IN PARTNERSHIP WITH

Good morning ☀️ ️

If you have missed some editions of #TCDaily over the past two weeks, our emails might have ended up in your Spam or Promotions folder.

To prevent this from happening in the future, we recommend that you move TC Daily to your primary folder.

For Gmail users: On your phone, click the 3 dots at the top right corner, click “Move to”, then “Primary.”

On desktop, drag and drop this email into the “Primary” tab near the top left of your screen

For Apple mail users: Tap on our email address at the top of this email (next to “From:” on mobile) and click “Add to VIPs.”

In today’s edition:

- Why is Nigeria’s CBN going after abokiFX?

- Gassing up is burning Kenyans out

- TC Insights: Stemming Africa’s talent flight

- Tech Probe

- Events: Four days until #TheFutureofCommerce

WHY IS NIGERIA’S CBN GOING AFTER ABOKIFX?

The Central Bank of Nigeria (CBN), is going after the country’s popular foreign exchange rating platform, abokiFX.

abokiFX is a mobile and web-based platform that collates the black market foreign exchange rates in Nigeria. Basically, the platform tells you how much naira you can get for your dollars or pounds. In fact, if you live in Nigeria or trade in naira, you’ve probably used abokiFX.

Well, you can’t anymore because the CBN has ordered that the platform be taken down. They’re also planning to prosecute the alleged owner, Olusegun Adedotun Oniwinde.

Why?

For economic sabotage. For illegal forex trading. For illegal activities that undermine the economy.

Or at least that’s what CBN governor, Godwin Emefiele, says.

Unlike other countries, Nigeria has different exchange rates. This includes a strong official rate published by the CBN itself, a weaker one for investors and exporters known as the NAFEX window, and the parallel or black market where foreign currencies are traded unofficially and the naira is often valued less than the NAFEX rate.

Here’s a quick illustration: In March, the official dollar rate by the CBN was set at ₦379 to $1, while the NAFEX rate was ₦410.25 to $1. But on the black market, the rates went as high as ₦482.25 to $1.

What does this have to do with abokiFX?

abokiFX is a parallel window. The website collates data from BDCs and black markets in Lagos, Nigeria, and publishes the rates so people know what to expect.

CBN doesn’t believe this though. The apex bank believes that the platform manipulates forex by publishing false rates, all for a tidy profit.

Michael Ajifowoke has more in Explained: What’s happening between Nigeria’s central bank and abokiFX?

GASSING UP IS BURNING KENYANS OUT

If you want to go for a nice drive in Kenya, it’s going to cost you.

No, really. Kenya is now the most expensive country to buy fuel in East Africa. At an average of $1.20 per litre, you’ll pay $0.17 more for a litre of petrol in Kenya than in Tanzania, Uganda and Rwanda.

Why, though?

The Kenyan shilling weakened due to an increased demand for dollars from the energy sector and importers.

There is a fund in place that can be used to stabilize prices in times like these, but Kenyan authorities decided not to tap into it as they’ve previously done, citing unsustainability as the reason.

Kenyan motorists also pay nine different taxes on fuel including the Petroleum Regulatory Levy, Railway Development Levy, Anti-adulteration Levy, Merchant Shipping Levy and the Import Declaration Fee, all of which contribute to the high cost.

A 10-year-high

Petrol prices are at a 10-year high and everyone is feeling the pressure. Last Thursday, public service vehicle operators (also called matatus in Kenya) held protests arguing that the new price of fuel is pinching their profits. Motorists also staged demonstrations, using boulders to block the Migori-Isebania highway that connects Kenya and Tanzania.

The price hike will have resounding effects on the cost of goods and services in Kenya. After all, history has shown us what happens when fuel prices get too high, too fast. Inflation!

A

Remember Ecuador in 2019? Protestors took to the streets – the President declared a state of emergency and had to move the government out of the capital. But can governments subsidise their petrol prices forever? Subsides cost money. In Ecuador, the government required funds to pay off mounting fiscal debt. Cutting fuel subsidies saved them an estimated $1.3 billion annually.

Kenya’s Energy and Petroleum Regulating authority will review retail fuel prices again on October 14th.

But measures to cushion the economy should be taken well before then. Many Kenyans thought the fuel prices would be revised downward, and weren’t prepared for the hit.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

🏾 Learn more at paystack.com/storefront

This is partner content.

TC INSIGHTS: STEMMING AFRICA’S TALENT FLIGHT

African startups are solving the continent’s problems using technology. Mobile apps are disrupting and enhancing the growth of diverse industries as funding continues to increase.

At the root of this growth is the ingenuity of founders, the problem-solving skills of developers, and the war chest of venture capital. Yet, there is a shortage of developers across the continent to power this new digital wave. The digital economy is projected to contribute 5.2% to the continent’s total GDP by 2025. This is a huge leap, when compared to the 1.1% it contributed in 2012.

