IN PARTNERSHIP WITH

Good morning ☀️ ️

New African magazine—in its Dec 21/Jan 22 edition—has announced its 100 Most Influential Africans of 2021 list.

While I’m noticeably not on this year’s list, many noteworthy Africans in the tech space made it.

The list includes global techpreneur and CEO of Co-Creation Hub, Bosun Tijani and Flutterwave’s co-founder and CEO, Olugbenga “GB” Agboola.

Also on the list is Future Africa’s Iyinoluwa Aboyeji, ABAN’s Tomi Davies, AppsTech’s Rebecca Enonchong, and TikTok star, Khaby Lame. The trailblazing fashion designer, Virgil Abloh, also made the list posthumously.

Here’s to seeing my name on it next year. And congratulations to everyone on the list. Nice one. Happy for you. 🙂

In today’s edition

- Gricd and NPHCDA are delivering 4.2 million vaccines in Nigeria

- Could Africa ditch cash for CBDCs?

- Flutterwave invests in Côte d’Ivoire’s CinetPay

- Events: Building from Ground Up

GRICD AND NPHCDA ARE DELIVERING 4.2 MILLION VACCINES IN NIGERIA

As the world struggles to understand the new Omicron variant of the coronavirus—sequestering Africa in the process—it’s becoming increasingly evident just how unvaccinated African countries are.

As of October, only 4.4% of the continent’s population has been fully vaccinated against COVID—a sad figure compared to the EU’s 62% and US’s 55%. While the largest barrier to vaccination is the purchasing power of most countries, another is the lack of storage and delivery infrastructure.

If it’s not cold, it gets old

Over the course of the year, countries like Malawi, Congo, and South Sudan destroyed thousands of COVID vaccine doses because they couldn’t store them properly or deliver them before their expiry dates.

In fact, Nigeria lost over 1 million AstraZeneca vaccines last month because they couldn’t be administered before their expiry dates.

To combat this, Nigeria’s National Primary Health Care Development Agency (NPHCDA) teamed up with Gricd—a cold chain technology company—to use IoT to deliver 4.2 million doses of the Moderna COVID-19 vaccine to all 36 states of the country and the Federal Capital Territory (FCT), Abuja.

What are they doing differently?

Vaccines can be sensitive too—like you, me, and Bitcoin’s ego. Unlike me and you though, they’re only sensitive to temperatures, and Gricd helps measure that sensitivity.

Gricd is a cold chain technology company that provides IoT solutions to enable last-mile delivery of temperature-sensitive products such as vaccines, insulin, and food.

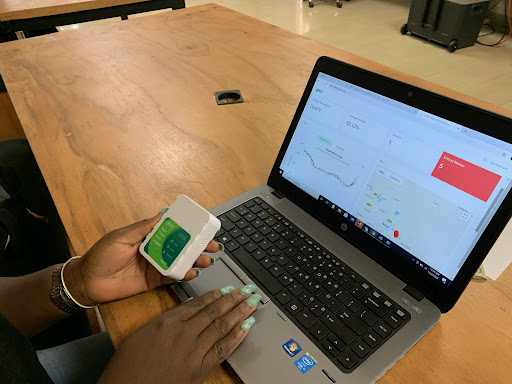

Every year, WHO estimates that 50% of vaccines worldwide are wasted because of inefficient cold storage and cold chain management. Companies like Gricd help reduce this number through a number of ways including automated real-time monitoring of temperature and data logging during storage, transit and distribution of temperature-sensitive products. They do this using MOTE, a data logger that transmits information about location, humidity, and temperature in real-time.

With Gricd’s MOTE, Nigeria’s NPHCDA tracked its latest batch of dosages—about 4.2 million doses of Moderna donated by USAID through the COVAX scheme—across all its 36 states and the FCT.

The vaccines required storage conditions between -15 degrees and -25 degrees, and the NPHCDA reports that it safely delivered all batches and no cases of ineffectiveness have been recorded.

COULD AFRICA DITCH CASH FOR CBDCs?

The era of cash could be drawing to an end as central bank-backed digital currencies (CBDC’s) take root in Africa.

While the COVID-19 pandemic has significantly accelerated the use of cashless payments, the period has also ushered in the widespread use of cryptocurrencies, with the result that digital currencies are fast becoming mainstream across the continent.

Digital currency in Africa

So far, it’s only Nigeria that has launched an official, state-backed digital currency—the eNaira—on the continent as more countries continue to express interest.

Last month, Tanzania’s central bank joined a growing list of African countries to express the intention of launching its own digital currency.

South Africa is currently piloting Project Dunbar, an international financial settlement system that uses multiple central bank digital currencies, while Mauritius has a digital currency in the development stages.

