Table of contents

The Bank Verification Number, a.k.a. BVN, is a must-have for anybody who wants to access robust financial services in Nigeria.

What’s BVN?

The BVN is like a security number, but for banks and other financial institutions to identify an individual with their bank account details. It’s a unique 11-digit number allocated to you upon biometric registration.

Biometric registration refers to the identification of an individual based on their physiological attributes: fingerprint, voice, facial features, etc.

To address the increasing compromise of customer security data like passwords and PINs, and the challenges banks face with identity management, the Central Bank of Nigeria (CBN), in collaboration with all Nigerian banks launched a centralised biometric identification system called the Bank Verification Number (BVN), on February 14, 2014.

Since then, the BVN has been used to identify customers. But many people have issues obtaining their BVN and accessing financial services because they forget or don’t have them saved.

Luckily, you don’t have to enter the banking hall to obtain your BVN. You can check your BVN number wherever you are, on your phone, without compromising your security. Then you can save it for future use.

All telecom providers in Nigeria enable users to perform this task.

When do you need your BVN?

You’ll need your BVN for more than just opening a bank account. It’s increasingly being used across various sectors to verify your financial identity. Here are common situations where your BVN is required:

- Opening new bank accounts: Most banks will not process account opening without a valid BVN, even for online-only accounts.

- Linking multiple accounts: If you bank with more than one institution, your BVN helps create a unified customer profile.

- Accessing government benefits or grants: Programs like TraderMoni, NPower, and other social intervention schemes often require your BVN for verification and fund disbursement.

- Applying for loans or credit facilities: Whether through your bank or digital lenders, your BVN is used to assess your creditworthiness and prevent duplicate borrowing.

- Recovering a locked or inactive account: If you lose access to your bank account, your BVN helps verify your identity and restore access.

- Registering for fintech services: Wallets and fintech apps (like Opay, PalmPay, or Carbon) often request your BVN to comply with CBN regulations.

- Verifying your identity at NIMC: Since the BVN is being linked with the NIN, it’s useful during national identity verification or updates.

8 simple ways to check your BVN in Nigeria

Need to check your BVN? There are several easy ways to do it, and you don’t have to visit the bank or fill out any long forms. Here are the most reliable methods you can use:

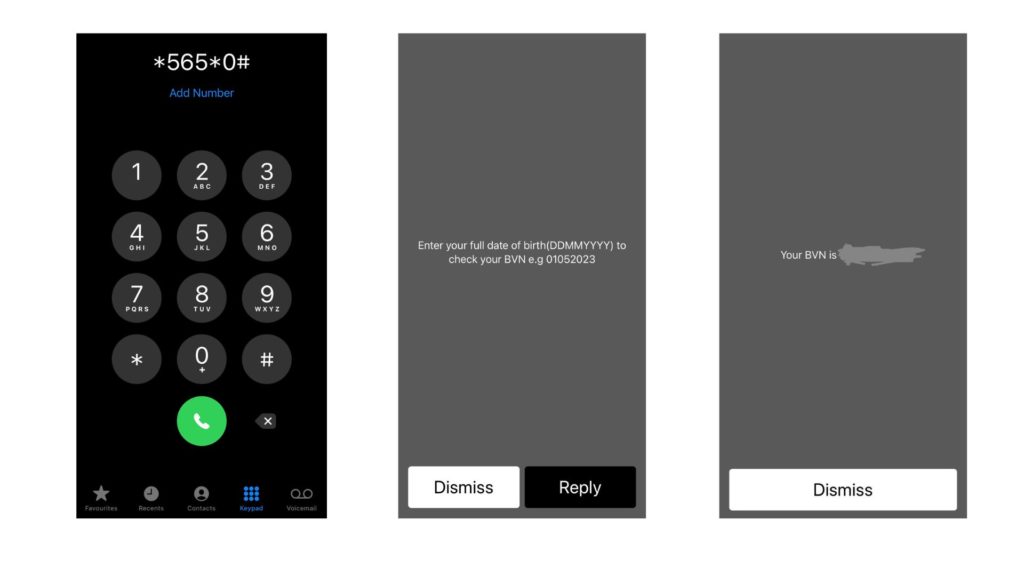

1. Check your BVN using USSD code (*565*0#)

This is the most popular and most straightforward method in Nigeria. Just dial *565*0# from the same phone number you used to register your BVN. Your 11-digit BVN will show up on your screen after a short verification.