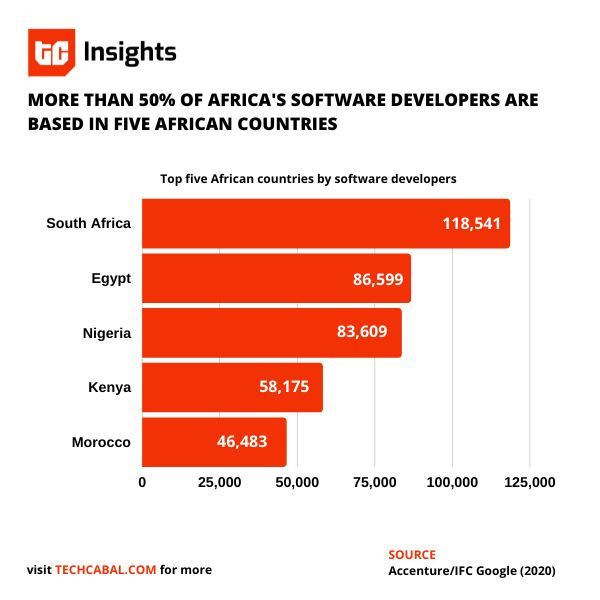

According to an IFC/Google report, there are nearly 700,000 professional developers in Africa, with more than 50% of this number in five countries: Egypt, Kenya, Morocco, Nigeria, and South Africa. It’s a low figure when compared to Latin America’s 2.2 million and California’s 630,000 developers.

But the journey has just begun.

One advantage Africa has is its young population and the increasing interest in software development. Half of Africa’s population is under 25 years old. Each year until 2035, there will be half a million more 15-year-olds than the year before, the World Bank predicts in its Youth Employment in Sub-Saharan Africa report. Many of them will learn quickly and become junior developers in a short time but it’ll take years of experience and executed projects to become senior software developers.

There is a low supply of experienced developers across the continent. It is a problem that made tech talent training/outsourcing firm, Andela change its business model. In African countries with smaller developer populations, 43% of developers have one to three years of experience, compared to 22% in the US. As it stands, there is a global competition for senior developers and Africa is at risk of losing its best hands.

With COVID-19 accelerating the shift to remote work, many senior developers across the continent are increasingly seeking opportunities outside the continent. This has led to homegrown startups considering equity options for them. It remains to be seen if that will stop/reduce the talent flight out of Africa and accelerate the growth of the digital economy.

Get all our reports here and watch videos from our events. Send your custom research requests to tcinsights@bigcabal.com.

KB4-CON EMEA is a free, highly engaging, cybersecurity-focused virtual event designed for CISOs, security awareness and cybersecurity professionals in Europe, the Middle East and Africa.

The event will be on Thursday, September 23rd and features keynotes from two of the most well-known figures in cybersecurity. Mikko Hyppönen will cover how our global networks are being threatened by surveillance and crime, and how we can fix our technical, and human, problems. Kevin Mitnick will reveal social engineering tradecraft and insights and wow you with a live hacking demonstration. You can register here.

This is partner content.

TECH PROBE

Share your answer with us on Twitter and Instagram, or send a reply to newsletter@techcabal.com.

We’ll publish the most interesting answers on Friday.

EVENTS: 4 DAYS LEFT UNTIL THE #FUTUREOFCOMMERCE IS OFFICIALLY LIVE

The Future of Commerce is only four days away! We’re very excited to usher you into all that’s changing in how we buy and sell.

This Friday, the 24th of September, we’ll be discussing with some of the most insightful speakers on and off the continent, from innovative startups to prestigious banks and more. Check here if you haven’t met them yet.

We have many great sessions lined up as well, and we’re sure you’ll learn plenty from not one, not two, but all of them!

What about our pitch sessions? Whether you’re a startup looking for investors, or you’re simply on the hunt for a strategic partnership, we have something just for you!

We’re leaving no stone unturned and neither should you. So, if you haven’t registered, fix that quickly by signing up now!

The Future of Commerce is brought to you in partnership with DAI Magister and Paystack and is sponsored by Doroki, Chipper Cash, Klasha, VerifyMe and GIG Logistics.

Next on the Grit & Growth podcast: meet Elo Umeh, CEO of Terragon Group, a Nigerian marketing and insights firm, and experts from TLcom Capital, and learn how to maximize the value of your firm’s next fundraising round. Listen here.

This is partner content.

JOIN THE CABAL!

Big Cabal Media is hiring for some super important postions. Supercharge your career with us!

- TechCabal – Consumer Tech & Digital Culture Writer – Africa – Deadline: September 30

- Big Cabal Media – Senior Sales Manager – Lagos, Nigeria – Deadline: September 24

- Big Cabal Media – Business Development Intern – Lagos, Nigeria – Deadline: September 25

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

What else we’re reading

- Didi is China’s dominant ride-hailing service, with 550 million annual active users globally. Now, the service is aiming for an increase as it plans to expand to Lagos, Nigeria.

- An MTN-Airtel market dominance is forcing another telecom, Africell, out of Uganda.

- After COVID limited the seating capacities of churches in Kenya, Jumuisha, a fintech startup, came in to help churches organize their events and receive donations from all over the world.

- Last year, Nigeria’s largest banks recorded a $194m income from electronic channels in the first half of the year. In H1 of 2021, they’ve gained a 51% increase with $282m from mobile apps, POS, online banking services, and USSD transactions.

- Here’s why the World Bank Group is discontinuing its Doing Business report.