IN PARTNERSHIP WITH

Good morning ☀️ ️

Netflix is launching its free plan in yet another country.

While Kenya was first to get the feature, Vietnam will be second.

In today’s edition

- Becoming Africa’s ASOS

- Helping Risevest rise

- Getting high on low emissions

- TC Insights: Harnessing blockchain

- Tech Probe

BECOMING AFRICA’S ASOS

When Wunmi Akinsola relocated to Nigeria in 2018, she had just one goal in mind: to work for a company doing what ASOS is doing in Europe.

Armed with a master’s in Entrepreneurship and Innovation, experience in founding a fashion brand worth over £1 million with her sisters, and her own B2B fashion outlet, Akinsola set out to lead the pack of young people building a thriving fashion economy for Africa.

Her dream birthed Fashtracker, a pan-African fashion marketplace, which recently won the Future of Commerce Pitch Contest.

While Fashtracker was initially built to make buying and selling of African fashion easy for Africans within the continent, that changed when more of its traction came from outside the continent.

Tracking the impact of African fashion

In 2019, Beyonce pushed Senegalese brand, Tongoro by Sara Diouf, into global spotlight with her “Spirit” music video. Similarly, leading Nigerian designer, Deola Sagoe, has had her pieces showcased by Will Smith and Oprah Winfrey.

There’s an undeniable craving for African fashion, and the mass adoption of eCommerce is channeling this craving into cash. The African fashion industry is at an estimated value of $31 million while the textile industry on the continent could generate as much as $15.5 billion by 2025.

In fact, one of the biggest markets, an Abidjan-based fashion-tech startup, Afrikrea, has recorded over $4 million in transactions since its inception in 2015.

Read more: Wunmi Akinsola is building “Africa’s ASOS” one brand at a time.

HELPING RISEVEST RISE

Over the past year, fintechs have begun employing a marketing strategy well deployed by telcos on the continent: hiring brand ambassadors.

Last year, Patricia signed on Zlatan and a host of others while WorldRemit pinned down Patoranking. More recently, in October, Chipper Cash launched in the US with a little shout-out from Grammy winner, Burna Boy.

Risevest is the latest fintech to join the trend by signing on Teni Makananki to become its first-ever brand ambassador.

Why the trend is rising

Word-of-mouth, or referral marketing, has proven to be the most effective way of acquiring new customers and keeping them. Referred customers are more likely to spend more and keep spending. In 2012, Harvard Business found that brand ambassadorship could help generate a 4% increase in sales.

And who better to refer customers than celebrities with large fan bases and social standing? A 2013 study discovered that celebrity endorsements helped 85% of consumers gain confidence in brands while another in 2020 showed that 50% of people were more likely to use products and services celebrities use.

Zoom out: It’s undeniable that brand ambassadors help build confidence in products but it’s a double-edged sword that, if done improperly, could hurt the brand and the ambassador. For example, Nike’s ambassadorship with Oscar Pistorius turned sour after the athlete was charged with killing his girlfriend.

AIn Ep. 2 of Artwork, learn how to set your rates while attracting and retaining the best clients.

👉🏾 Watch now.

This is partner content.

GETTING HIGH ON LOW EMISSIONS

We’ve been going hard on climate change this month.

That’s because the 2021 United Nations Climate Change Conference was held this month, and the world is asking questions. In 2020, the world’s wealthiest nations made a commitment to spend $100 billion a year on the fight against climate change for emerging economies, but the funds have yet to be delivered. This, combined with the highly publicised conference, has made the public more aware of the urgency with which growing economies need to deal with climate change.

A small contribution

Agriculture is one of the largest contributors to greenhouse gases.

Though East Africa’s agriculture industry is dominated by smallholder farmers that contribute markedly less emissions than that of large-factory farms, the region’s agritech companies are already doing their part to deal with the ripple effects of climate change.

Hello tractor, bye-bye high emissions

Hello Tractor, an agritech company that connects tractor owners to smallholder farmers in need of tractor services, with offices in Nairobi and Abuja, works with its farmers to implement no-till farming, a method that involves leaving crop residue on the field and applying fertilizers and seeds more precisely to create a carbon sink for storing and sequestering carbon. But no-till farming requires specialised equipment that many farmers cannot afford due to a lack of credit facilities.

To aid farmers in their low emissions journey, the startup offers pay-as-you-go tractor financing to rural entrepreneurs, regardless of banking history. To qualify for equipment, loan farmers need only pre-book 500 farmer customers for services. Hello Tractor then deducts a small amount of the farmer’s profit to repay the loan and tracks financing through IoT fleet management tech.

Join the Future Africa Collective – an exclusive community of investors who invest in startups building the future. With a $300 quarterly fee, you get access to invest a minimum of $2,500 in up to 5 high-growth African startups.