Tip: Make sure you have at least ₦20 airtime on your phone, as the service isn’t free.

This method works on any mobile phone, with or without internet, and no smartphone is needed. It supports MTN, Airtel, Glo, and 9mobile. It’s beneficial if you live in areas with poor internet or just want something quick and stress-free.

But keep in mind: If the phone number you used is no longer active or linked to multiple BVNs, this method won’t work. You’ll need to try another option or update your phone number with your bank.

2. Use the NIBSS BVN Validation Portal (Online)

If you have internet access, you can check your BVN online using the official NIBSS BVN Validation Portal.

Here’s how:

- Visit the portal online (just search for “NIBSS BVN validation”).

- Enter your full name, phone number (linked to your BVN), and date of birth.

- Pay a small ₦20 fee using your card or bank account.

- Once payment is successful, your BVN will appear on your screen.

This method is suitable if you’re more comfortable with online interactions. It’s quick, secure, and works anytime, as long as your details are correct.

3. Through your bank’s mobile app

Many Nigerian banks now display your BVN right inside their official mobile apps. If you’ve already set up your banking app, this is a simple way to find it.

Just follow these steps:

- Open your bank’s mobile app (like GTWorld, UBA Mobile, AccessMore, or FirstMobile).

- Log in with your username and password.

- Look for “Profile”, “Account Info” or “Personal Details” — that’s where your BVN is usually displayed.

- Copy or save it safely.

If you haven’t used your bank’s app before, you’ll need to download it from the Google Play Store or Apple App Store and complete the setup.

Ensure your app is updated to the latest version to avoid missing this feature.

4. Check your BVN using your bank’s Internet Banking

If you’re more comfortable using a computer than a mobile app, you can check your BVN through your bank’s internet banking platform.

Here’s how to do it:

- Visit your bank’s official internet banking website.

- Log in using your username and password.

- Go to sections like “Account Info”, “Profile”, “Personal Details”, or “Account Summary.”

- Your BVN should be listed along with your other account details.

Safety tip: Always double-check the website address to make sure you’re on the real banking site. Look out for the padlock symbol in the browser to know it’s secure.

Some banks, such as Zenith Bank, may display your BVN under sections like “BVN Update” or “Account Info”. Most banks follow similar steps, so once you’re logged in, it shouldn’t take long to find it.

5. Visit your bank branch

If you prefer speaking with someone face to face or can’t access your BVN online, walking into your bank is a trusted option.

To do this:

- Visit the bank branch where you first registered for your BVN.

- Go along with a valid ID, National ID, driver’s license, international passport, or voter’s card.

- Head to the customer service desk and ask to retrieve your BVN.

- They’ll confirm your identity and then provide you with the BVN, either as a printout, via SMS, or by email.

This is a good option if your phone number has changed or if none of the digital methods are working for you. Banks also use this in-person method when they need to update your phone number or other essential details.

6. Call or email the NIBSS helpdesk

You can also contact NIBSS directly, the body that manages the BVN system in Nigeria.

Here’s how:

- Call: 0700-2255-226 (toll-free)

- Email: bvn@nibss-plc.com.ng

When you call or email, you’ll need to give your full name, date of birth, the phone number linked to your BVN, and your email address. Once your details are confirmed, they’ll send your BVN to you.

This is helpful if you’re not sure which bank you used to register or if you’re stuck and none of the other options are working.

7. Check your BVN enrollment slip

If you still have the paper slip you got when you registered for your BVN, you can simply check it to find your number.

The slip has your 11-digit BVN printed clearly on it.

This option only works if you kept the slip in a safe place. If it’s missing or damaged, you’ll need to use any of the other methods listed here.

8. Visit a NIMC office

Because your BVN and NIN are now being linked together, NIMC offices can also help you retrieve your BVN, especially if it has been connected to your NIN.

