The Next Wave provides a futuristic analysis of BizTech and innovation in Africa. Subscribe here to get directly in your inbox on Sundays at 3 PM (WAT).

OPay’s ubiquitous green logo can be seen on the back of motorcycle helmets; OPay stickers plastered on the rear windows of Lagos danfos (buses); standing banners fixed next to POS shops or stalls manned by OPay agents. You might even see an OPay ad pop up before a YouTube video loads or while you’re playing a complex puzzle game on your phone.

OPay is green, audacious, and certainly here to stay.

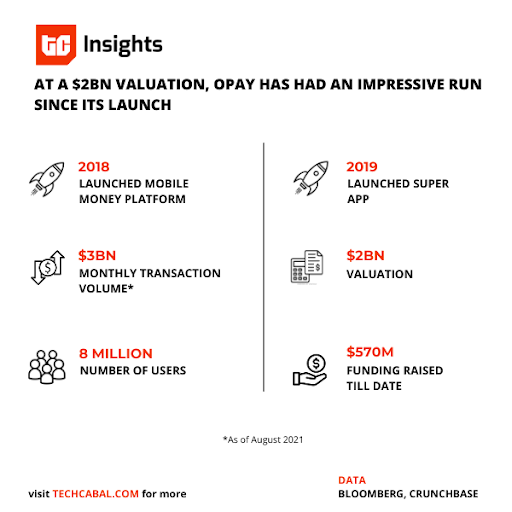

And their audaciousness has worked in their favor over the last three years. Since OPay launched in Nigeria in 2018, the company has achieved a series of milestones:

- They’ve raised over $500 million in funding. 💰 💰

- Their recent raise valued their business at $2 billion 💸💸💸

- Which means OPay is the latest unicorn un town 🦄

- They have 8 million users across Nigeria 📱

- OPay’s monthly transaction value has surpassed $3 billion ⭐️

These milestones are impressive, especially when you consider the fact that OPay is a three-year-old fintech startup that has operated primarily in one country: Nigeria.

This edition of Next Wave will explore OPay’s advantage and their plans to drive financial inclusion (the real kind) in Africa.

Special thanks to Abubakar Idris, former TechCabal reporter, for helping me fine-tune this angle.

Partner Message

The Flutterwave Mobile app, the app that turns any smartphone into a mobile POS is now redefining commerce.

The Flutterwave Mobile app: The app that turns any smartphone into a mobile POS is now redefining commerce. The Flutterwave Mobile app makes it super convenient for anyone to take their business with them anywhere, anytime. Learn how you can take your business anywhere, anytime here.

Zoom in: OPay’s online and offline advantage

“We want to be the power that helps emerging markets reach faster economic development.”

This statement was made by Yahui Zhuo, Opera’s CEO and Chairman, in an emailed response to Bloomberg a few weeks ago.

A number of fintech startups set up shop in Nigeria, promising financial inclusion for all, but somehow end up exclusively serving financially and technology-literate consumers. OPay is unlike these other fintech startups in the way they’ve strategically built their business to drive financial inclusion both online and offline.

Within OPay’s super app, users can pay bills, transfer money to other banks, request loans, chat with and send money to other OPay users, and save money with interest.

OPay’s mobile money business is thriving and the company reportedly processes about 80% of bank transfers among Nigerian mobile money operators. What this means is that a lot more people are using OPay to transfer money to other bank accounts than other fintech apps that offer a similar service.

OPay’s mobile money advantage is partly attributed to how aggressively they have marketed their mobile wallet services, targeting anyone who requires simple access to financial services.

But OPay hasn’t only successfully driven high adoption rates of their online services; the company has also done a stellar job with building an enviable POS agent network in Nigeria.

Between December 2018 and July 2019, OPay grew its number of agents from 5,000 to 40,000. By 2020, according to OPay Nigeria’s country manager, Iniabasi Akpan, their agent network had grown to 300,000 agents.

Comparatively speaking, Firstmonie (operated by First Bank of Nigeria) reportedly has over 120,000 agents; Paga has employed 27,000 agents and like OPay, currently operates only in Nigeria; and MTN Nigeria leads the charge with over 500,000 registered MoMo agents.

OPay’s agent network advantage is made possible due to the fact that the Fintech business acquired a Mobile Money Operator (MMO) license in 2019. With the MMO license, OPay can issue POS terminals to their network of agents around Nigeria.

OPay also operates under a switching license, which means that it doesn’t need to partner with any commercial banks to collect or process transaction or agency fees. It also means that OPay is running a very profitable business.

Most fintech startups that don’t have the required capital needed to obtain a coveted CBN license are forced to partner with Nigerian commercial banks that have the freedom to operate across multiple verticals, including electronic payments, card issuance, and merchant acquisition. For context, to obtain a CBN switching and processing license, a prospective business must deposit ₦2 billion (~ $3.77 million) in escrow in the apex bank.

Partner Message

Time to take control of your investing journey. Did you know that the US Stock markets have returned on average 10% annually for nearly a 100 years? Are you aware that Bitcoin has been the best returning asset-class in the past decade? Learn the basics, stay updated for free at 30%Club here.

Zooming out: What happens next with OPay?

Let’s circle back to OPay’s recent $400 million funding round led by SoftBank Vision Fund 2 with participation from Sequoia Capital China, Long-Z Capital, Redpoint China (are we seeing a trend here?) Source Code Capital, and a few other venture capital firms.

Looking beyond the impressive capital influx, OPay becomes SoftBank Vision Fund 2’s first foray into investing in an African fintech company. For SoftBank to bet on Africa in this way, the Japanese conglomerate has clearly seen untapped value in OPay and are willing to help the company reach its full potential.

And with plans to expand into other African regions including Egypt and Ghana, and the Middle East, OPay has a lot to prove over the next 5 – 10 years.

Expanding into Egypt is a strategic move because the North African country is home to Cairo, the 3rd most populous city in Africa and the 6th most populous city in the world. Where you find a populous capital, you will find opportunities to offer technology services to underserved communities and groups.

The Egyptian government is also playing its part to make the region more accommodating to local and international startups by setting up enabling entities like the Technology Innovation and Entrepreneurship Centre and Egypt Ventures, an investment vehicle focused on backing tech-enabled startups fostering innovation in Egypt.

Scaling quickly is the name of the game and OPay has become a key player in the mobile payments category. It will be worth keeping an eye on their expansion plans into the Middle East and North Africa (MENA) region. MENA’s startup scene is heating up and we’re going to see more investments pouring into that region’s ecosystem. In April of this year alone, 44 startups across the Middle East and North Africa have raised more than $175 million collectively.

Will OPay experience even more advantages outside Nigeria? We’ll see.

Partner Message

KB4-CON EMEA is a free, highly engaging, cybersecurity-focused virtual event designed for CISOs, security awareness and cybersecurity professionals in Europe, the Middle East and Africa. The event will be on Thursday, September 23rd and features keynotes from two of the most well known figures in cybersecurity. Mikko Hyppönen will cover how our global networks are being threatened by surveillance and crime, and how we can fix our technical, and human, problems. Kevin Mitnick will reveal social engineering tradecraft and insights and wow you with a live hacking demonstration. You can register here.

Have a great week

Thank you for reading Next Wave. Please share today’s edition with your network on WhatsApp, Telegram, and other social media and messaging platforms. Got suggestions, comments or ideas? Send an email to editor@techcabal.com.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT). Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

— Koromone Koroye, Managing Editor, TechCabal