IN PARTNERSHIP WITH

Good morning ☀️ ️

If you have missed some editions of #TCDaily over the past two weeks, our emails might have ended up in your Spam or Promotions folder.

To prevent this from happening in the future, we recommend that you move TC Daily to your primary folder.

For Gmail users: On your phone, click the 3 dots at the top right corner, click “Move to”, then “Primary.”

On desktop, drag and drop this email into the “Primary” tab near the top left of your screen

For Apple mail users: Tap on our email address at the top of this email (next to “From:” on mobile) and click “Add to VIPs.”

In today’s edition:

- Scrapays is turning trash into treasure

- The Epic Apple battle

- TC Insights: Last mile insurance

- How connected are you?

SCRAPAYS IS TURNING TRASH INTO TREASURE

What if I told you that you could turn your trash into a little bit of cash?

Every year, the world produces about 2.1 billion tonnes of trash. To put it into perspective, we produce enough trash, daily, to fit into 14.7 million football stadiums, depending on the density of the waste, and if the standard size of each field were half an acre.

That’s a lot of plastic bottles, styrofoam packs, paper, nylon bags, and straws being thrown away every year. There are options to recycling this waste but they’re not as popular as you’d think.

The US, which contributes 12% of the global garbage, recycles only 35% of its waste while Germany, the highest as of 2019, recycles 65% of its waste.

Bringing it a little closer to home, Sub-saharan Africa produces 174 million tonnes annually; and of that number, Lagos, Nigeria contributes about 5 million tonnes annually. Per day, the number is about 15,000 tonnes and only 40% of waste generated is collected and just 13% is recycled each year. The rest – including materials that could feed the local recycling industry – litters the streets and clogs open drains.

Scrapays, a trash-for-cash initiative in Nigeria, is tackling the waste problem in Lagos and helping everyone from waste collectors, and recycling centers to turn a profit. There’s an $8 billion potential in recycling waste, and Scrapays is tapping into the industry.

The alchemy behind it all

Scrapays is the brainchild of Boluwatife Arewa, Tope Sulaimon, and Olumide Ogunleye, while they were students at the Federal University of Technology Akure (FUTA).

The startup is using technology to facilitate a decentralised ecosystem for recovering recyclable waste in Nigeria. The startup facilitates the transfer of waste starting with everyday waste producers such as individuals or SMEs, who can request waste pickup through Scrapays’ USSD code, mobile app or website.

The next link on the chain are the collectors who receive the waste from the producers. Scrapays collectors are largely made up of informal waste pickers who are equipped with digital scales and customized carts. They collect the waste, sort through it, and calculate the monetary value using the mobile app.

Next are the agents who temporarily store the waste received from the collectors, before logistics partners can transport them to centralised processing spaces where they are sold off to several local companies that convert the material into finished products like tissue paper or textile materials.

How much does everyone receive?

Using a wallet-based system, Scrapays operates a revenue-sharing model that allows all stakeholders in the value chain – from producers to all its partners – to earn commission per kilogram recovered.

Waste producers get paid directly in mobile wallets and funds can be redeemed in cash or directly transferred to the individual’s account. They can also be used to buy airtime or make purchases on Scrapays’ partner marts.

Michael Ajifowoke has more in How Scrapays is helping Nigerians get value from waste with USSD technology.

THE EPIC APPLE BATTLE

Apple is a huge tree. It literally has a lot of branches everywhere and these branches grow a lot of fruit. Apple is a $2 trillion company after all. But being a company worth that much means that Apple is in constant litigation in different parts of the world where it’s either disputing copyright issues, defamation suits, or even consumer class actions for wry tactics like pushing the sales of newer iPhones by slowing down older iPhones.

Last month, I wrote about Apple’s proposed court settlement with app developers. The tech company is planning to launch a $100 million fund to support (or compensate, if we’re being honest) app developers in the US.

This settlement, as was speculated, was made in hopes of currying the favour of a certain judge who was also presiding over another litigation Apple was involved in.

The issues in Apple Inc v. Epic Games are a bit similar to the one we discussed last month.

In August of 2020, the gaming company which owns popular hits like Fortnite and Infinity Blade, introduced a direct payment system for its online game, Fortinite. This is in direct contradiction with the agreement all app developers have with Apple. The agreement, in simple terms, is this: if your app is accepted and put on the Apple store, all purchases of the app and in-app must be made through Apple’s payment gateway which will then entitle Apple to 30% of whatever you make.