Here’s what to do:

- Go to any nearby NIMC office.

- Take your National Identification Number (NIN) with you.

- You’ll also be asked to confirm other details like your name, date of birth, and phone number.

- If your BVN is linked to your NIN, they can help you pull it up.

If you don’t know if your BVN has been linked to your NIN, dial *346# using the phone number connected to your BVN. You’ll get a message telling you if your NIN has been assigned based on your BVN.

This method demonstrates how the government is working to integrate identity systems in Nigeria. And with time, checking either your BVN or NIN could become even easier.

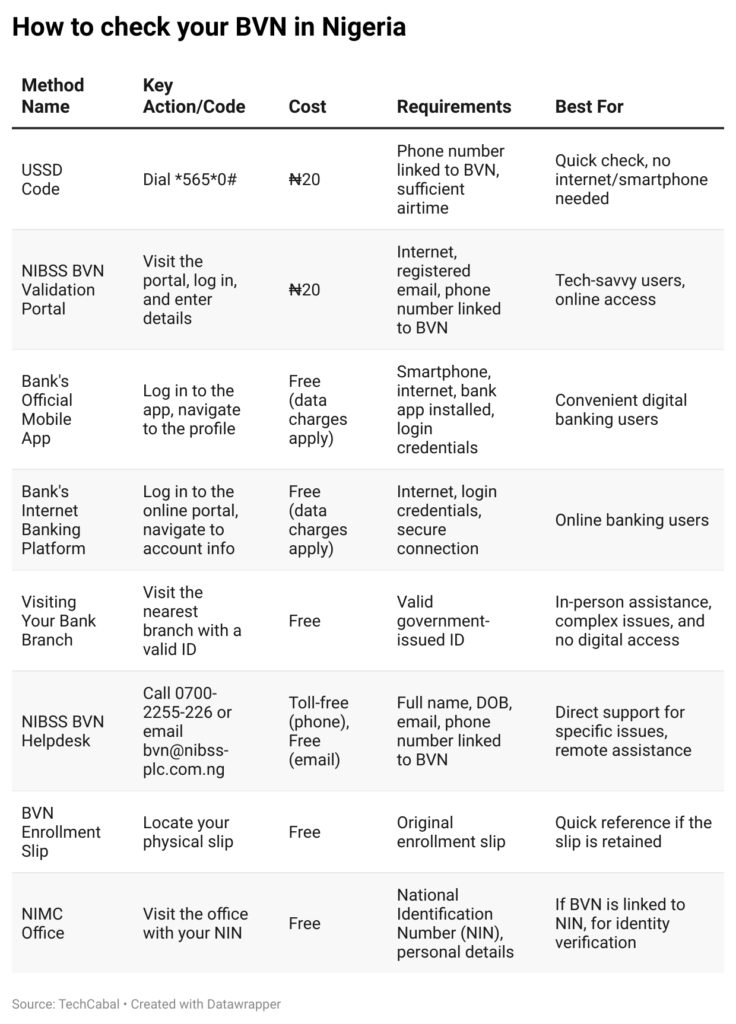

Quick reference guide: How to check your BVN in Nigeria

For quick access to the most suitable BVN retrieval method, the table below provides a concise overview based on everyday needs and resources.

Final thoughts

Your Bank Verification Number (BVN) isn’t just another number; it’s your financial ID that helps protect your money and gives you access to important banking services across Nigeria.

There are plenty of ways to check your BVN:

- Dial 5650# on your phone

- Use the NIBSS online portal

- Log in to your bank’s app or website

- Visit your bank branch

- Reach out to NIBSS via telephone or email

- Check your enrollment slip

- Visit a NIMC office

Just pick the one that’s easiest for you.

But don’t forget, keeping your BVN secure is just as important as knowing it. Don’t share it carelessly, stay alert for scams, and always keep your details updated with your bank.

As BVN and NIN continue to be linked and made mandatory for all accounts, not having your BVN or letting it fall into the wrong hands can block you from using banking services or put your money at risk.

So stay safe, stay informed, and treat your BVN like the critical key it is.