August 23rd, 2021

The Next Wave provides a futuristic analysis of BizTech and innovation in Africa. Subscribe here to get directly in your inbox on Sundays at 3 PM (WAT).

Tech businesses in Nigeria are no strangers to receiving notice about sudden changes to policies and laws by the powers that be.

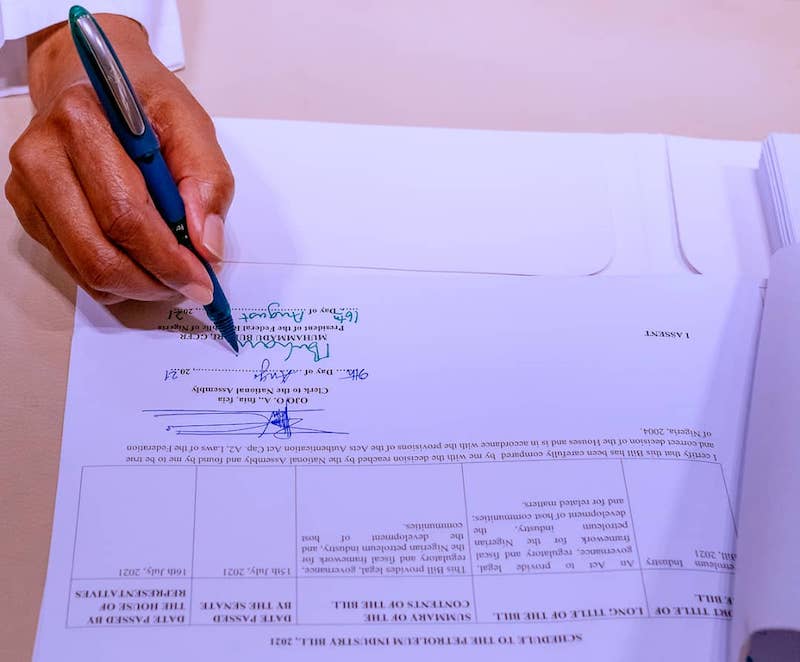

A new bill meant to revamp Nigeria’s tech regulator was made public last Monday, with some of its provisions introducing licensing for tech companies, payment of pre-tax profit levies, and hard penalties for violators of the Act.

Yet to be sent to the national assembly, the proposed changes to the National Information Technology Development Agency (NITDA) Act 2007 give the body complete control over the country’s burgeoning tech ecosystem.

Earlier this year, NITDA head Kashifu Abdullahi informed legislators of the plan to repeal the Act in order to keep up with the global pace of innovation as well as address opportunities and threats posed by recent digital technologies.

“The kind of information we store on our phones and other technological gadgets make the human brain susceptible to the possibility of being hacked,” Abdullahi said back in March. “Technology is taking over the only thing that differentiates us (humans) from other animals.”

Rather than create an enabling environment for startups to thrive, however, details of the 26-page draft document are troubling for founders and players in the digital economy who fear that the new bill, if passed, could stifle innovation in Nigeria.

Partner Message

The Flutterwave Mobile app: The app that turns any smartphone into a mobile POS is now redefining commerce. The Flutterwave Mobile app makes it super convenient for anyone to take their business with them anywhere, anytime. Learn how you can take your business anywhere, anytime here.

Zoom in: Regulatory overreach?

Some specific aspects of the bill – such as Section 6, 13, 20, and 21 – are more concerning than others and raise questions of regulatory overreach.

Section 6 grants new powers to NITDA, including testing and approving any technology before it can be used in Nigeria. It can also demand whatever charges and fees it deems necessary as well as penalties for non-compliance with the Act.

The agency also gets authority to “enter premises, inspect, seize, seal, detain and impose administrative sanctions on erring persons and companies who contravene any provision of the Act”, subject to a court order.

According to Section 13, tech companies making a yearly turnover of ₦100 million ($243,000) have to pay a 1% levy from their profit before tax. This, in addition to other grants-in-aid, fees, and levies, will go to a fund for Nigeria’s digital economy.

Under Section 20 and 21, NITDA gets to issue its own licenses for tech products, services, and platforms. Operating any of these without authorisation is tantamount to an offense.

Individuals found guilty will be fined not less than ₦3 million or placed into custody for a year or more. A person can also be charged both a fine and imprisonment. For corporate bodies, the fine is set at N30 million. The ‘principal officers’ of the companies may also be imprisoned for two years or more.

Furthermore, individuals or corporations that deny NITDA personnel to carry out their duties will be fined ₦3 million and ₦30 million respectively. Prison terms for this offense range from a year to two.

A tech company that qualifies for levies but fails to, after two months, will be liable to a fine of 0.5% of the total amount to be paid every day after the default.

