and MTN’s MoMo will be bound by the objectives of the framework which include promoting the safety of mobile money services, reduction of cash dominance in the economy, and providing an enabling environment for the adoption of mobile money services in the country.

Financial Inclusion for the Unbanked

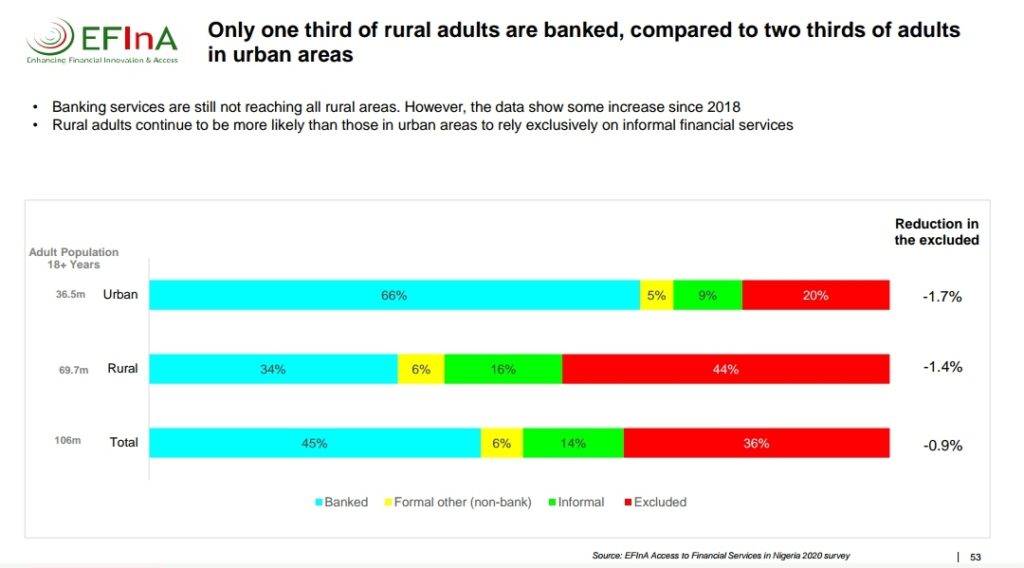

As of 2020, at least 55% of the Nigerian population still remains unbanked according to the Access to Financial Services in Nigeria Report. While the highest contributing factor to this remains low income, the next on the list is lack of access to banking services as 44% of the unbanked population live in rural areas.

About 70 million Nigerians live in rural areas where banks are too far from where people live or work. At least two-thirds of the number is part of the unbanked, a small percentage of whom use informal methods of banking systems such as saving groups or co-operatives. The rest, which forms the majority, do not use these banking services, whether formal or informal.

Of the 1.2 billion Mobile Money accounts that exist globally, West Africa contributes a significant 192 million accounts to the number with at least 15.3 million Nigerians contributing to the number.

CBN seems to be prioritizing a significant reduction of this number by providing simplified access to mobile money services. Since 2018, the percentage of Nigerians with bank accounts has increased by 5% at least, and a lot of this is owed to the rapid increase in mobile money services.

Who is concerned?

The framework regulates the activities of everyone involved in the mobile money ecosystem, from the mobile money operators to banks, telecommunications companies, agents, and consumers.

It also lists permissible and non-permissible activities under its business rules, allowing mobile money operators to create wallets and even issue cards while prohibiting them from issuing insurance or accepting foreign deposits. The most notable restriction on the Non Permissible list under Section 7.2.2 is in subsection (a) which prevents operators from granting, “any form of loans, advances, and guarantees (directly or indirectly).

Endowing consumers with certain rights and responsibilities, the framework provides in Section 8.5 the rights of consumers to ease of use, ease of enrollment, and accessibility to funds on completion of the transaction process.

Sanctions

Modern financial services can often be untrustworthy and this has contributed to the increasing number of unbanked individuals. From transfer errors, to debit alerts, and unresponsive customer service, there are a number of reported mishaps regarding mobile money services available online.

The new framework pushes forward consumer protection measures as well, compelling operators, in Section 18. (f), to resolve all customer complaints within forty-eight hours.

While the framework provides a list of sanctions against operators that fail to put these measures in place, it neglects to provide details on how consumers will be compensated when a sanction is evoked.

Legislation is scarcely an issue in Nigeria. When it comes to creating laws, however obscene, Nigerian lawmakers are quick to boot. Implementation remains the and one can only wonder if CBN’s latest attempt will provide a reduction in the unbanked, in coming months.