This is partner content.

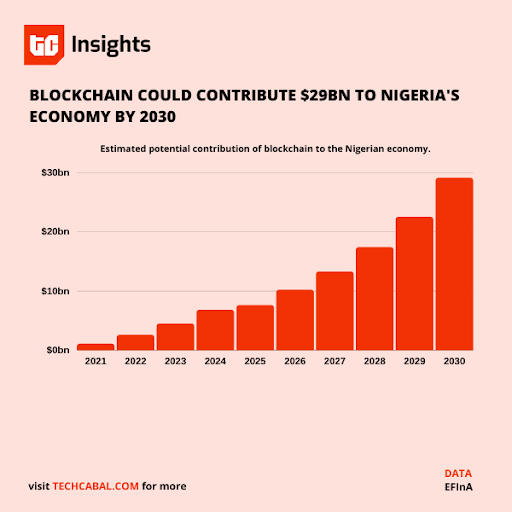

TC INSIGHTS: HARNESSING BLOCKCHAIN

Two major events could happen by 2030.

One, Nigeria could become the first African country to reach $1 trillion in GDP. Impressive? Secondly, the blockchain industry is projected to contribute an additional 76% to that number, bringing it to a total of $1.76 trillion.

In Nigeria, the blockchain industry could add $29 billion to the economy within the next decade.

Blockchain helps organisations save on the cost of supply chain leaks or errors by helping them conduct source verification, i.e., the ability to verify and monitor the sources of their goods from end to end.

Globally, $962 billion of the blockchain industry’s contribution could come from source verification. In Nigeria too, source verification could be the biggest blockchain contributor to the economy in the near future.

Blockchain’s second-biggest use case is in payments and financial instruments ($433 billion). Blockchain is improving the payments infrastructure through digital currencies, and it also facilitates cross-border payments. Across many African nations including Nigeria, Kenya and Ghana, crypto startups are making it easier for traders to pay their vendors across borders.

However, the growth of blockchain is hindered by a number of factors. One that is major is the lack of trust in the internet and digital services. Technology is evolving so much and so fast, and it elicits two kinds of reactions: excitement and skepticism.

This skepticism stems from a limited understanding of blockchain and its capabilities.

There’s also the tendency for people, especially policymakers, to associate blockchain with criminal activity due to the anonymity it grants users. The concerns are not unfounded. In 2019, $21.4 billion worth of transfers was reportedly linked to criminal activity.

So, is there a growth opportunity? Yes—especially when you consider a sector like payments. Ironically, increased use of blockchain technology could stem from the lack of trust that people have in financial services. Blockchain takes out the middleman and rules out excess charges—something people have come to easily associate with the financial system.

Yet, although blockchain unlocks many opportunities, it unlocks certain risks too. Now, this is where the regulator comes in.

While it has the crucial job of harnessing the potential of blockchain to benefit the economy, it’s also responsible for protecting that same economy from bad actors. It’s not an easy job because its ability to closely supervise new markets built on blockchain is limited.

However, finding a balance to formulate the right policies that do not stifle the growth of the blockchain industry is key. This is essential as no matter how revolutionary a thing is, it can only do so much in the absence of enabling regulation.

Get all our reports here and watch videos from our events. Send your custom research requests to tcinsights@bigcabal.com.

TECH PROBE

Timi: Easy. Take my current income and bet 23 odds on BetNaija or BetKing 😂. No need to overthink these things.

Share your own thoughts with us on Twitter and Instagram, or send a reply to newsletter@techcabal.com.

We’ll publish some of the most interesting responses on Friday.

Join Bolaji Balogun, one of Nigeria’s leading dealmakers by volume and value of successfully completed transactions, as he talks about the Art of Dealmaking. With 30+ years of experience in capital raising and investment, BB is the CEO of Chapel Hill Denham and Vice-Chairman of the Endeavor Nigeria board.

Sign up here.

This is partner content.

JOB OPPORTUNITIES

Every week, we share job opportunities in the African ecosystem.

- Big Cabal Media – Finance Intern, Sales Associate, Senior Sales Manager – Lagos, Nigeria

- Bolt – Regional Marketing Manager – Accra, Ghana

- Gokada – Creative Design Lead, Motion Graphics Designer & Animator – Lagos, Nigeria

- Future Africa – Investment Associate – Africa (Remote)

- Watoto – Budgeting and Accounting roles – Uganda

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

What else we’re reading

- In this recap of the latest TechCabal Live, we find answers to where Afrca’s digital media landscape is headed.

- Last week, Flutterwave announced that it had acquired Disha. Is this acquisition a win for the creator economy?

- Africa’s new futures were showcased at last week’s Art X Lagos where David Alabo and a host of talented visual artists mixed tech with art.