As necessary as compliance and regulatory requirements are for the ecosystem to grow and thrive, it feels as though these regulatory agencies are bent on throwing a spanner into the wheels of tech businesses in Nigeria.

In conversation with some first time tech founders, they’ve expressed their fears and frustrations about the leaked NITDA bill. All they want is an enabling environment to build great products and succeed in their home country. But they constantly find themselves walking on eggshells and they’re slowly losing their trust in the Nigerian government.

Partner Message

KB4-CON EMEA is a free, highly engaging, cybersecurity-focused virtual event designed for CISOs, security awareness and cybersecurity professionals in Europe, the Middle East and Africa. The event will be on Thursday, September 23rd and features keynotes from two of the most well known figures in cybersecurity. Mikko Hyppönen will cover how our global networks are being threatened by surveillance and crime, and how we can fix our technical, and human, problems. Kevin Mitnick will reveal social engineering tradecraft and insights and wow you with a live hacking demonstration. You can register here.

Zoom out: Regulations… again

Across the world, technological innovations move faster than regulations, and Nigeria is not an exception.

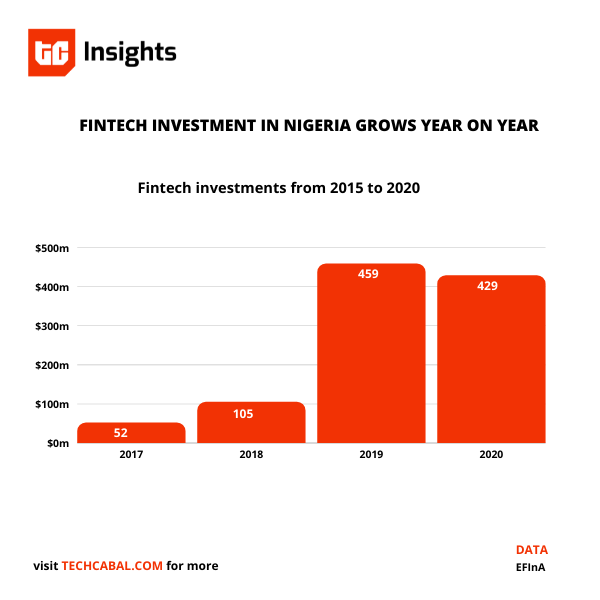

Nigeria’s fintech industry has seen startups innovate around existing regulations, offering customers diverse products and services. These range from wealth management to the trading of cryptocurrencies and foreign stocks. This has brought rapid growth to these startups and fintech at large, therefore ushering in foreign direct investment.

This has not gone unnoticed. Regulatory bodies like the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC), are bringing startups in the industry under regulatory oversight.

In February 2021, the CBN released a circular addressed to banks and other financial institutions prohibiting transactions in cryptocurrencies. This decision made Patricia, a fintech company relocate its operations to the Republic of Estonia.

In the same vein, the Securities and Exchange Commission (SEC) stopped unregistered investment platforms from offering foreign stocks to Nigerians earlier this year. To keep up with this, top players within the space like Chaka, and Cowrywise, took steps to comply with the regulatory requirements.

Chaka acquired SEC’s “Digital Sub-Broker/Sub-Broker Serving Multiple Brokers Through a Digital Platform” license, making it the first recipient of the newly created license. Cowrywise also received a fund/portfolio management license from the same body. These licenses gave them the right to continue offering digital investment solutions to Nigerians.

In August 2021, the Central Bank of Nigeria froze the bank accounts of Nigerian fintech platforms Risevest, Bamboo, Trove and Chaka for 180 days.

The CBN alleged that these four startups were complicit in operating without license as asset management companies and “utilizing Foreign Exchange sourced from the Nigerian FX market for purchasing foreign bonds/shares in contravention of a CBN circular. This was after they received licenses from Nigeria’s Securities and Exchange Commission (SEC) to operate as digital platforms for buying and selling stocks.

This is a new entry in the list of shock waves fintech startups in the country have faced. It is true that regulation is crucial in any industry, however, frequent changes can stall progress. No one knows how long Nigerian startups can withstand the frequent regulatory changes, but for an industry like fintech that has brought in foreign investments in recent years, there is a need for regulation that encourages growth and innovation, instead of stifling it.

Partner Message

Time to take control of your investing journey. Did you know that the US Stock markets have returned on average 10% annually for nearly a 100 years? Are you aware that Bitcoin has been the best returning asset-class in the past decade? Learn the basics, stay updated for free at 30%Club here.

Have a great week

Thank you for reading Next Wave. Please share today’s edition with your network on WhatsApp, Telegram, and other social media and messaging platforms. Got suggestions, comments or ideas? Send an email to editor@techcabal.com.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT). Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

— Koromone Koroye, Managing Editor, TechCabal & Michael Ajifowoke, West Africa reporter, TechCabal