Fortnite damned this last year and their app got taken off the App store almost immediately. In response, Epic launched an antitrust suit against Apple seeking to establish Apple’s App store as a monopoly.

Months later, the case finally came to a close after Judge Yvonne Gonzalez handed down her judgment. Who won and who lost?

The real winners are other developers, not Apple nor Epic.

If Apple was hoping that the Judge would see their earlier compromises and have pity, their wish may have come true although it’s one of those things that come back later to bite you in the posterior.

In summary, the honorable judge’s 185-page ruling (yes, that’s how long these things can get) has given both sides a little edge.

Epic Games was ruled to have violated its contract with Apple by introducing a new payment gateway for their app. They will now have to pay Apple 30% of the amount they made through their getaway, a total loss when you consider the fact that they ran a 30% discount in order to get people to use their alternative payment system in the first place. Of the $12.2 million they made, Apple will be getting $3.6 million.

Now Apple may be getting some cash from this lawsuit but parts of the ruling also means they’ll lose billions more in the future as they can no longer prevent developers from including alternative payment gateways for their apps. While Apple doesn’t release data on their App revenue per year, the estimates are around $64 billion and this judgment threatens that.

Zooming out: In the end, neither Epic nor Apple got what they wanted. Apple can still decide to keep Fortnite off its App, but very soon, other developers will be able to include alternative modes of payments for their apps.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

TC INSIGHTS: LAST MILE INSURANCE

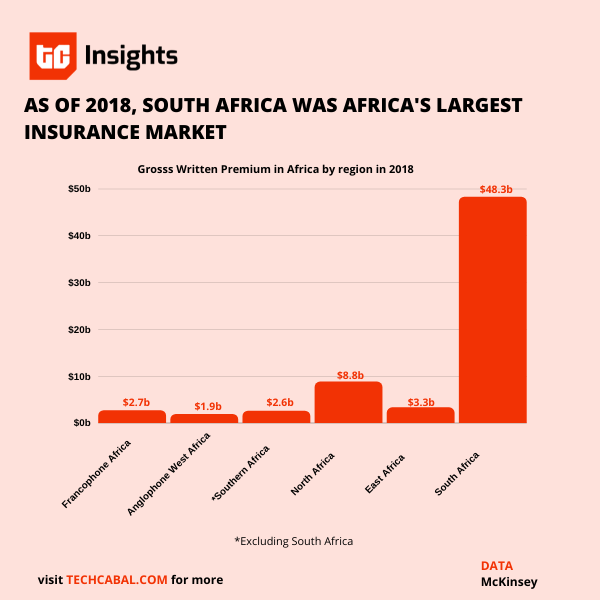

Economic growth across Africa is reshaping its insurance market. It is the second-fastest-growing insurance market in the world, behind Latin America, and it’s expected to grow at 7% per annum from 2021 to 2026. This figure is approximately twice that of North America, more than three times that of Europe, and slightly higher than Asia’s 6%.

In 2019, Africa’s insurance premiums were valued at $68.5 billion. Compared to Latin America & the Caribbean’s $157 billion, Asia’s (excluding China) $194 billion; it is far from achieving its potential.

The market is highly fragmented and unequally distributed across countries. 91% of insurance premiums are concentrated in only 10 countries, with South Africa holding 70% of the entire figure.

As the continent recovers from the financial effects of the COVID-19 pandemic, the industry is likely to see new gains. Traditionally, insurance companies across the continent sell insurance products and services through brokers and agents. However, this approach limits some segments of the population as brokers are unlikely to target customers in the informal sectors. In recent years, however, there has been a shift to digital channels. Online platforms are now being used to process end-to-end transactions.

Innovative companies like Jumo, ACRE Africa, and MobiLife are aligning their strategy to meet the needs of low-income consumers. By leveraging digital innovation, they are able to offer products that are less reliant on expensive legacy infrastructures. This allows them to reach underserved market segments.

Usually, customers tend to have more information about themselves than insurance companies. By using data analytics, companies are able to bridge this gap by mining data to get a profile of the customer. This means products are created to fit the customer’s needs.

Furthermore, partnerships with mobile network operators (MNOs) mean insurtech companies can leverage existing customer base, thereby increasing reach. Mobile technology such as USSD codes and text messages reduce complexity for consumers and accommodate low cash flows. In the same vein, it ensures fast, and cost-effective pay-out of claims without depending on traditional banking infrastructure or accounts.

As technology continues to disrupt Africa’s insurance sector, new markets will be unlocked and more people will have access to insurance across the continent.