Other countries in Africa—including Kenya, Morocco, Tunisia, and Ghana—are researching the best model to deploy in their jurisdictions, according to the US think tank Atlantic Council’s digital currency tracker.

Traction summary

Currently, three countries are driving the continent towards a cashless era, with the widespread use of both mobile money, or crypto adoption, or both—driven partly by the pandemic.

The Baobab Network has traced at least 60 cryptocurrency companies in Africa, with the majority (43%) of them headquartered in Nigeria, followed by South Africa (18%), and Kenya (11%).

Similarly, global digital payments solution provider Visa, in a September report, showed a growing preference for mobile wallets, particularly in Kenya (56%), followed by Nigeria (14%), and South Africa (7%).

In Ep. 4 of Artwork, learn how you can grow from a freelance designer to a world-class brand design studio.

👉🏾 Watch now

This is partner content.

FLUTTERWAVE INVESTS IN CÔTE D’IVOIRE’S CINETPAY

This year has seen a rise in the trend of African founders supporting one another.

Last month, Flutterwave backed Payhippo in its $3 million seed round. The unicorn also announced its acquisition of Disha. Now, it’s invested in CinetPay, an Ivorian startup that enables merchants in francophone Africa to accept and make electronic payments online or via mobile point-of-sale (POS) devices.

Yesterday, the startup announced the close of a $2.4 million seed round with 4DX Ventures, a pan-African venture capital fund, and Nigeria-based unicorn startup Flutterwave as co-investors in the round.

The seed investment is expected to boost CinetPay’s sales and marketing efforts in the countries it operates across West and Central Africa.

The story behind CinetPay

Founded by Idriss Monthe and Daniel Dindji in 2016, CinetPay simplifies the process of accepting payments.

On CinetPay’s mobile and web-based platform, businesses can sign up to process payments from over 130 different payment operators—including MTN mobile money, M-Pesa, Orange Money, Visa, Mastercard, etc—via a single interface. This eliminates the need for merchants to integrate with different systems in order to manage sales and revenues.

Its solution, which can be integrated into merchant websites, is used by a wide array of businesses, from e-commerce platforms to digital public services, insurance companies, and schools. This makes sense since up to 75% of the population in the Ivory Coast owns a mobile money account whereas less than 25% have a bank account.

Since launch, the startup claims to have processed over 30 million transactions for 350 active merchants in nine countries, including Ivory Coast, Senegal, Cameroon, Mali, Togo, Burkina Faso, Benin, and Guinea.

Read more: Ivorian fintech CinetPay secures $2.4m seed investment from Flutterwave, 4DX Ventures.

Quidax is an African-founded cryptocurrency exchange that makes it easy for you to access Bitcoin and other cryptocurrencies. They also make it possible for Fintech companies to offer cryptocurrency services to their customers.

This is partner content.

EVENTS: BUILDING FROM GROUND UP

Before building Autochek, Etop had served as CEO at Cars45, an innovative technology platform. Under his leadership, the company expanded into two other African companies (Ghana and Kenya). Before then, he was CEO at DealDey, Nigeria’s largest discount store. He was also Commercial Director at Konga, one of Nigeria’s largest eCommerce platforms.

In the last season of Building From Ground Up, we spoke with founders like Shola Akinlade, CEO of Paystack and Onyekachi Izukanne, co-founder and CEO of TradeDepot. Tomorrow, Etop will be sharing his experience as a serial entrepreneur and what he’s learned from building multiple businesses.

This conversation is open to everyone, particularly founders, aspiring founders, and everyone who’s curious about what goes into starting a business.

Register to attend.

The #BuildingFromGroundUp Series is powered by the UK-Nigeria Tech Hub.

OPPORTUNITIES

- The Mastercard Strive Community Innovation Fund 2021 is offering small businesses the chance to receive up to $200,000 in funding for projects that leverage data and digital solutions. Check it out.

- The ANF Future Africa Grant 2021 is open to African storytellers who have worked with 360 video, augmented, virtual or mixed reality to tell African stories. Selected winners will get up to $30,000 to showcase their projects. Tell your story.

- The Deji Alli ARM Young Talent Award 2022 is open to young Nigerians who have innovative startup ideas that add economic value to the country. Winners of the award will get support and funds of up to ₦12,000,000 ($28,000). See if you qualify.

What else we’re reading

- Amidst price surges, Bolt introduces a 3% “booking fee” in Nigeria.

- Autochek Africa launches Africa’s first online brand new cars loans marketplace to further help mobility.

- MTN, Africa’s largest telecom operator, is making vaccination mandatory for its employees.

- Visa launches crypto advisory service for banks and merchants.