No standard definitions exist for what scale is for fintech in Africa. But one effort by the Wheeler Institute at the London School of Business can be a guide.

Here are five key numbers from the report:

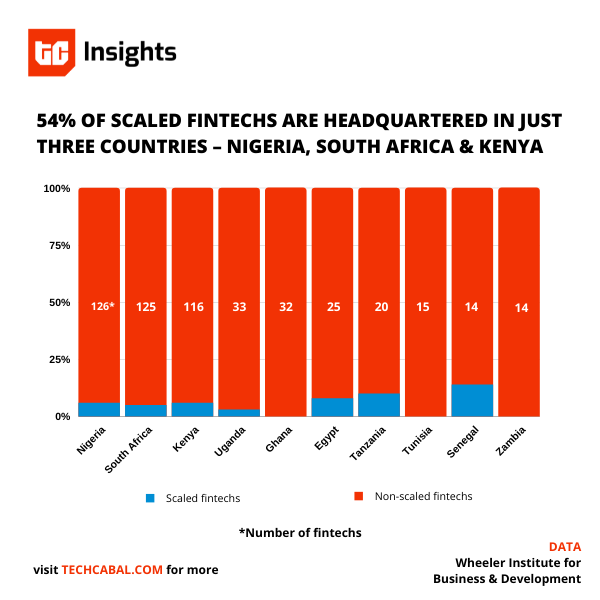

Out of 716 fintech companies pooled across Africa, only 37 have achieved scale. 20 out of those 37 companies are headquartered in Nigeria, Kenya and South Africa.

On average, it takes 12 years for a African fintech company to scale; only 5 startups have managed to scale within 5 years of operations.

Olanrewaju Odunowo/TC Insights

Also, those 37 include ‘fintech’ units launched by Airtel and MTN. So we really only have 4% scale prevalence in African fintech.

These numbers are not pretty. Is Africa not a huge market populated by young people with internet-enabled smartphones? Why are the fintech companies serving them not scaling?

The report gives two explanations:

- Fragmentation: Many tech companies have not overcome the complex aspects of implementing their ideas in practice. A major complexity is the existence of different (and sometimes harsh) regulations from one country to another.

- Low-income: How many people can pay for the services being offered? An “addressable market” is demand – the number of people “willing and able to pay” – not population. Goodwill may attract but it is self-interest that converts.

Putting it bluntly, the report states that “scaling a business that serves lower income tiers is notoriously hard.” It’s a reality check for those who dream of capturing the next billion from Africans at the bottom of the pyramid. Beware of “financial inclusion” apps.

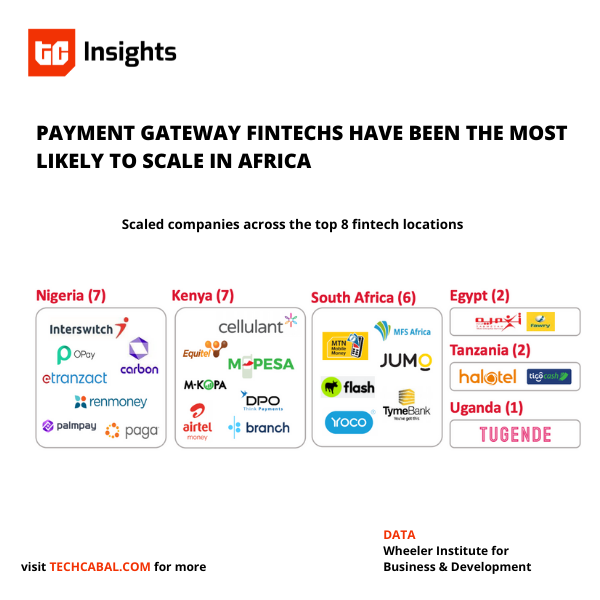

However, it’s not all bad news. One interesting takeaway is that “infrastructure” fintech companies are likely to scale in Africa.

Olanrewaju Odunowo/TC Insights

Infrastructure fintechs, according to the report, are those providing payment gateways, building banking-as-a-service applications or aggregating services into APIs. Of the 96 fintech companies defined as being in the sub-sector, 10% have scaled.

Interswitch, MFS Africa and Fawry probably typify the infrastructure fintechs but I am surprised that certain names are not listed among the scaled in this sub-sector. Is a multimillion-dollar acquisition not a signal of scale? How about a presence in 30 countries with over $50m in annual revenue? The researchers explain their methodology in the report.

Whatever those answers, the important thing to note is that companies building the rails for other services (financial and non-financial) in Africa are likely to expand quickly.

But scale is not just for B2B fintechs. Carbon and Branch, two digital lending companies, make the case that it is possible to scale by serving consumers efficiently. Both have recently evolved to digital banks. Carbon staking out a claim to lead Buy Now Pay Later in Africa – in other words, to become infrastructure for lending.

Perhaps another report with a different yardstick will reveal other scaled fintechs in Africa. For now, we can look deeper into the top 4% to see how they arrived where they currently are. Like McDonald’s, did they all scale by owning land instead of burgers and fries?