Get all our reports here and watch videos from our events. Send your custom research requests to tcinsights@bigcabal.com.

KB4-CON EMEA is a free, highly engaging, cybersecurity-focused virtual event designed for CISOs, security awareness and cybersecurity professionals in Europe, the Middle East and Africa.

The event will be on Thursday, September 23rd and features keynotes from two of the most well-known figures in cybersecurity. Mikko Hyppönen will cover how our global networks are being threatened by surveillance and crime, and how we can fix our technical, and human, problems. Kevin Mitnick will reveal social engineering tradecraft and insights and wow you with a live hacking demonstration. You can register here.

HOW CONNECTED ARE YOU?

Last week, Wiza Jalakasi, VP of Global Developer Relations at ChipperCash, tweeted this question: “How many things in your house have the ability to connect to WiFi?”

This question, and the replies under it, brought some pretty interesting notes I wanted to share with you.

Internet penetration in Africa stands at 29% – a pretty low compared to other continents. And the replies to Wiza’s question reveal just how much this low number affects IoT penetration in Africa.

Sidebar: Internet of Things (IoT) refers to the ability of physical devices to collect data and connect to the internet due to sensors, or software embedded in them. Think of remote-controlled devices like rechargeable fans, toys, traffic lights, or even jamboxes.

IoT Penetration around the world

There are about 10 billion devices using IoT right now, and the value of the industry is greater than $500 billion. While other parts of the world have been pretty open towards embracing IoT, embedding the system in simple household items like vacuum cleaners, or complex systems like smart cities, Africa is understandably a little behind.

Challenges in Africa

As I’ve said, the replies to Wiza’s tweet are interesting. Some people had claimed to have as many as 57 devices connected, while the lowest number – the most likely number for many – is 2, a laptop and a phone.

In conversations like this, I like to remind myself that as exciting as the numbers appear on social media, they’re probably lower in real life, considering how many people have access to the internet or even social media.

Since internet penetration in Africa is quite low, then it stands to reason that the percentage for connectivity of things is low as well.

The reason? Well, poor power supply, low internet penetration, network capacity constraints, and even poverty all play contributory roles to this. In essence, there’s a lot of work to be done as this paper explains.

Nevertheless, there are still a few countries that are doing exemplary work with IoT in Africa. There are waste management systems in Kenya, remote appliance control systems in Egypt, product verification initiatives in Nigeria, and electronic tolling systems in South Africa that make lives easier for Africans.

Even with all the barriers, people are still finding a way to connect themselves to the rest of the world. I’m connected in seven ways. How connected are you?

Meet intrepid entrepreneurs from Africa and South Asia, hear their stories and learn from Stanford University faculty how to transform today’s challenges into tomorrow’s opportunities. Listen to Grit & Growth wherever you get your podcasts.

JOIN THE CABAL!

Big Cabal Media is hiring for some super important postions! Supercharge your career with us!

- Big Cabal Media – Senior Sales Manager – Lagos, Nigeria

- TechCabal Insights –Junior Analyst – Remote – Deadline: September 17

- TechCabal Insights – Lead Analyst – Lagos, Nigeria – Deadline: September 17

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

OPPORTUNITIES: FT X SEEDSTARS CHALLENGE

Financial Times is partnering with Seedstars to host a competition aimed at empowering promising, impact-driven startups and entrepreneurs with learning and funding opportunities.

On the FTxSDG Challenge, one hundred and fifty (150) participants will be invited to solve real business challenges and present innovative strategies with a focus on the SDGs.

The event programme includes one-month’s access to the Investment Readiness Sessions by Seedstars and a five-day event filled with workshops, masterclasses, talks, mentoring and networking hosted by FT and Seedstars experts. Winning startups will be fast-tracked to the Seedstars Investments Fund and have the opportunity to secure up to $500,000 in funding.

Find out more about the challenge here.

What else we’re reading

- Over the years, there have been complaints on how Instagram’s algorithm prevents people from seeing posts by people they actually follow. Now, Instagram is testing a new feature that will let you choose whose posts appear first on your feed.

- A collaborative project in Botswana is using unmanned drones to get emergency healthcare products and services to remote communities.

- To decrease the possibility of fraud, South Africa is developing digital vaccine passports so that vaccinated people can travel seamlessly.

- As e-hailing apps grow more popular in South Africa, taxi drivers are getting more agitated. So agitated, in fact, that some of them have begun targeting and attacking the drivers who use these apps.